Since the first Bitcoin block was mined on January 3, 2009, the leading cryptocurrency has gone through many milestones. ETF approvals and Trump’s weekend statements were the latest key stages. What happens if 99% of all BTC is held by just 1% of holders?

Bitcoin Supply Distribution

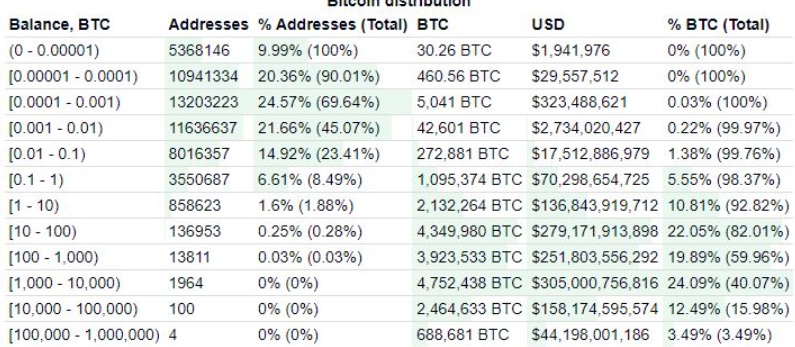

BitInfoCharts data tells us that only 1.86% of BTC wallets (meaning over 1 million addresses) hold 90% of the BTC supply. Among these are large whales, institutional companies, and early Bitcoin enthusiasts. Already, 90% is held in about 1 million wallets in a world of 8 billion people.

Caroline Bowler highlights both the positive and negative aspects of this scenario. Crypto Traders Are Rushing to This App – Here’s Why You Should Too

“On one hand, it raises concerns about market manipulation, centralization, and liquidity constraints. On the other hand, it provides significant market impact, strategic advantages, and exclusive opportunities to these large investors.”

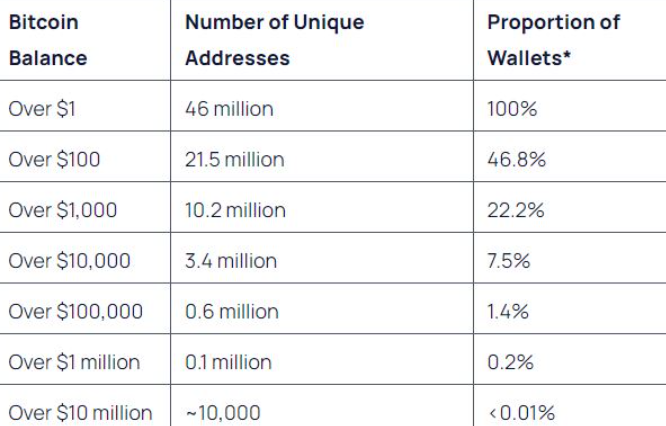

According to Exploding Topics data, a little over 46 million BTC wallets hold at least 1 dollar in assets. Half of these hold over 100 dollars in BTC. 104 addresses hold close to 16% of the total supply.

Bowler says:

“If 100% of Bitcoin is concentrated in a few addresses, it will fundamentally change the dynamics of the Bitcoin ecosystem. It will centralize control, weaken the core principles of decentralization, and potentially lead to market manipulation, loss of trust, and increased regulatory scrutiny.”

On the other hand, a significant portion of large wallets belongs to exchanges and ETF issuers. So, assets belonging to a much larger investor base appear to be concentrated in a few wallets.

Bitcoin and Its Future

Phillip Lord says that while having many wallets holding a significant portion of the supply gives them greater market control, it does not grant the authority to change the protocol. The centralization risk is a fundamental issue for Bitcoin, which is integrated with traditional markets, but most investors don’t care because the majority are focused on more profits. That’s why Lummis’s proposal for the US to accumulate 1 million BTC garnered significant interest.

Phillip Lord said:

“Since these addresses can affect Bitcoin’s price with large transactions, this centralization can potentially impact the market. However, owning such a significant portion of Bitcoin does not provide direct control over the protocol or the ability to change its code. For a change to be implemented, it must gain broad support from miners, developers, and node operators.”

Türkçe

Türkçe Español

Español