According to a market analyst, as with previous cycles, a significant Bitcoin outflow from miners could occur in the months following the halving event. 10x Research’s head of research Markus Thielen calculated in his April 13 analyst note that Bitcoin miners could potentially liquidate $5 billion worth of Bitcoin after the halving.

Expert Comments on Halving

Markus Thielen stated that if the crypto markets face a significant challenge during a potential six-month summer lull, the same could happen again, and he included the following remarks:

“This sell-off could last four to six months, which explains why Bitcoin may move sideways over the next few months, just as it did after previous halving events.”

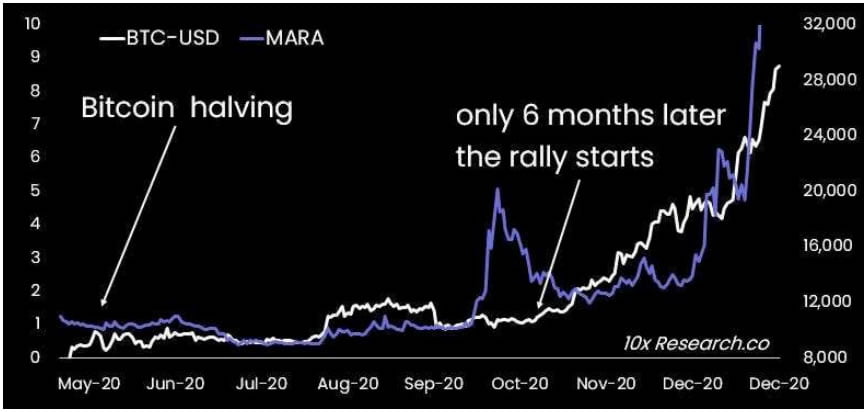

Bitcoin prices remained between $9,000 and $11,500 in the five months following the 2020 halving event. This year’s halving event will occur around April 20, just six days later, so if history repeats itself, the markets may not see a significant uptrend until October.

Additionally, he mentioned that miners tend to stockpile Bitcoin, leading to a supply/demand imbalance and subsequently a rise in Bitcoin prices, which resulted in the halving event. This happened as Bitcoin prices surged 74% in 2024, reaching an all-time high of $73,734 on March 14, before falling below $63,000 in mid-April. Thielen also believes that altcoins, in particular, could bear the brunt of this situation. Many have retreated heavily in the past week and are far from their 2021 peaks:

“Even if there is a correlation between the halving and an altcoin rally as some predict, historical evidence suggests that the rally usually starts almost six months later.”

The Halving Process and Bitcoin Mining

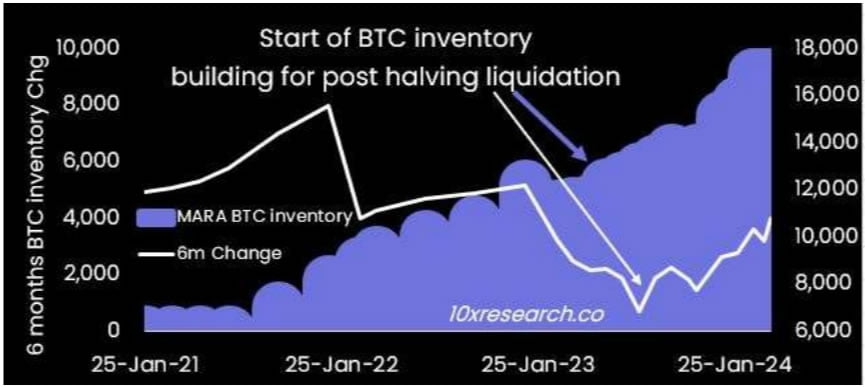

Thielen suggested that the world’s largest Bitcoin miner, Marathon, is likely to create an inventory to be sold off gradually after the halving event to prevent a revenue cliff. As Marathon currently produces 28-30 Bitcoins per day, this could result in 133 days of additional market supply plus the Bitcoins they produce, which would then become 14-15 Bitcoins per day after the halving:

“Other miners will likely follow a similar strategy to gradually liquidate parts of their inventory.”

The researcher concluded that if all miners adopt a similar strategy to sell off inventory after the halving, it could result in a maximum daily Bitcoin sale of $104 million, potentially reversing the supply/demand imbalance that caused Bitcoin’s rise before the halving.

Last week, Marathon CEO Peter Thiel stated that to remain profitable after the halving, the company’s break-even point would be approximately $46,000 per Bitcoin, and he anticipated no significant price movement in the six months following the event.