Despite the surge in meme coins and significant interest, Bitcoin (BTC) experienced a decline in value after reaching record levels and undergoing a sharp price correction within a short period. Nevertheless, Bitcoin has shown an increase of about 60% from the beginning of the year to date (YTD), indicating a remarkable rise.

Bitcoin Commentary

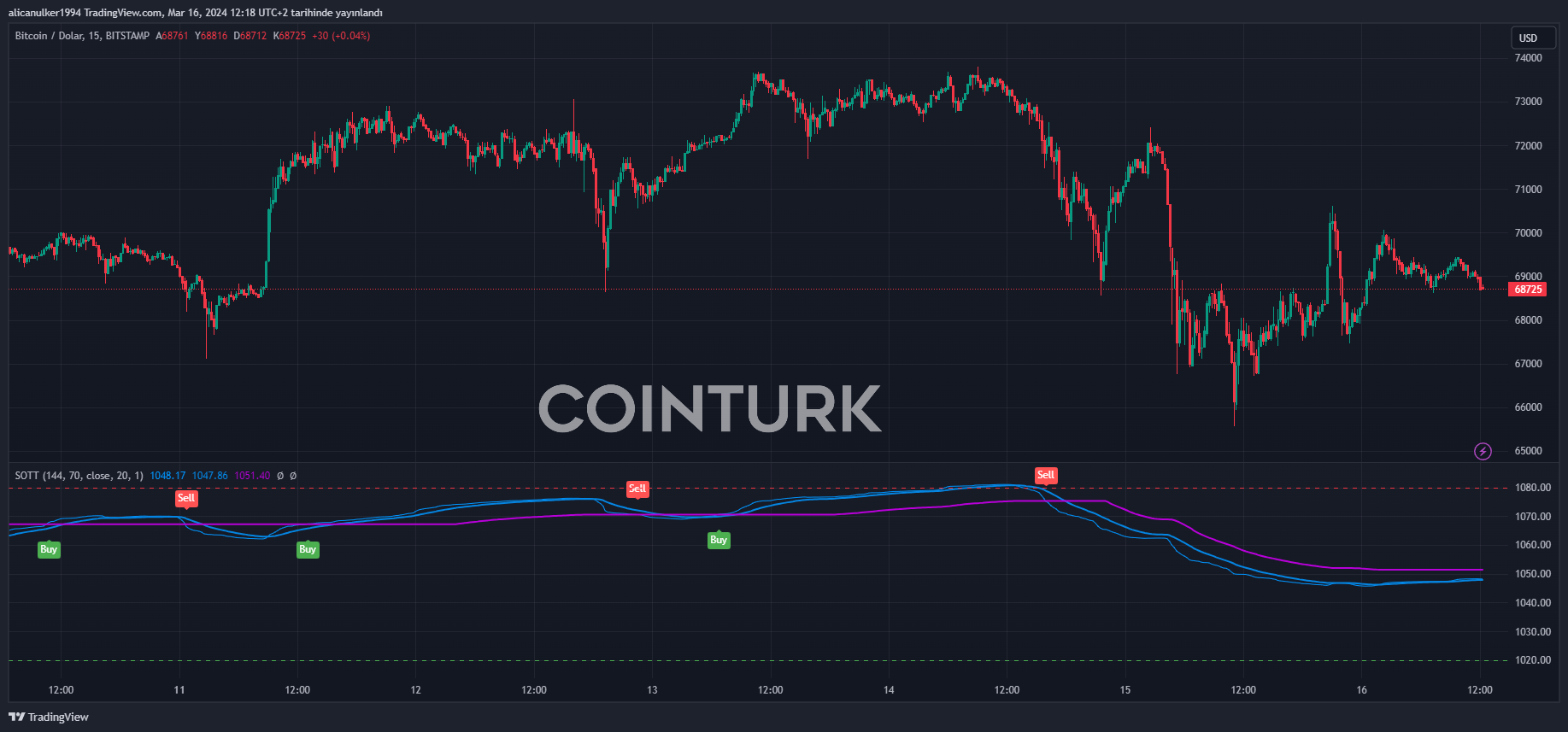

We previously mentioned how BTC’s price fell below $70,000 after surpassing $73,000 and the significant liquidations that occurred.

In an interview with CNBC TV, Cryptocom’s CEO Kris Marszalek commented on the matter, saying:

“I think this is primarily due to what happened in the options market and a correction, but we should not forget that this level of volatility is actually quite low compared to what we have seen in previous cycles.”

As of the time of writing, BTC, which trades at $68,725, appears to have recovered somewhat from its drop to the $66,000 level. According to CMC data, this increase points to a daily rise of 2.47%.

Marszalek stated in his remarks that the recent drop in BTC was a beneficial correction. He mentioned that it eliminated the excessive leverage used by investors and also prevented overly aggressive price increases.

The famous figure emphasized the long-term potential returns of Bitcoin investment by saying:

“Bitcoin is an asset you would want to hold for decades, not just days or weeks.”

Bitcoin’s 2025 Expectation

On the other hand, Bernstein analysts have drawn attention to the rise, indicating that the total market value of cryptocurrencies could potentially triple, reaching $7.5 trillion by the end of 2025.

According to Bernstein analysts, this significant growth movement will occur after an unprecedented level of institutional engagement with cryptocurrency. Marszalek also emphasized his agreement with this positive expectation, saying:

“I think this movement is mainly due to inflows from Bitcoin ETFs. It’s a very successful product, and you know there is a problem on the supply side, so this has to be reflected in the price.”

Spot Bitcoin ETFs Hit Record After Record

So, what does the future hold for Bitcoin ETFs? Considering current trends and expectations before the halving, investors seem to have a promising path ahead. JMP Securities suggests that spot ETFs could attract approximately $220 billion of investor capital over the next three years.

If JMP Securities’ predictions come true, Bitcoin’s value could rise to $280,000, which would increase the market value of the leading cryptocurrency to $5.50 trillion.

Türkçe

Türkçe Español

Español