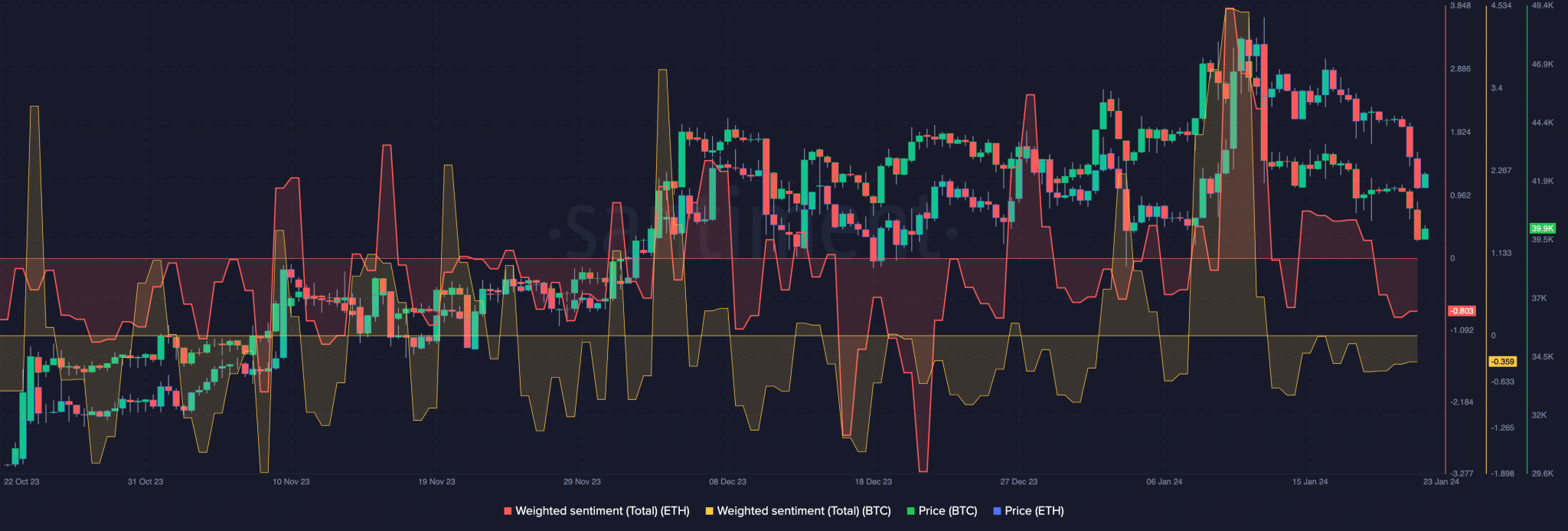

Bitcoin (BTC) has witnessed a significant correction in the past few days. The BTC price dropped below the support level of $42,000, causing widespread FUD in the overall market. The recent correction in BTC not only created shock waves within the community of holders but also significantly affected Bitcoin miners.

Bitcoin Mining Data

In the last 24 hours, BTC miners found themselves struggling with financial difficulties as transaction fees hit their lowest levels since June 2022. As miners face challenges in maintaining profitability amidst decreasing fees, a new layer of complexity emerges. The financial pressure on miners has broader implications for the BTC environment.

Miners may create selling pressure due to reduced rewards as they oscillate between sustaining profitability and managing their assets. This miner-led selling could potentially contribute to downward pressure on the Bitcoin price and add momentum to the ongoing market correction. In contrast to the miners’ difficulties, institutional players are strategically accumulating BTC.

Short-Term Forecast for BTC

Grayscale excluded, Bitcoin ETF issuers have accumulated a significant amount of 86,320 BTC at an average price of $42,000. This reflects a substantial investment of $3.63 billion. The strategic accumulation by institutions underscores a long-term perspective and suggests continued confidence in Bitcoin’s future value. However, it also implies potential short-term effects on the BTC market and further centralization of BTC ownership. There has been a decrease in the total number of BTC holding addresses, which could indicate a potential contraction in overall market participation.

Additionally, the decline in the long/short ratio, with new addresses outpacing old ones, could signal a potential shift in market sentiment. Amid these developments, there has been a positive trend with an increase in daily active addresses on the Bitcoin network. This rise in network activity served as a balancing force, provided a degree of stability, and potentially mitigated the impact of other negative factors.

Türkçe

Türkçe Español

Español