Cryptocurrency markets experienced a historic day yesterday, with Bitcoin (BTC) reaching an all-time high (ATH) level for the first time since November 2021. It then fell by $10,000 due to rapid profit-taking and the liquidation of accumulated long positions in futures. However, at the time of writing, BTC is finding buyers at $67,200, indicating a strong appetite for new peaks.

Spot Bitcoin ETF

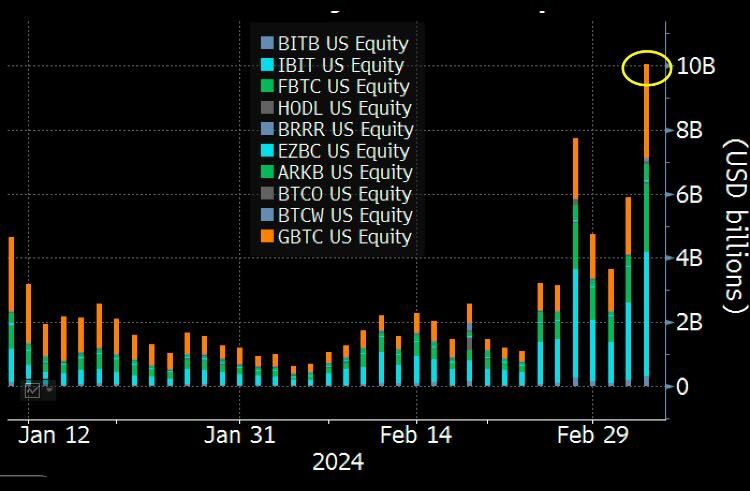

The United States ignited this rally earlier this year by approving the Spot Bitcoin ETF, proving analysts who said BTC was on its ATH journey correct. After a false “sell the news” event, the price recovered from $38,500, surging by $30,500. Below, you can see the daily volume data for the on spot BTC funds since their first trading day on January 11.

Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Crypto Traders Are Rushing to This App – Here’s Why You Should Too

While a few billion dollars in volume excited the market in the early days, yesterday all ETFs reached a daily volume of approximately $10 billion. Bitcoin analyst Alessandro Ottaviani reported a net volume of $9.58 billion for the funds. This figure surpasses the previous record of $7.7 billion seen on February 28, reflecting massive interest when considering the volume data of all ETFs in the US.

According to Ottaviani’s numbers, BlackRock’s iShares Bitcoin ETF (IBIT) saw the highest volume with $3.7 billion, while Grayscale Bitcoin Trust (GBTC) and Fidelity Wise Origin Bitcoin Fund (FBTC) reached volumes of $2.8 billion and $2 billion, respectively.

Will Bitcoin and Cryptocurrencies Continue to Rise?

The supply of BTC and ETFs on exchanges is at historic lows. Only $142 billion worth of Bitcoin remains on cryptocurrency exchanges, and ETFs have seen nearly $10 billion in net inflows in roughly two months. While exchange supply is tightening, the reserve wallets of ETF issuers are growing. BlackRock’s reserve has reached $10 billion, while Fidelity has surpassed $7 billion. Outflows from GBTC are slowing down.

In April, the halving event will cut the new supply released by miners by half. Considering all these factors, including the FOMO through the ETF channel, a general uptrend in crypto is expected unless a catastrophic scenario unfolds.

Türkçe

Türkçe Español

Español