Bitcoin (BTC) dropped by 1.62% in the last 24 hours, falling below the $57,500 threshold, resulting in a weekly loss exceeding 10.5%. Despite historical expectations of a downward trend in September, investor concerns have increased.

Capital Flows into Stablecoins

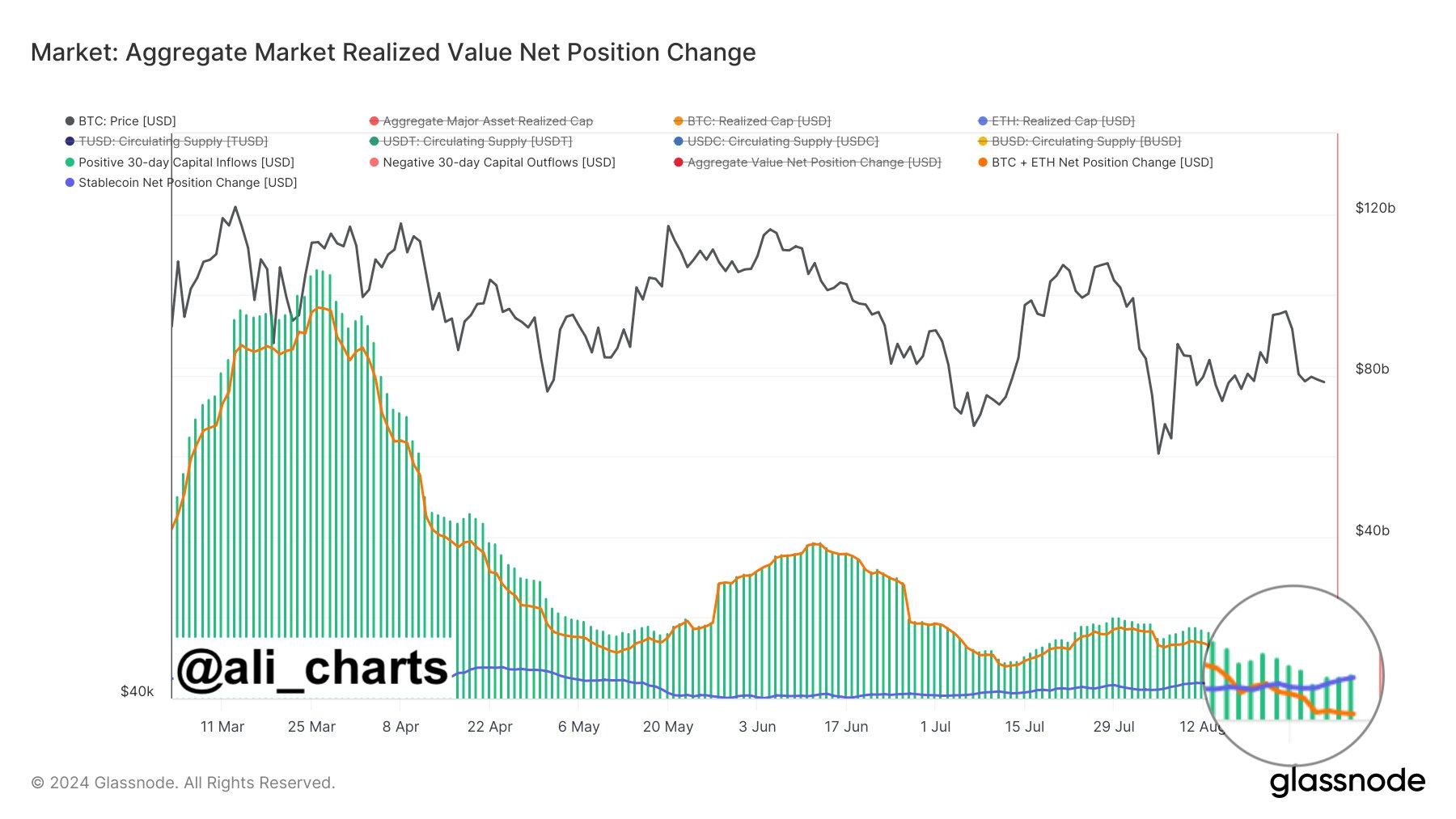

After pulling back from the $65,000 level last week, Bitcoin’s intensified decline reflects a broader shift in market sentiment as capital flows into stablecoins. This shift indicates growing caution among investors, who prefer stablecoins, pushing their total market value to a record near $170 billion. Analysts interpret this trend as a sign of decreased short-term confidence in Bitcoin, with investors possibly expecting more significant declines before re-entering the market.

Experienced crypto analyst Ali Martinez noted a significant drop in on-chain activities related to exchanges, as indicated by the Exchange Volume Momentum indicator. According to the analyst, the decline in on-chain activities reflects reduced investor interest and decreased network usage, indicating potential weakness in Bitcoin’s fundamentals.

Throughout the past quarter, Bitcoin attempted several V-shaped recoveries following declines in May, July, and August, but each subsequent drop was deeper, and the recoveries became less robust. End-of-August data suggested that the market might approach a critical breaking point in September, potentially leading to a decrease in demand, raising concerns about Bitcoin’s resilience.

Key Support Levels Threatened

Crypto analyst Rekt Capital highlighted that Bitcoin was trading below the crucial support level of $58,540 just hours before the weekly candle close. Closing below this level could pave the way for further declines, while maintaining the uptrend requires a close above $59,000. Given the current price movement, a close above $59,000 is considered an unlikely scenario.

Meanwhile, the upcoming US employment data and its impact on the Fed interest rate decision in September will play a crucial role in Bitcoin’s trajectory. Currently, Bitcoin is in a strong reconsolidation phase. Rekt Capital reminded that historically, Bitcoin tends to make significant moves approximately 150-160 days after block reward halvings, warning that if past patterns repeat, a breakout might not occur until the end of September.