Bitcoin continues to face resistance around $64,000 and struggles to overcome this key level despite multiple attempts. Currently trading at $60,990 with a market cap of $1.2 trillion, BTC is under pressure as analysts foresee potential negative scenarios for its price trajectory.

Will Bitcoin Rise or Fall?

As the question of whether Bitcoin will rise or fall becomes more frequent, crypto analyst Ali Martinez outlines two scenarios for Bitcoin’s price movement. Regaining the support level of $64,290 could signal a rise towards $76,610. However, failing to surpass this crucial threshold may cause BTC to revisit the support at $51,970. This analysis underscores the importance of $64,290 as a critical level for Bitcoin’s short-term price movements, indicating potential volatility ahead.

Echoing similar sentiments, analyst Michael van de Poppe emphasizes that Bitcoin’s fate is tied to specific price points and highlights its critical position. According to him, if Bitcoin fails to hold above $60,000, it could lead to a definitive downward movement towards the $52,000 to $55,000 range. On the other hand, a breakthrough above $63,000 could potentially propel BTC towards $70,000 to $72,000.

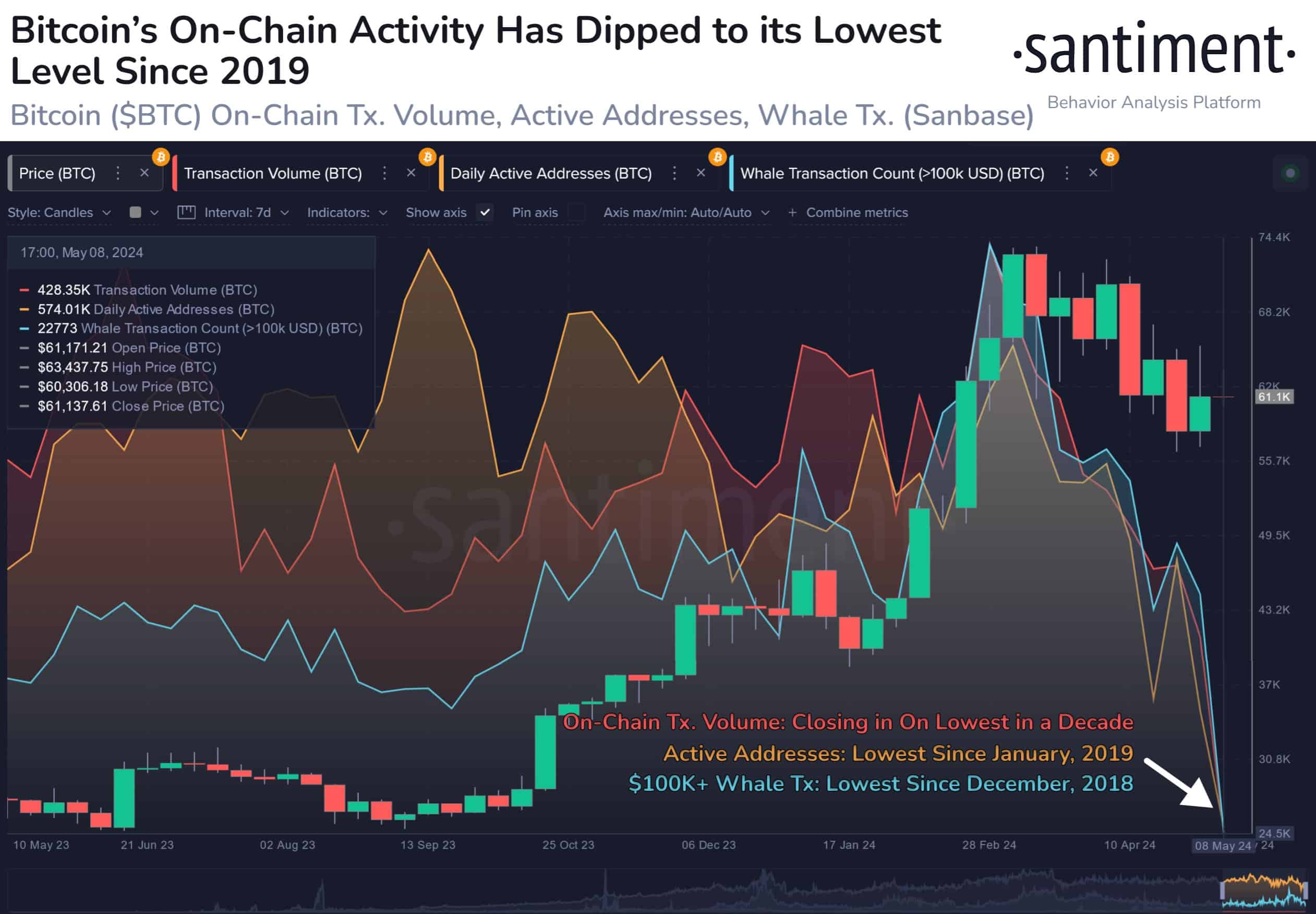

Bitcoin’s On-Chain Activity Declines

Crypto data platform Santiment reveals a significant drop in Bitcoin’s on-chain activity, with transactions approaching historically low levels. This decrease in on-chain activity reflects increased fear and uncertainty among investors following Bitcoin reaching its all-time high. However, this decline in on-chain activity does not necessarily imply an imminent price drop.

Despite the drop in transaction activity, long-term Bitcoin investors display a strong belief in holding their BTC. Santiment’s Long-Term Investor Spending Binary Indicator shows a significant behavioral shift among long-term investors, with a cessation of selling activity. Even though prices rose above $73,000, long-term investors sold approximately 1.3 million BTC, yet the current trend indicates reluctance to sell, pointing to confidence in Bitcoin’s long-term prospects.

Overall, Bitcoin’s price is at a critical point, and market dynamics hint at potential fluctuations ahead. Investors closely monitor key resistance and support levels, while on-chain activity and long-term investor behaviors provide insights into market sentiment and investor confidence. As BTC attempts to overcome these challenges, its ability to break through resistance or hold at crucial support levels will determine the short-term direction of its price.

Türkçe

Türkçe Español

Español