Bitcoin (BTC), on January 10, saw eleven spot ETF applications approved, with trading starting the next day. While some investors anticipated further price increases, others argued that the event was already priced in. BTC prices rose to $48.9k on Binance on January 11, but fell to $41.5k the following day.

Expert Opinion on Bitcoin

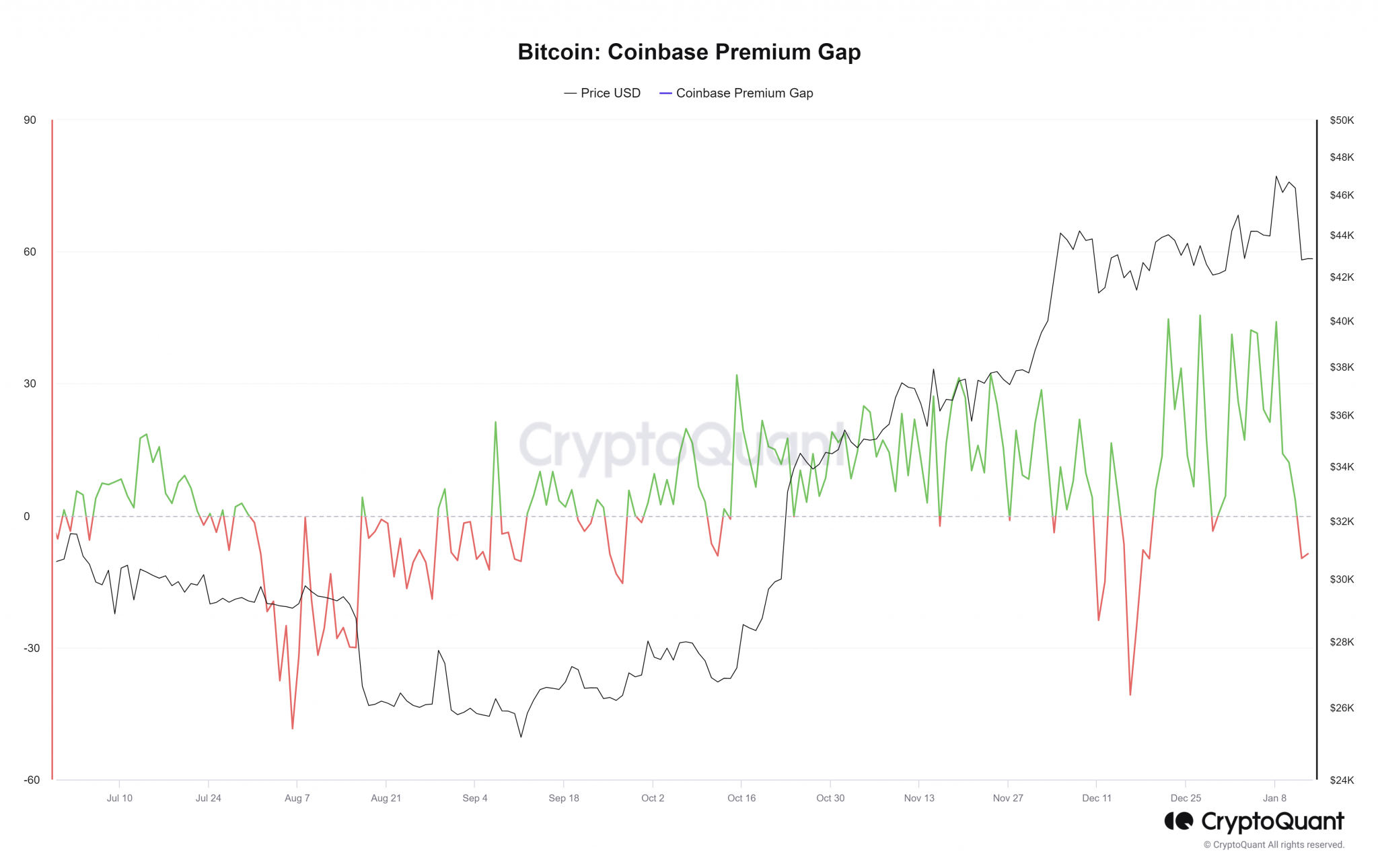

Ki Young Ju, founder and CEO of CryptoQuant, shared that Grayscale sent 21.4k BTC to multiple addresses in the last 30 days. The implication is that this outflow might not be the sole reason for the price drop. Maarten also turned to research the consequences of this BTC outflow. After spot ETF transactions began, the Coinbase Premium Gap started to fall into negative territory. This index is the price difference between Coinbase’s BTC/USD pair and Binance’s BTC/USDT pair. Higher values imply US investors are willing to buy BTC, while negative values could mean US participants are selling. The premium was mostly positive in December and January, indicating strong demand. Notably, in January, Bitcoin twice surpassed the high level of $44.3k, but prices returned to the range in both instances.

In addition to the falling Premium, it was suggested that this could be a bad sign for Bitcoin bulls on the next trading day, January 16. Analysts took on Bitcoin’s liquidation heat map to understand where prices might head next. Since liquidity is one of the fundamental drivers of the market, high liquidity pockets can help identify where trends might reverse.

Critical Levels in BTC

The liquidity pool between $48k and $48.2k was tested, and BTC faced a sharp reversal around $49k on January 11. On the downside, the levels of $50.2k, $51.2k, and $52.4k could be significant areas of interest.

The region between $39.2k and $40k at the bottom of the chart is an area with much denser liquidation levels. Further down, the levels of $35k and $33.8k are predicted to have even more liquidation levels. Therefore, a return to these levels in the coming weeks or months could likely indicate the local market’s bottom. Given this situation, BTC is more likely to fall in search of liquidity rather than surpassing $50k.

Türkçe

Türkçe Español

Español