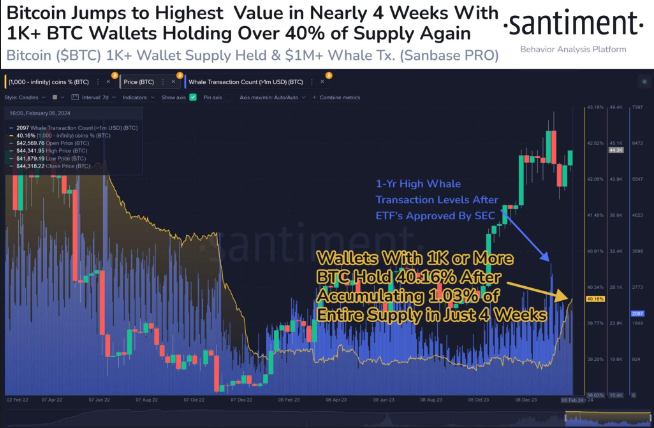

After weeks of recovery in the cryptocurrency world, Bitcoin (BTC), the undisputed leader, continues to flirt with the $45,000 level with an increase of over 4%. This price increase occurred amidst significant whale transactions observed in Bitcoin over approximately the last four weeks.

Whale Moves in Bitcoin

According to information shared by on-chain data provider Santiment, the Bitcoin price has surpassed the $44,500 level for the first time since the pullback that started following the ETF decision on January 12. This increase in price is associated with a rise in BTC held in wallets containing 1,000 or more bitcoins.

Looking at the data, it is observed that wallets holding more than 1,000 BTC each have been maintaining peak levels of Bitcoin for over 14 months now.

The accumulation trend among whales or near-whale investor groups reveals a steadily growing confidence in Bitcoin’s long-term price rise, potentially contributing to the observed price increase.

Prominent analyst Ali Martinez made significant remarks. The analyst, who drew attention to important developments in the Bitcoin market, highlighted a key support zone in BTC. According to Martinez, approximately 1.50 million BTC were purchased by over 3 million wallets within the price range of $41,800 to $43,080.

On the other hand, Michael van de Poppe emphasized that the correction in Bitcoin might be nearing its end. He suggested that this could indicate a potential rally before the upcoming halving in April. Van de Poppe also highlighted that Bitcoin’s price level could soon move into the range of $48,000 to $51,000.

While all this is happening, Bitcoin miners also seem to be taking action. During the process, miners appear to be selling to generate capital to purchase advanced mining equipment and elevate their operations to a new level.

Stocks and BTC

Considering a scenario where the long-term correlation between crypto and the S&P 500 remains unbroken, there are views that BTC and altcoins could close the gap, possibly influenced by the halving scheduled to occur in Bitcoin in April.

At the same time, signals from recent statements by the Fed Chairman suggest that interest rate cuts may be postponed, indicating that strong price fluctuations could occur in the coming period.

As stocks reach their all-time high (ATH) levels, attention turns to the BTC outlook. Historical analysis shows that the most significant bull periods in cryptocurrencies occurred when the correlation between stocks and BTC was at its minimum or non-existent.