Bitcoin (BTC)  $106,368 and altcoins are struggling to find movement space under selling pressure, as CoinShares’ weekly report indicates a $726 million outflow from crypto investment products last week. This $726 million outflow marks the largest since March of this year.

$106,368 and altcoins are struggling to find movement space under selling pressure, as CoinShares’ weekly report indicates a $726 million outflow from crypto investment products last week. This $726 million outflow marks the largest since March of this year.

Bitcoin Takes the Lead While Solana Surprises

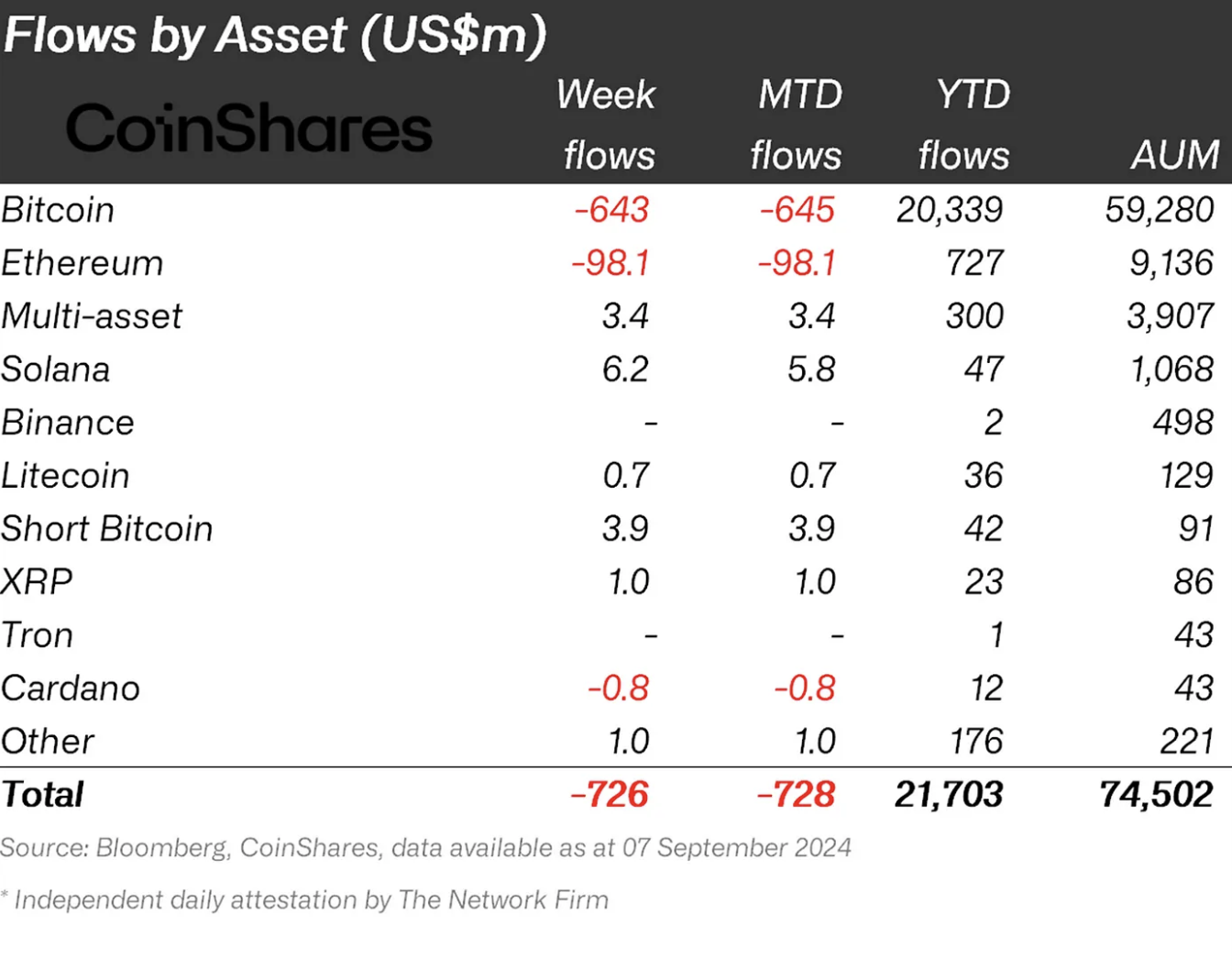

CoinShares‘ data shows that Bitcoin recorded a $643 million outflow, making it the most affected cryptocurrency, while short-Bitcoin products saw an inflow of $3.9 million.

Altcoin king Ethereum (ETH)  $2,529 followed Bitcoin with a $98 million outflow, largely due to Grayscale Trust, and negligible inflows into newly launched spot Ethereum ETFs. On the other hand, Solana (SOL) attracted the highest inflow among crypto investment products with a total of $6.2 million, indicating selective optimism among investors despite the overall market downtrend.

$2,529 followed Bitcoin with a $98 million outflow, largely due to Grayscale Trust, and negligible inflows into newly launched spot Ethereum ETFs. On the other hand, Solana (SOL) attracted the highest inflow among crypto investment products with a total of $6.2 million, indicating selective optimism among investors despite the overall market downtrend.

US at the Epicenter of Outflows

US was the epicenter of outflows with a staggering $721 million, followed by Canada with $28 million. In contrast, Europe showed a more positive outlook, particularly with inflows of $16.3 million and $3.2 million recorded in Germany and Switzerland, respectively.

US Federal Reserve’s stronger-than-expected macroeconomic data, increasing the likelihood of a 25 basis point rate cut, is cited as the main reason for the current negative sentiment in the crypto market and crypto investment products.

Last week’s weaker-than-expected employment market data accelerated the outflows, while inflows into crypto investment products are expected to resume if this week’s inflation figures fall below expectations, making a 50 basis point cut more likely.

Türkçe

Türkçe Español

Español