Following the launch of the Spot Bitcoin ETF, Bitcoin (BTC) prices continue to face sharp sell-offs and pressure. During Thursday night, losses reached 3.45%, causing the price to fall below $41,000. Meanwhile, since the beginning of the week, losses have exceeded 10%, causing concern among investors. As of the time of writing, BTC’s market value is $805 billion, trading at around $41,100.

Current Situation in BTC

After the spot Bitcoin ETFs started trading last week with great enthusiasm, significant sell-offs occurred on the Grayscale Bitcoin Trust (GBTC) side. Consequently, Grayscale balanced the situation by liquidating a large number of Bitcoins as part of the GBTC assets. The total outflows from GBTC last week exceeded $2.2 billion.

Famous crypto analyst Scott Melker, shared his thoughts on the role Grayscale plays in the market, emphasizing that the company is not driving the market down. According to Melker, the sales of Grayscale’s Bitcoin Trust (GBTC) were triggered by individuals selling their GBTC assets.

He stressed that this process is not malicious, but rather a fundamental aspect of the mechanics associated with an Exchange Traded Fund (ETF). Melker’s views shed light on the dynamics at play and provide context for market movements involving Grayscale and Bitcoin assets.

However, these developments have led to downward selling pressure on BTC prices in recent days.

Development of Bitcoin ETFs

Since the start of Spot Bitcoin ETF trading, despite a drop in BTC price, there has been a noticeable increase in trading volumes, with multiple ETF proposals experiencing volume growth. BlackRock’s spot Bitcoin ETF saw over a billion dollars in inflows within just four days of trading.

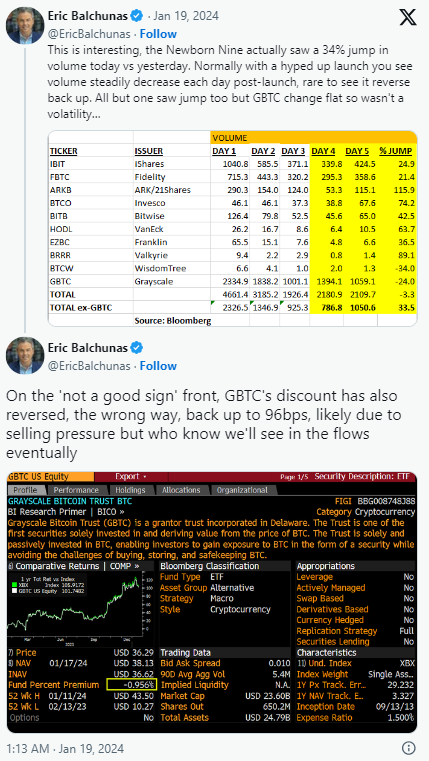

On the other hand, Eric Balchunas, who is often mentioned in the approval process of the Bitcoin ETF, highlighted nine Bitcoin ETFs and noted a 34% increase in volume compared to the previous day. Balchunas pointed out that normally, declines are expected daily after such market entries, but this was not the case with Bitcoin ETFs.

Indeed, ETFs have experienced an unexpected surge in volume, showing movements contrary to what has been seen in the market to date. Since the launch of the ETFs, all but one have seen an increase. According to Balchunas, this is not due to volatility, and the Grayscale Bitcoin Trust (GBTC) continues its sideways trend.

Balchunas believes this creates a positive atmosphere. He continues to maintain an optimistic view on the performance and future of the 9 ETFs that have emerged in the market. Moreover, Bitcoin ETFs, surpassing the $27.5 billion barrier, have once again demonstrated their appeal by leaving silver behind.

Türkçe

Türkçe Español

Español