Bitcoin is going through a difficult period. Following last week’s Bitcoin ETF approval by the SEC, the market, which was expected to rise, has been dominated by a decline. The downturn has taken an unprecedented form, with four consecutive days of negative closing reflecting a loss series not seen in a long time. As of the time of writing, the Bitcoin Price was finding buyers at $42,588, down 0.22%, and the market cap had fallen to $834 billion.

Bitcoin ETF – Sell the News Event

Following the approval and commencement of trading of 11 ETF applications, including those from major asset management firms such as BlackRock Inc. and Fidelity Investments, Bitcoin reached its highest level in two years at $49,000 within a very short period of time.

The subsequent decline, as pointed out by crypto analyst Tony Sycamore, demonstrated the “buy the rumor, sell the news” price reaction. According to Sycamore, a retraction in Bitcoin’s price to the $38,000 to $40,000 range could be possible.

According to Eric Balchunas, the senior analyst at Bloomberg Intelligence who has been closely monitoring Bitcoin ETFs in recent times, the new US spot funds entering the market saw an influx of $819 million in the first two days of trading.

Among these, BlackRock’s iShares Bitcoin Trust attracted $500 million in investment, while Fidelity Wise Origin Bitcoin Fund stood out with an investment of $422 million.

Negative situations also occurred in the market. Grayscale Bitcoin Trust, which has a notable asset of $26 billion and ranks first in this field, caused investors to be caught off guard last week, creating a panic atmosphere with significant outflows of $579 million following its conversion to an ETF.

Will Bitcoin Price Fall?

Ali Martinez, who has been noted for his recent analyses, has put forward his predictions for the possible price direction of Bitcoin and highlighted the existence of a noticeable parallel channel. According to the graph shared by Martinez below, Bitcoin has a resistance at the upper limit of the channel, at the $48,000 level.

In the graph where the upper resistance is $48,000, the lower limit for Bitcoin is found in the $34,000 region, and a potential drop could pull the price down to this level. A drop to the mentioned levels could potentially trigger a rise that would lead Bitcoin to its upper level seen, namely $57,000.

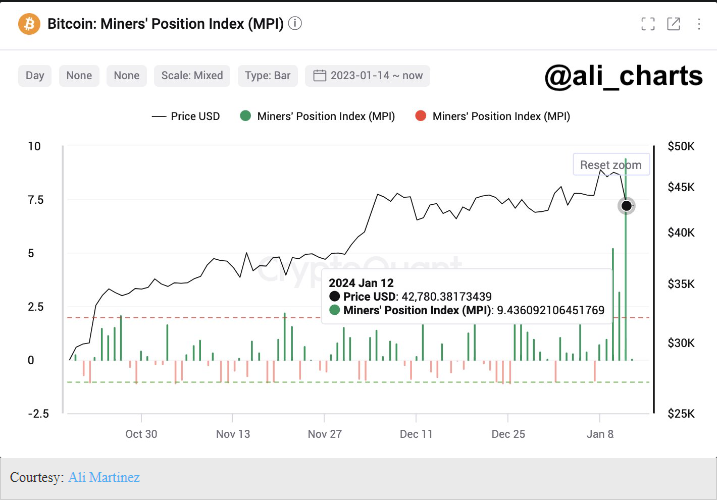

Martinez also drew attention to another matter. The analyst pointed out a significant change in the Bitcoin Miners Position Index (MPI), which rose to 9.43 on January 12. The rising MPI indicates that miners are moving Bitcoin in higher volumes than usual and could potentially execute sales.

According to the analyst, despite the price correction that has already occurred, the ongoing sales by miners could continue to affect the price, and additional sales could drive the price to lower levels. Considering the effects on the price, the significant influence of miners on Bitcoin is evident, and investors should closely monitor this situation.

Türkçe

Türkçe Español

Español