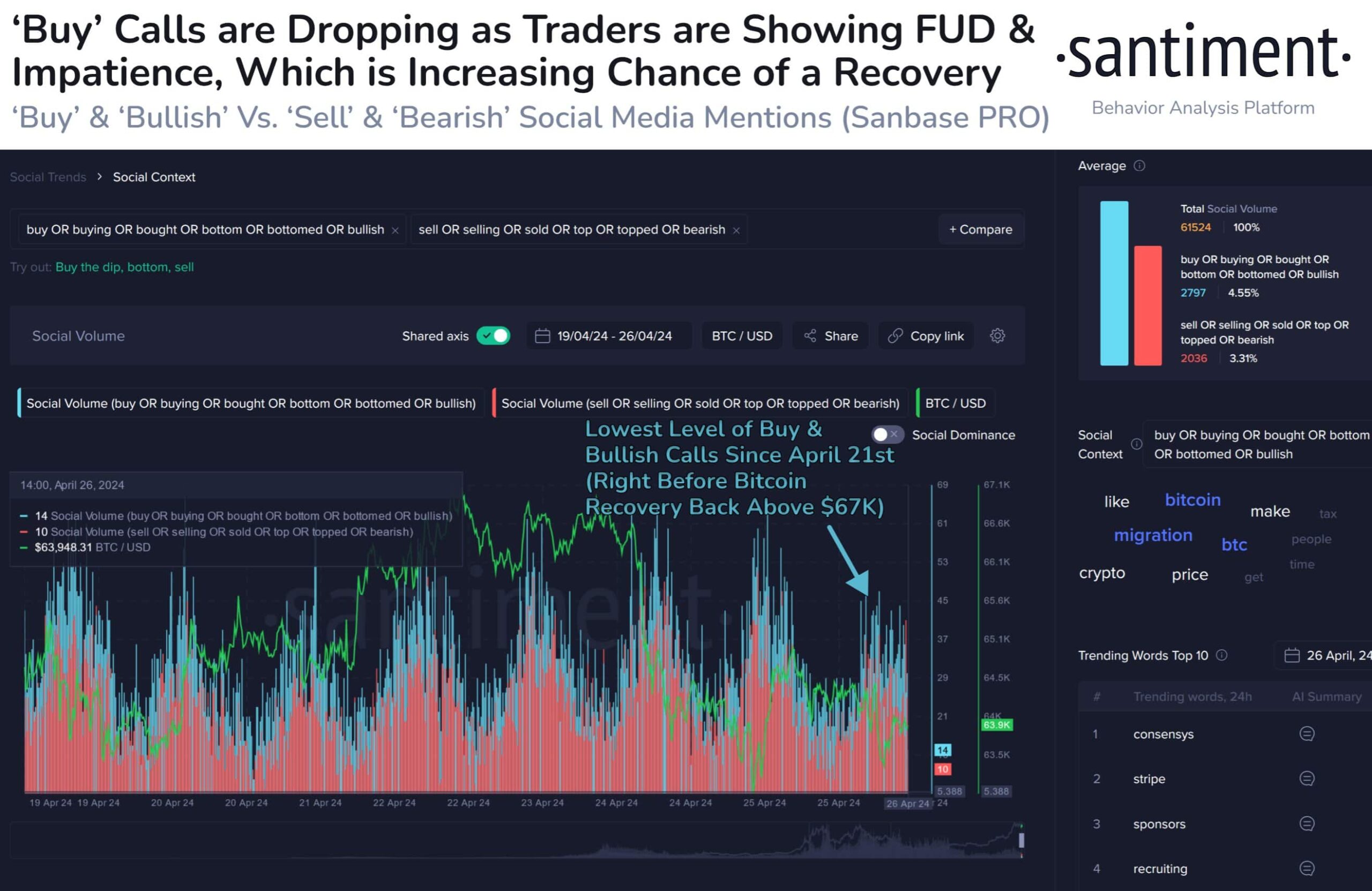

The largest cryptocurrency Bitcoin (BTC), has seen a 2% decline in the last 24 hours, falling below the $63,000 level, continuing to show signs of ongoing selling pressure. Recent on-chain data indicates a shift in sentiment among Bitcoin investors, with a decrease in buy calls and a notable increase in sell calls.

Increased Sell Calls in Bitcoin

The drop in Bitcoin’s price has heightened anxiety among cryptocurrency investors, leading to an increase in sell calls on social media platforms. Conversely, there is a significant decrease in buy calls. This type of change, characterized by fear, uncertainty, and doubt (FUD), is often seen as a potential opportunity period for recovery.

As is known, Bitcoin has been under some selling pressure following its 4th block reward halving. Analyses show that different Bitcoin investor groups apply different strategies in response to market dynamics. Large investors, often referred to as “crypto whales,” typically sell during price fluctuations to protect their gains, while smaller investors tend to preserve or increase their assets even after market peaks.

In this context, mid-scale investors holding between 100 and 1,000 BTC tend to show a strategic approach to trading. They actively respond to market trend changes using sophisticated investment tactics. These investor groups play a significant role in shaping Bitcoin’s price movements and stand out during periods of fluctuation and price corrections.

From October 2023 to March 2024, the observed high supply rates during bullish market periods often reflect overbought conditions, indicating a potential market correction. Moreover, this week, Bitcoin’s volatility dropped from 70% to 50%, reflecting a significant decrease on the volatility front and indicating that investors are in a “wait and see” trend.

Spot BTC and ETH ETFs Expected to Open in Hong Kong

Looking ahead, market participants are anticipating the launch of spot Bitcoin (BTC) and Ethereum (ETH) exchange-traded funds (ETFs) in Hong Kong on April 30th. This development is expected to positively impact the market and stimulate the overall cryptocurrency market.

This development is particularly being closely watched as it could potentially attract institutional capital to the cryptocurrency market in Asia and positively influence Bitcoin’s price trajectory.

Türkçe

Türkçe Español

Español