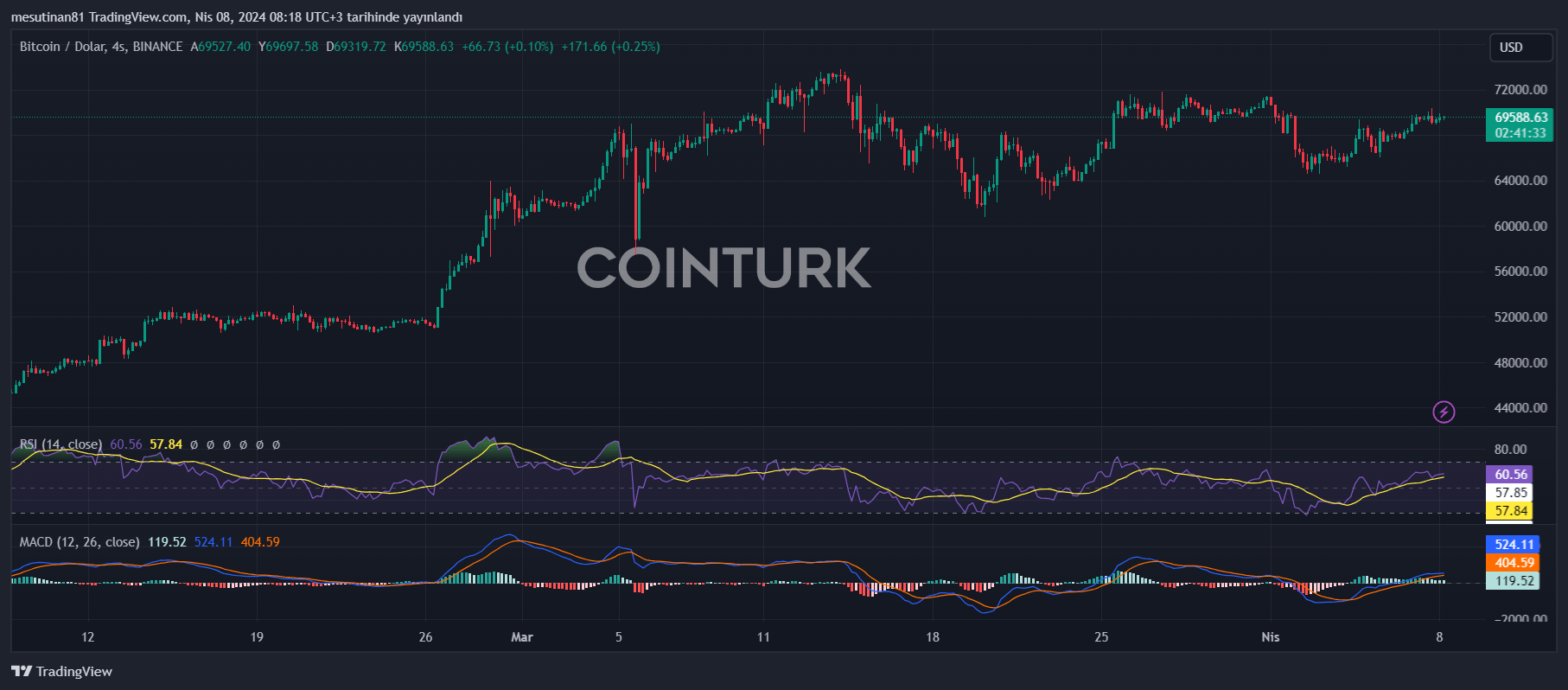

Cryptocurrency flagship Bitcoin has started to show positive signs above the recent $68,500 resistance level. However, investors are curious: Is it time to buy BTC at these levels now? Let’s take a look at the latest developments and price movements in the market.

Bitcoin Must Surpass $70,000 for Upward Trend

Bitcoin needs to break above the $70,000 resistance level to gain upward momentum in the near term. Currently, a steady increase above the $69,500 and $70,000 levels is targeted. The price trading above the $68,000 level and the 100-hour simple moving average being above this level are considered positive signs.

Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Looking at the hourly chart of the BTC/USD pair, a significant upward trend line is forming around $68,800. This indicates that the price has found solid support to maintain the uptrend. Therefore, if Bitcoin remains above the $68,000 support area, a new increase is anticipated.

Bitcoin Price Maintains Its Support

Bitcoin price started a strong rise above the $67,500 resistance area and gained positive momentum. BTC cleared the $68,500 and $68,800 resistance levels, moving into a positive zone.

With the price even surpassing the $70,000 resistance area, the highest level reached around $70,300. However, the price is currently correcting gains and has retreated below the $70,000 level. Bitcoin is now trading above the $68,000 level and also above the 100-hour simple moving average. The immediate resistance is near the $69,800 level, while the first major resistance is set at $70,000.

In the upcoming period, if a clear move above the $70,300 resistance area is observed, the price is expected to gain a new upward momentum. In this case, Bitcoin’s movement towards $71,200 can be expected. Looking further ahead, Bitcoin’s potential journey towards the $73,500 resistance area in the near term should not be overlooked.

Downward Movement Could Bring BTC to This Level!

If Bitcoin fails to break above the $70,000 resistance area, concerns about a potential downward correction are increasing. Bitcoin price recently encountered instant support near the $69,000 level or the trend line.

However, the point of interest is that the upward move to $70,300 corresponds to the 50% Fibonacci retracement level between $67,800 and $65,116. This indicates that critical support levels exist for BTC’s price.

If there is a close below $66,500, a downward trend towards the $65,350 level is anticipated. More losses could indicate a near-term move towards the $62,500 support area for Bitcoin.

Technical Indicators Signal Market Uncertainty

Technical indicators show that the hourly MACD for Bitcoin is losing momentum in the bullish zone. Similarly, the hourly RSI (Relative Strength Index) for BTC/USD is currently hovering near the 50 level, indicating a market in uncertain equilibrium.

In terms of key support levels, $68,800 and then $67,800 stand out. However, if BTC continues its upward movement, resistance levels such as $69,800, $70,000, and $71,200 should be monitored closely.

Türkçe

Türkçe Español

Español