Bitcoin began the last week of February above $52,000, breaking a new two-year high for the weekly close. As investors push the market closer to all-time highs, Bitcoin’s price strength shows little sign of reversing downward. Investors and market observers have mixed opinions on timing, but there is a growing consensus for upward calls.

What’s Happening on the Bitcoin Front?

Bitcoin has successfully navigated the turbulence from significant events of the year, and predictions for a classic rally continue with only two months left until the block subsidy halves. The longer-term outlook appears less predictable: analyses warn that the BTC/USD pair could peak towards the end of 2024 before entering a secular bear market, while the overall strength of the halving event in terms of price action is also scrutinized.

When the tumultuous macroeconomic and geopolitical issues in the United States and beyond are added, the factors influencing crypto volatility become even clearer. According to TradingView data, Bitcoin achieved its highest weekly close since November 2021 at $52,100 on February 18th.

This brings the market symbolically closer to the peak of that period’s exuberance, which saw a blow-off top at $69,000. Predictions for how the week would end varied, with various support levels on the radar in case of a last-minute market reversal. However, the event concluded with minimal volatility, and the price held steady at the $52,000 level during the Asian session.

Notable Analysts Offer Insightful Comments

Michaël van de Poppe, founder and CEO of trading firm MNTrading, summarized in his recent update that Bitcoin’s price has consolidated at $52,000 with a total market value of $1.9 trillion.

Van de Poppe discussed a popular theory regarding the short-term Bitcoin price performance, suggesting that the upside for Bitcoin appears relatively limited, stating:

“My general thesis is a continuation to $54,000 to $58,000 followed by consolidation and a broader correction. After that, I expect a rotation towards altcoins.”

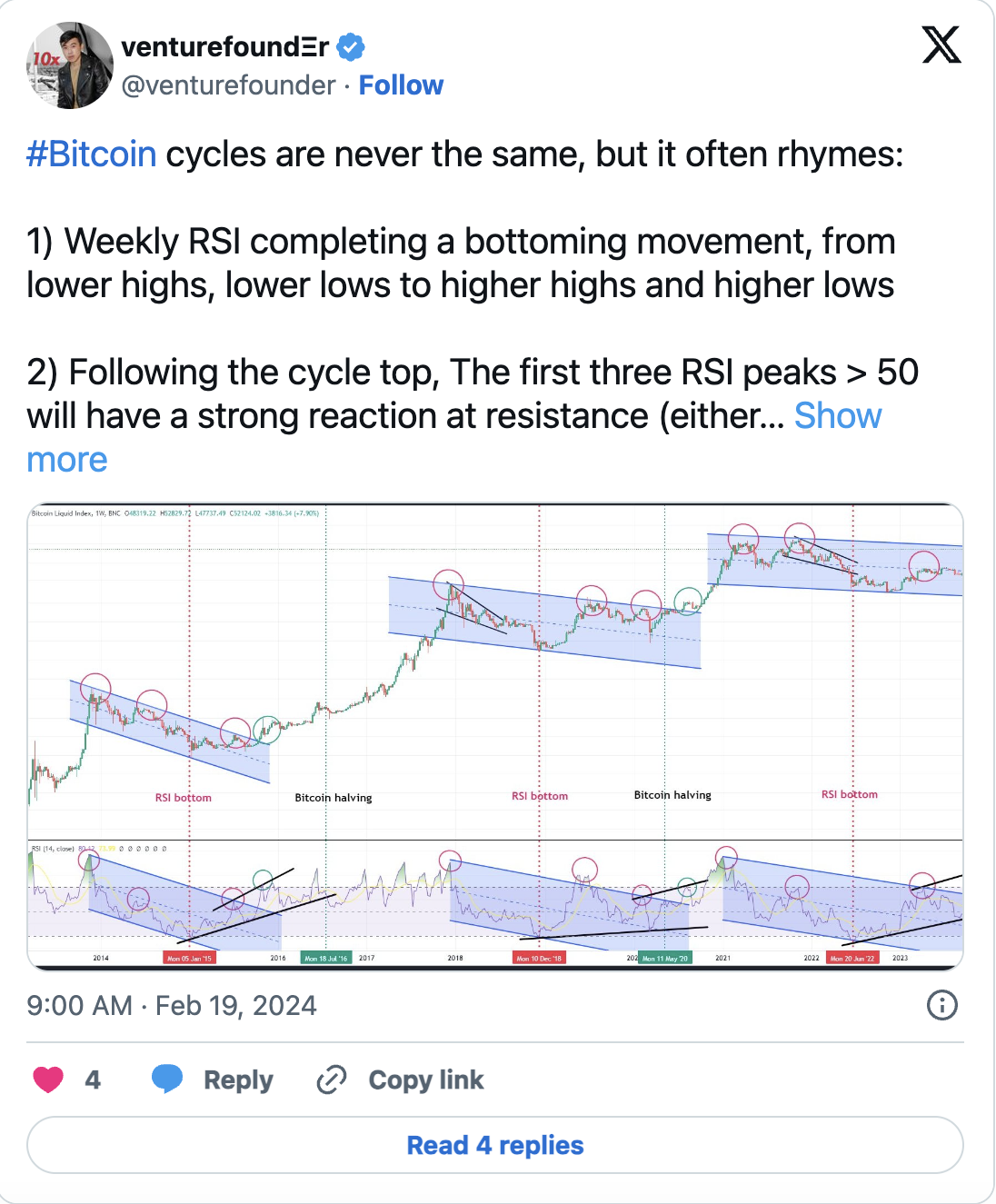

However, liquidity at $52,000 and associated resistance became a sticky focal point, avoiding much of the past week’s spot market action. Venturefounder, a contributor to on-chain analysis platform CryptoQuant, agreed with the $58,000 target. His rationale revolves around the behavior of the Relative Strength Index (RSI):

“If everything follows, the last Bitcoin RSI peak indicates the downward channel has been broken, which will push the price up to $58,000, followed by a correction, and the $50,000 level will become a strong support moving forward.”