Bitcoin (BTC) price recently held above $71,000, indicating renewed interest and confidence among long-term investors and major investors. This trend shows that Bitcoin whales or significant investors have started accumulating substantial amounts of the largest cryptocurrency over the past month.

Revival in Bitcoin Demand

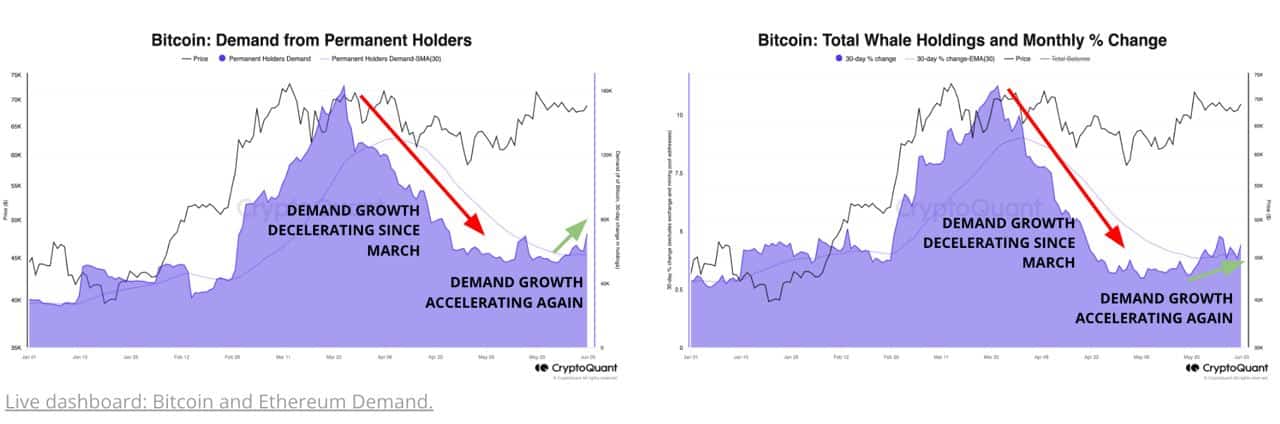

A cryptocurrency data provider, CryptoQuant, highlighted this revival in Bitcoin demand, which is crucial for a sustainable price rally. Various factors contribute to this positive trend. Firstly, the balances of long-term investors and significant investors are increasing more rapidly. This growth demonstrates a strong belief in the future performance and value appreciation potential of the largest cryptocurrency.

In addition, the market is facing significant daily inflows from major Bitcoin investors. Over the past month, these investors have provided daily inflows of $1 billion, showing their increased interest and commitment to Bitcoin. This fund flow is a positive indicator of the growing appeal of the crypto king.

Moreover, there is a notable increase in Bitcoin purchases from spot ETFs in the US. As known, spot Bitcoin ETFs are investment funds traded on exchanges similar to stocks and hold Bitcoin as the underlying asset. The increasing buying activity of these funds further boosts Bitcoin demand, supporting price stability and potential upward movement.

Data also shows a decrease in intense selling by investors. This is evidenced by the unrealized profit ratio resetting to 0%, suggesting that the market may have reached an equilibrium point. With the reduction in selling pressure, the current stability in Bitcoin prices could pave the way for future gains.

70,000 BTC Acquired in the Last 30 Days

In the past two months, Bitcoin whales’ appetite for buying has reached its peak. Persistent investors accumulated 70,000 BTC in the last 30 days, and the demand for Bitcoin from whales increased by 4.4% monthly. This trend shows the strong confidence significant investors have in Bitcoin’s long-term value.

On the ETF front, spot Bitcoin ETFs saw inflows for 18 consecutive days. As of June 6, 2024, the total net inflow for spot Bitcoin ETFs in the US reached $218 million. Grayscale’s ETF GBTC experienced a single-day net outflow of $37.57 million, while BlackRock’s ETF IBIT saw a single-day inflow of $350 million. The cumulative historical net inflow for IBIT has now reached $17.43 billion.