Cryptocurrency markets have been on a downward trend since the weekend sell-offs, which saw the price of Bitcoin fall from nearly its all-time high to $66,000. Some stability was observed on Monday, but volatility did not ease on Tuesday, facilitating more widespread losses.

Resistance Levels in Bitcoin

After a 8.6% correction in the last 24 hours, the price of BTC has settled at $62,500. Altcoins, including Ethereum, have also experienced significant corrections due to their recent correlation with Bitcoin price movements. A 63% increase in trading volume to $67 billion suggests that investors are more interested in selling BTC than buying. The visible drop in market value to $1.24 trillion could reflect intense selling pressure.

Bitcoin’s decline from its record high of $73,000 could indicate significant changes in both technical and fundamental factors. Blockchain data from IntoTheBlock, as shown in the graph below, reveals new solid resistance zones. The IOMAP model highlights current significant resistance bands between $64,960 and $66,845, $66,845 and $68,730, and finally between $70,615 and $72,500. In contrast to last week when Bitcoin reached a new historical peak, about 58.15% of all addresses are now at a loss.

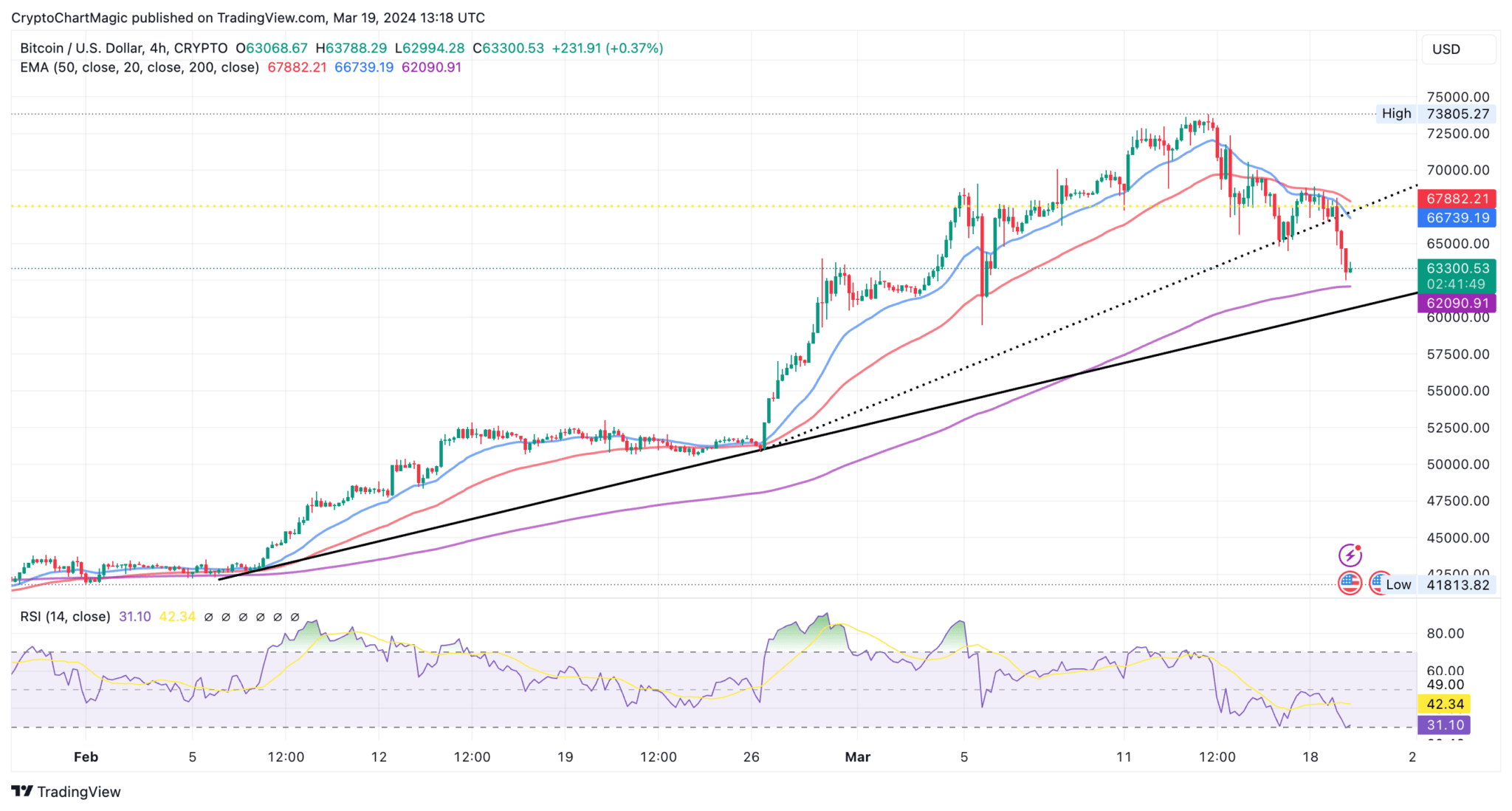

It is unclear when Bitcoin will end this retreat and when it will make a significant recovery. This is especially true as support areas appear smaller than resistance zones in the IOMAP model. Bitcoin has managed to stay above the $62,500 support level and is trading at $63,515. The relative strength index (RSI) being close to oversold territories could mean that the selling has been intense and a trend reversal is possible.

Liquidations in Bitcoin

Investors are also cautious about buying at the bottom price due to fear of being liquidated. According to Coinglass data, total liquidations in BTC reached $191 million in the last 24 hours, with only $44 million occurring in short positions. The cumulative market liquidations stand at $664.5 million. The four-hour chart points to a potential major support around $62,000, which is supported by the 200-day exponential moving average (EMA).

Bitcoin has already shown respect for this level, giving bulls a chance to regain control and make a significant comeback. Should demand exceed $62,000, BTC could have a chance to rise to $60,000, supported by a lower rising trend line. Further corrections below this critical support could mean that Bitcoin will complete a 20% pullback before the halving, potentially reaching $57,500.