Recent data shows that crypto investors have been turning to Bitcoin investment products (ETPs) trading at record speeds since the world’s largest asset management firm, BlackRock, applied for a spot-based Bitcoin ETF with the US Securities and Exchange Commission (SEC) on June 15.

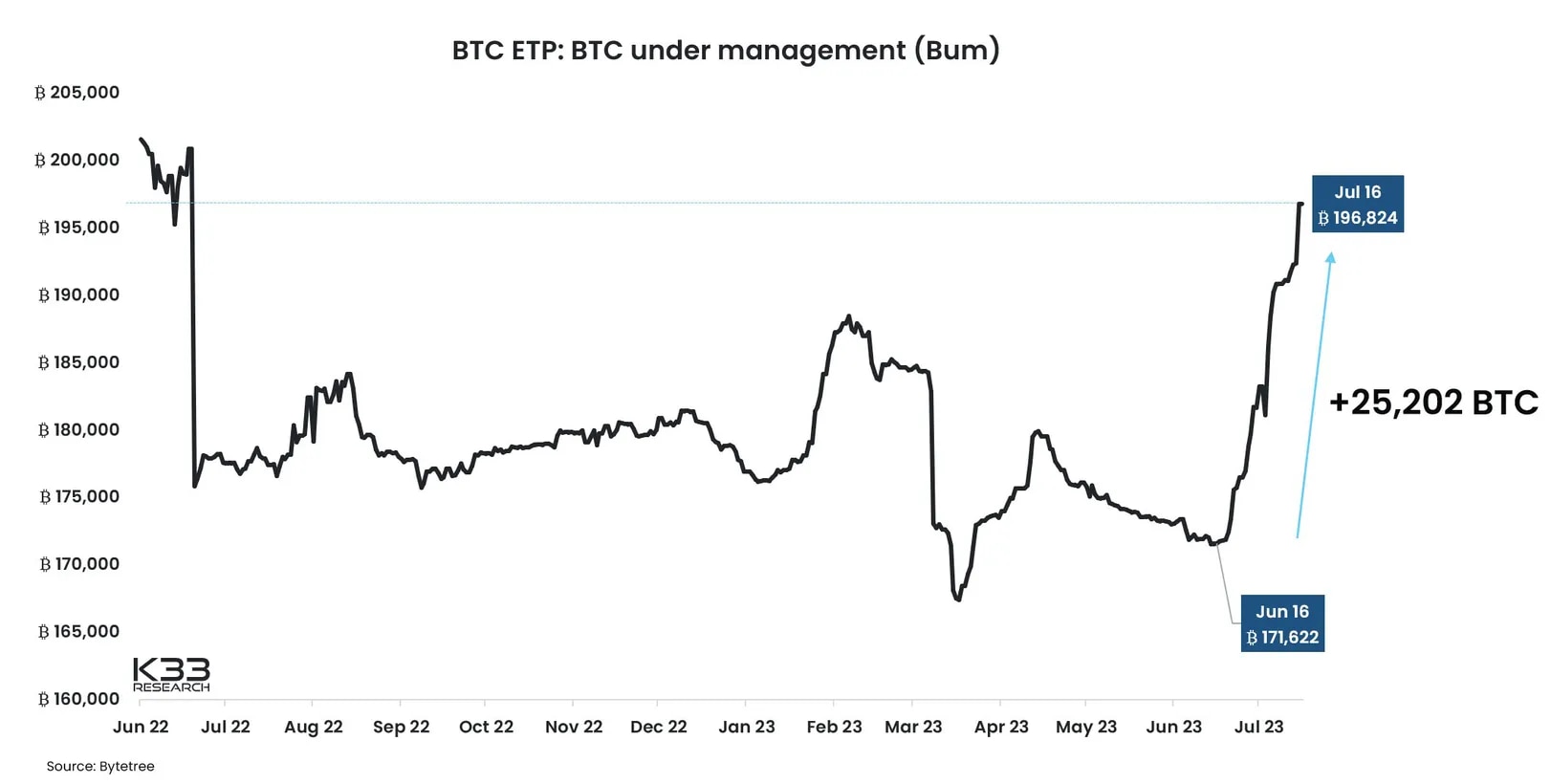

Bitcoin ETPs Reach Equivalent of 196,824 BTC

The latest data provided by K33 Research reveals that the BTC equivalent of ETPs listed worldwide has increased by 25,202 BTC (worth $757 million) to reach 196,824 BTC during the four-week period ending on July 16. According to Vetle Lunde from K33 Research, this is the second-highest monthly net inflow after the launch of ProShares’ Bitcoin futures ETF (BITO) and other futures-based ETFs in October 2021.

Currently, the total BTC equivalent in Bitcoin futures ETFs has reached its highest level since June 2022.

ETPs are a widely traded investment product category that tracks the value of an underlying financial asset. Exchange-traded funds (ETFs) are a subset of ETPs and typically rely on various financial products based on a specific theme.

While the SEC has shown reluctance to approve crypto-based ETFs for a long time, many issuers in Europe have listed numerous ETPs and made them available for trading.

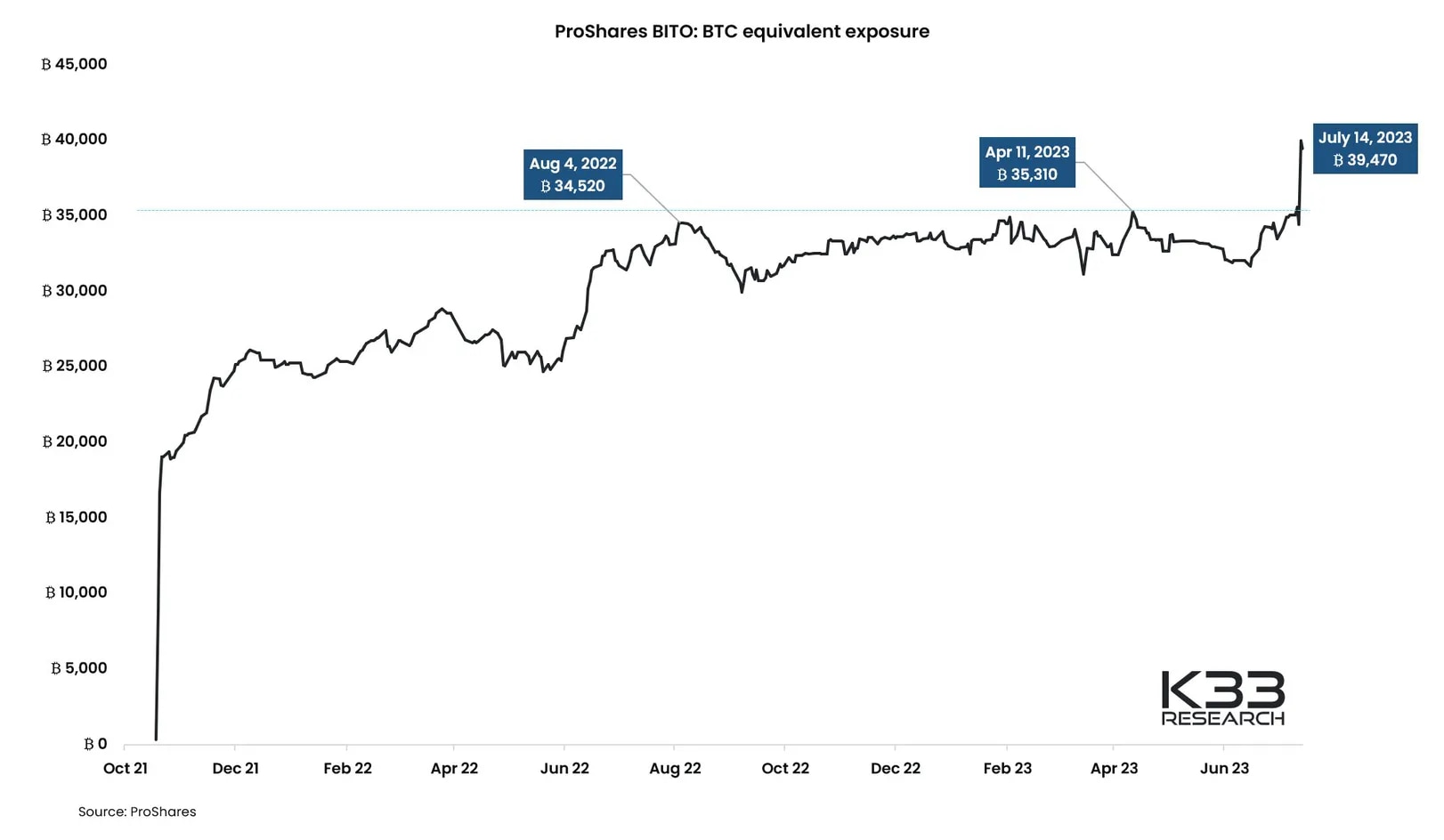

BITO Sets a New Record with 4,425 BTC

Lunde also mentioned that BITO reached its all-time high of 4,425 BTC. BITO offers investors Bitcoin-related returns through regulated products and holds over $1 billion worth of CME Bitcoin futures.

Lunde added, “BITO’s sudden surges tend to occur when the market is near its peak. BITO’s overall BTC exposure has remained structurally stable since June 2022, when the market saw its first significant range breakout, until last week.”