Bitcoin, is witnessing one of the most significant periods in its history during the second week of 2024. These developments could ignite a fuse that may shape Bitcoin price movements for a long time. The United States is expected to make a decision on its first spot Bitcoin exchange-traded fund (ETF), a step that has been anticipated following months of speculation and years of unsuccessful attempts.

What to Expect from the ETF Process?

Sources in the crypto market believe that the application process should be different this time, and as Wall Street prepares to open the week’s trading, there is a clear sense of expectation in the crypto market. Bitcoin investors have a lot to be concerned about. Not only the ETF process but also the US macroeconomic data and the battle against inflation will offer a view on potential volatility for risk assets.

However, with on-chain indicators pointing higher, confidence in the upward continuation for the BTC/USD pair is growing step by step. This period, which is crucial for the adoption of Bitcoin by institutional investors, may potentially present years of work for investor approval.

Piyasa İkiye Bölündü

The Securities and Exchange Commission (SEC), has caused a division in the industry with its reluctant approach to approving spot ETF applications. When it comes to products, the US is already a barrier on its own because spot Bitcoin ETFs have already met investors in Europe and other countries.

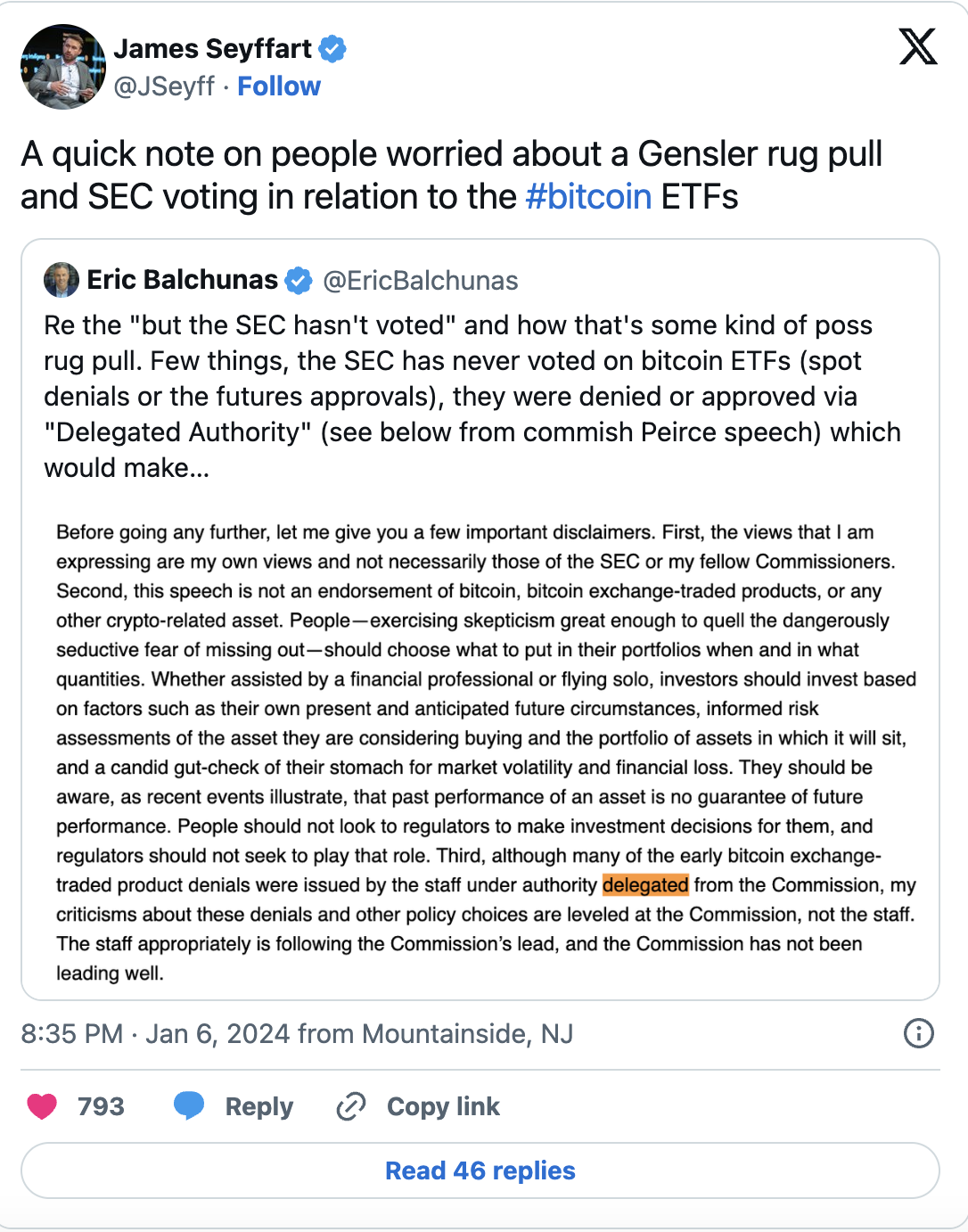

The uncertainty regarding the US’s stance on the issue manifests in many ways; the most recent was the rumor of political sabotage just days before the final deadline of January 10. This was later addressed by Bloomberg Intelligence analysts Eric Balchunas and James Seyffart, who together provided the most comprehensive news on the path to ETF approval.

Meanwhile, Nate Geraci, a private ETF consultant, laid out his roadmap for the week, supporting the possibility of the SEC waving through applications. The expert shared in a post on X that he expects 19b-4 approval orders and predicted a decision would be made by the deadline. Geraci also added that it would be fascinating to see the type of capital present on launch day:

“It’s going to be another crazy week. I’m eager to see how all this turns out.”