Bitcoin, the flagship cryptocurrency, did not reach the expected price levels after the April halving. As a result, there was a significant drop in positive comments about Bitcoin on social media. According to Santiment’s data, this decrease in enthusiasm is seen as a potential bottom signal for the market. Bitcoin’s price is currently trading at around $61,500. Analysts consider this as a sign of a possible future recovery.

Decline in Social Media Sentiment for Bitcoin

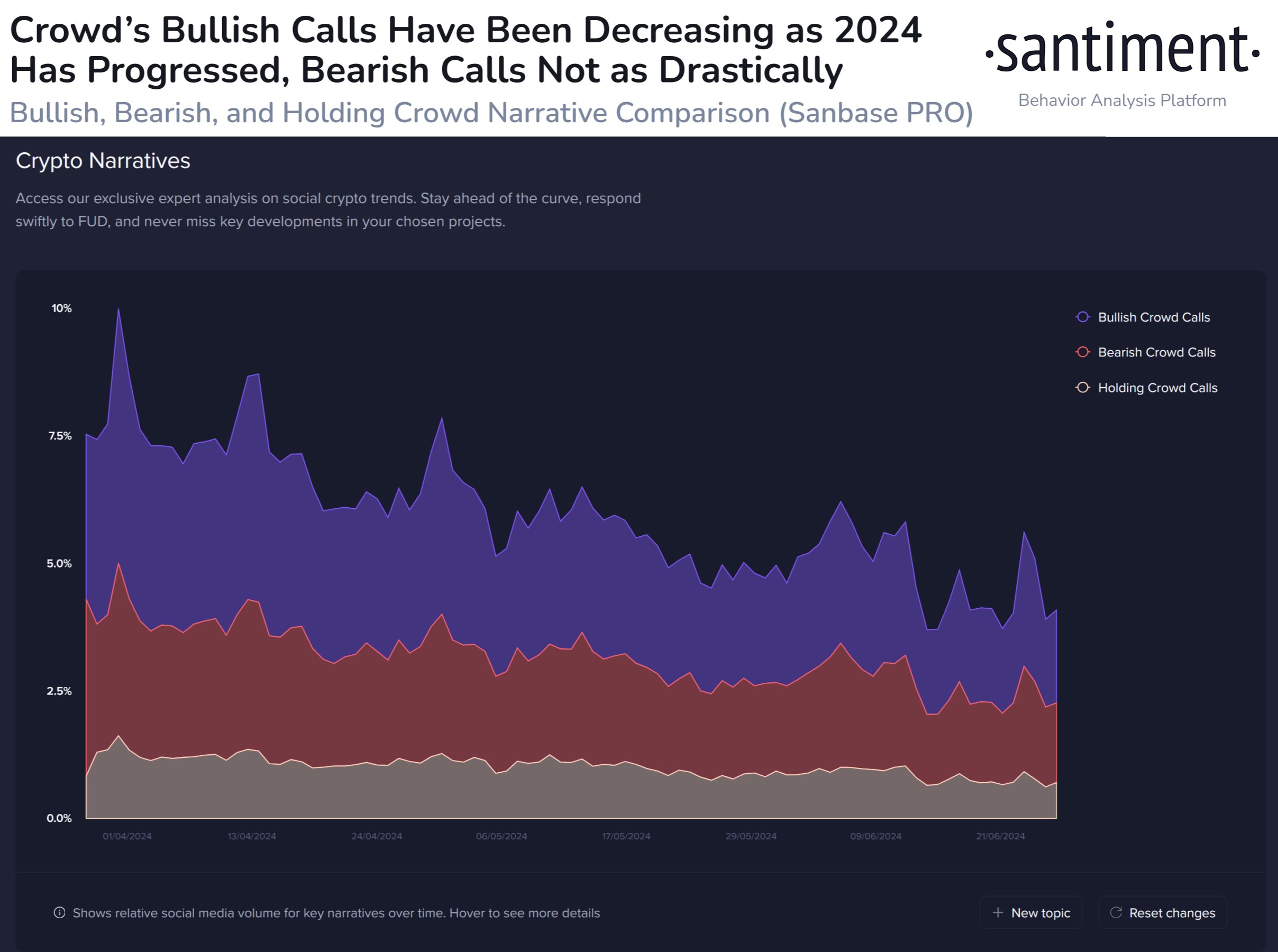

The failure of Bitcoin’s price to reach all-time highs after the halving caused disappointment among investors. According to an analysis by Santiment, positive comments about Bitcoin on social media, especially on platforms like X, Reddit, Telegram, 4Chan, and BitcoinTalk, have significantly decreased. The rising investor sentiment in April gave way to a loss of confidence as prices remained stable.

When an asset reaches its market bottom, it usually means it is trading at its lowest value. At such a stage, signs of a trend reversal start to appear. According to technical analyses, the current price levels of the Bitcoin cryptocurrency offer a recovery opportunity for investors. Bitcoin, which rose to $73,777 in March, has fluctuated between $60,000 and $70,000 since then and is currently trading at $61,500.

Historical Periods and Post-Halving Consolidation

Bitcoin’s four-year halving cycles generally lead to price increases due to scarcity expectations. However, price increases do not occur immediately after the halving, and Bitcoin usually enters a consolidation phase. According to analyst Willy Woo, this recovery process may take longer this time. Rekt Capital notes that Bitcoin is consolidating in an accumulation range with upper resistance at $71,500 and lower support at $60,600.

The negative sentiment on social media about Bitcoin is interpreted by some analysts as a sign that the market is approaching its bottom levels. Historical data shows that Bitcoin consolidates after the halving period and then rises. Therefore, the current price levels and the decline in social sentiment could be indicative of a possible future increase.