Bitcoin (BTC) market experienced a slight decline on Monday, April 1, capturing the attention of investors worldwide. Despite growing optimism related to the upcoming Bitcoin Halving event, the recent volatility in BTC price movements has increased both expectations and concerns among investors.

Expert Insights on Bitcoin

A leading cryptocurrency analyst shared significant predictions regarding the Bitcoin price, intensifying discussions about BTC’s future trajectory. The recent drop in Bitcoin’s price, particularly amidst the increased optimism for the Bitcoin Halving planned for later this month, has sparked debates in the cryptocurrency market. Following the price reaching all-time highs, investors are eagerly searching for important predictions amidst the tumultuous market scenario.

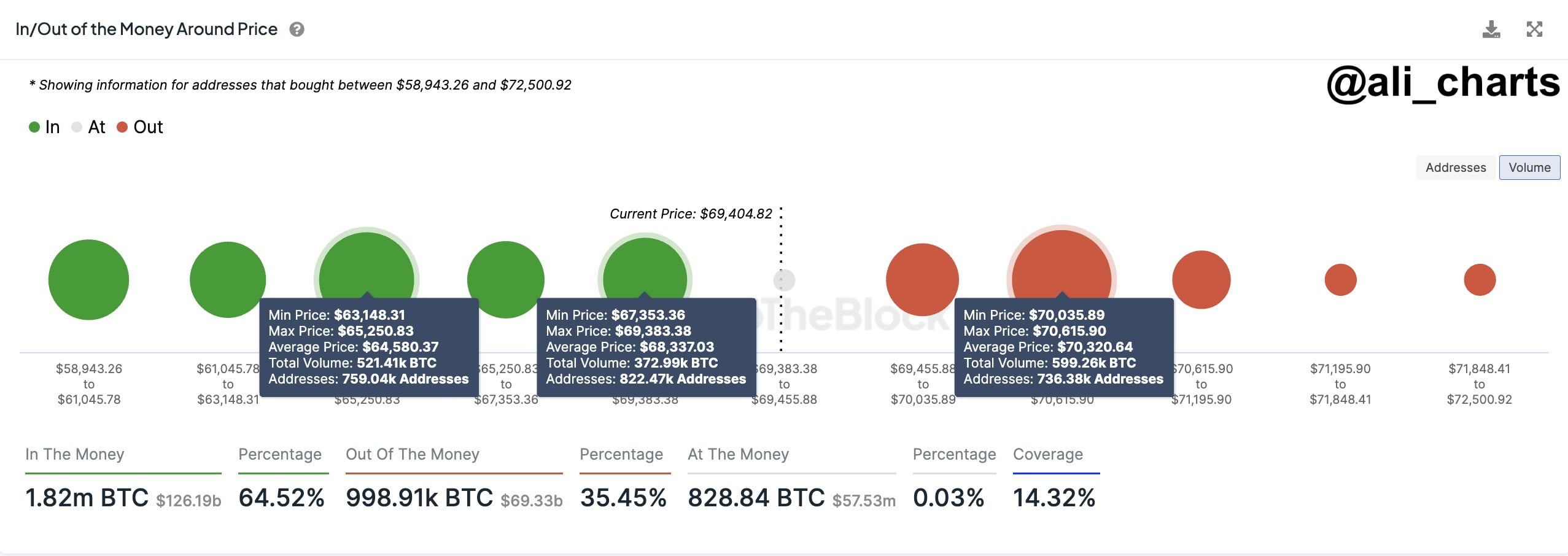

Additionally, as Bitcoin stands on the brink of uncertainty, cryptocurrency market analyst Ali Martinez provided crucial information about potential price movements. Ali Martinez highlighted a critical support level at $68,300 and emphasized that breaching it could trigger a downward spiral towards a range between $65,250 and $63,150. This range, where 760,000 wallets hold 520,000 BTC, could present a significant psychological threshold for Bitcoin’s trajectory.

Martinez’s analysis could also underscore the importance of securing support at $70,320 to propel Bitcoin into its next upward trend. The discussions sparked by Ali Martinez’s observations reflect the market’s sensitivity to Bitcoin’s current price dynamics, especially in an environment of falling values. Despite concerns about potential price drops, optimism fueled by expectations for the Halving event prevails in the crypto community. Historical data shows that Bitcoin has rallied after previous halvings, leading many analysts to predict new peaks in the coming months.

Meanwhile, as the market prepares for potential volatility, the overall sentiment continues to be cautiously optimistic. Investors are closely monitoring Bitcoin’s price movements and anticipating future developments by evaluating critical support levels and historical trends.

Furthermore, as Bitcoin goes through a period of uncertainty, the views of experts like Ali Martinez offer valuable guidance to investors. The delicate balance between support levels and market sentiment will likely determine Bitcoin’s short-term direction, and the upcoming halving event could add an extra layer of expectation to the mix. At the time of writing, Bitcoin’s price had fallen by 1.02%, trading at $69,549.96, while the 24-hour trading volume had increased by 47% to $25.57 billion. Notably, the flagship cryptocurrency reached a high of $71,377.78 and a low of $68,986.95 within the last 24 hours.

Türkçe

Türkçe Español

Español