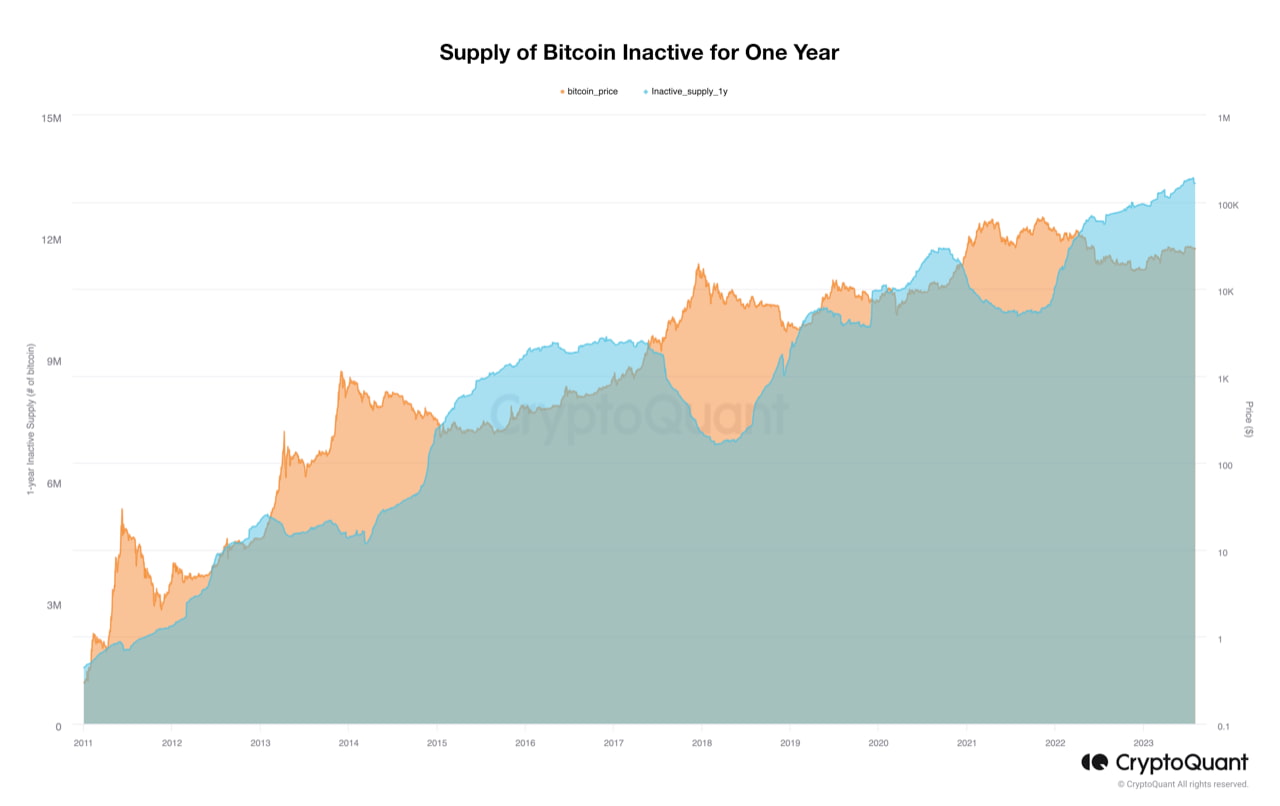

Bitcoin (BTC) investors are showing a positive trend by not selling their BTC at current price levels due to the 13.42 million BTC remaining inactive in Bitcoin wallet addresses since August 2022. Furthermore, the sending of approximately 1.14 million BTC to cryptocurrency exchanges at the lowest level in the past month during the week indicates a decrease in selling pressure on the largest cryptocurrency and also points to a positive trend.

Investors Hold BTC without Selling

Onchained, a verified on-chain analyst on the data platform CryptoQuant, stated that “It is quite surprising to observe that 69.2% of the total Bitcoin supply has remained inactive for over a year. Despite the notorious high volatility of the cryptocurrency market, this situation indicates a strong belief among Bitcoin investors in the long-term value of the largest cryptocurrency.”

The inactive supply, which currently stands at around 19.45 million BTC against the circulating supply, corresponds to a market value of nearly $400 billion. This surpasses the market value of the remaining altcoin market of approximately $340 billion when Bitcoin and Ethereum are excluded.

CryptoQuant data also shows the percentage of two, three, and five-year inactive supplies of Bitcoin. According to this, 55.7% of the supply (10.83 million BTC) remained inactive in the two-year period, 40.1% of the supply (7.8 million BTC) remained inactive in the three-year period, and 29.1% of the supply (5.66 million BTC) remained inactive in the five-year period.

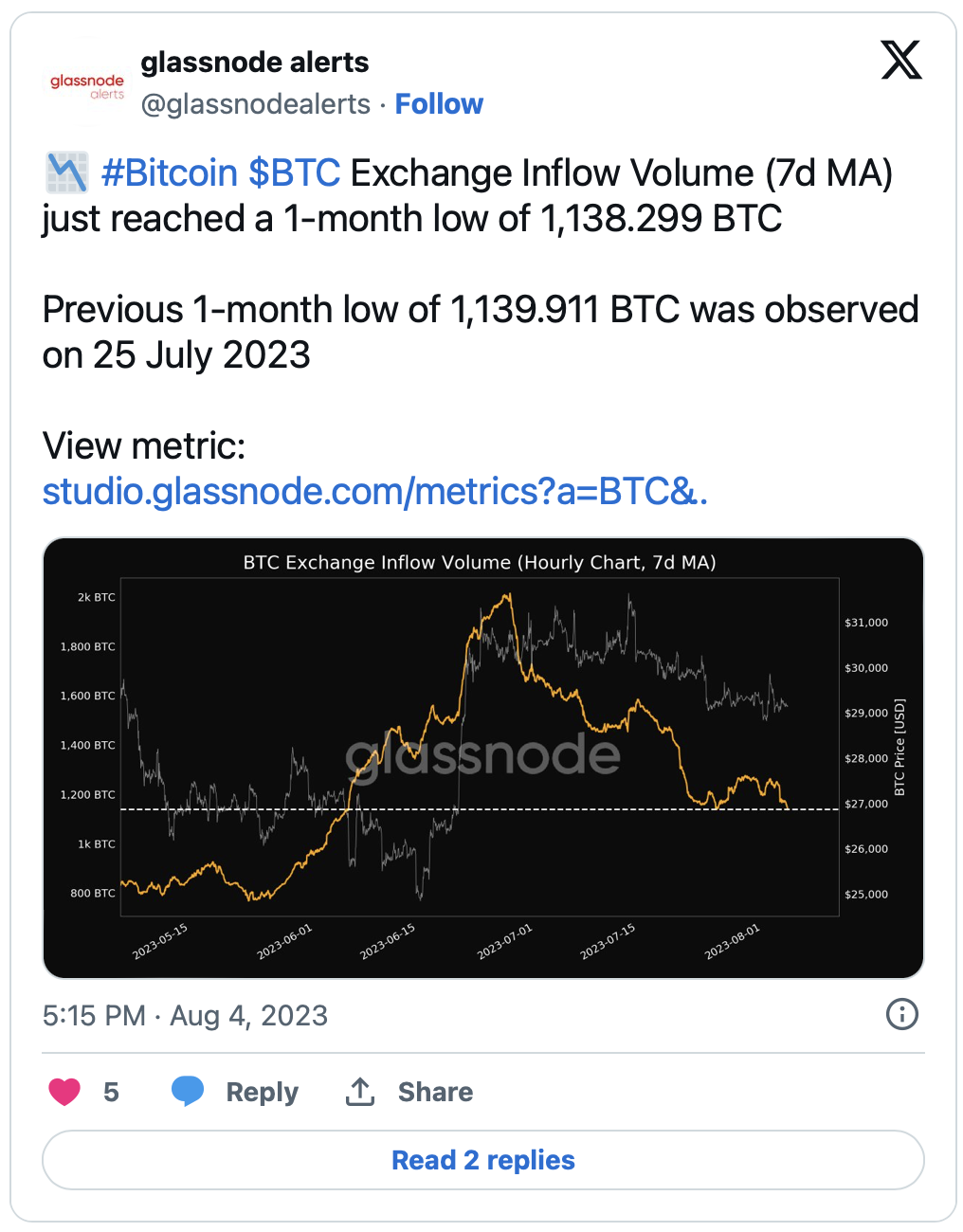

Inflow to Exchanges at the Lowest Level in the Past Month

Glassnode, another on-chain data platform, showed that the metric indicating the flow of BTC sent to cryptocurrency exchanges, which is generally considered to be for sale, dropped to the lowest level in the past month in the 7-day moving average (7d MA). According to the metric, only 1.138 million BTC was deposited into known cryptocurrency exchange wallet addresses in the last seven days. The lowest value so far was recorded on July 25th with 1.139 million BTC in the 7d MA. This indicates that investors have a tendency to HODL their BTC.

HODL is a passive investment strategy based on holding BTC for a long period of time regardless of price or market changes. This strategy emerged years ago after a user misspelled the word ‘hold’ as ‘hodl’ on the oldest Bitcoin forum, bitcointalk.org.