Bitcoin (BTC) investors faced significant losses in June as the price of the largest cryptocurrency fell by approximately 17%. This decline had a general impact, causing the total market value of the cryptocurrency market to drop by 10.27%, from $2.53 trillion to $2.27 trillion. Market sentiment was quite negative, influenced by factors such as the announcement of Mt. Gox starting repayments and macroeconomic conditions. Despite these issues, July shows signs of potential recovery.

Historical Data and July

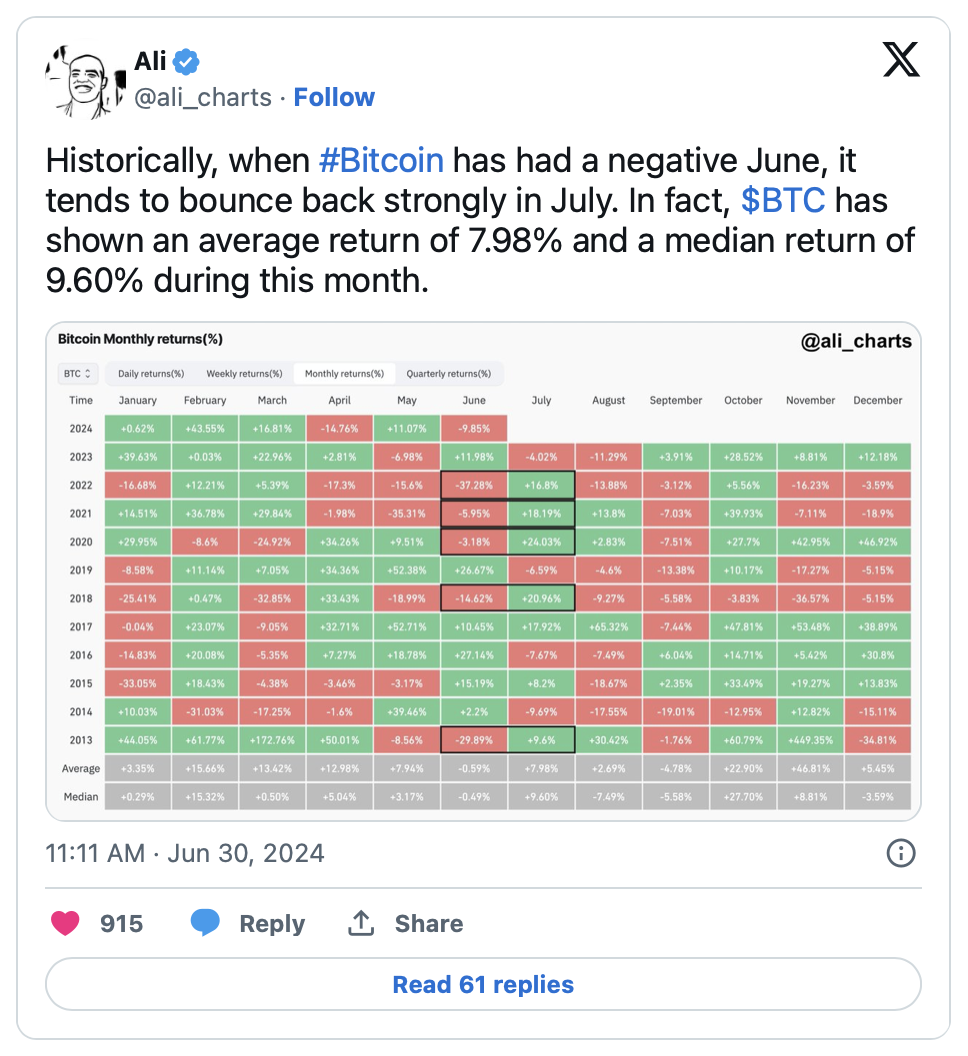

Renowned cryptocurrency analyst Ali Martinez painted a highly positive picture, pointing to historical trends that suggest Bitcoin might be on the verge of a significant recovery. Historically, Bitcoin has shown strength after a challenging June and generally recovered strongly in July.

Martinez highlighted that in recent years, Bitcoin has risen by 7.98% and a median of 9.60% in July, emphasizing the potential for growth within the month. These figures present a promising outlook for investors expecting a recovery after a tough June.

Predicting a Rise to $70,000

Bitcoin’s price has already shown signs of this potential recovery, rising by 4% in the last 24 hours to $63,360. Analysts are optimistic that this trend will continue, predicting another 10% rise in the coming days. This optimism is supported by technical analysis suggesting that Bitcoin could break out of a Descending Broadening Wedge formation, which typically indicates a potential upward breakout.

Another leading cryptocurrency analyst, Captain Faibik, also supported this view in his analysis. He noted that while Bitcoin’s price has fallen since last month, it is now poised for a significant upward breakout. Faibik’s analysis suggests that a successful breakout from the Descending Broadening Wedge formation could drive Bitcoin’s price up by approximately 10% to around $70,000.

This technical formation has been observed on the 4-hour chart, indicating that a breakout is very close. The analyses of Captain Faibik and Martinez suggest that Bitcoin’s poor performance in June could be followed by a recovery in July, as seen in historical trends.

Türkçe

Türkçe Español

Español