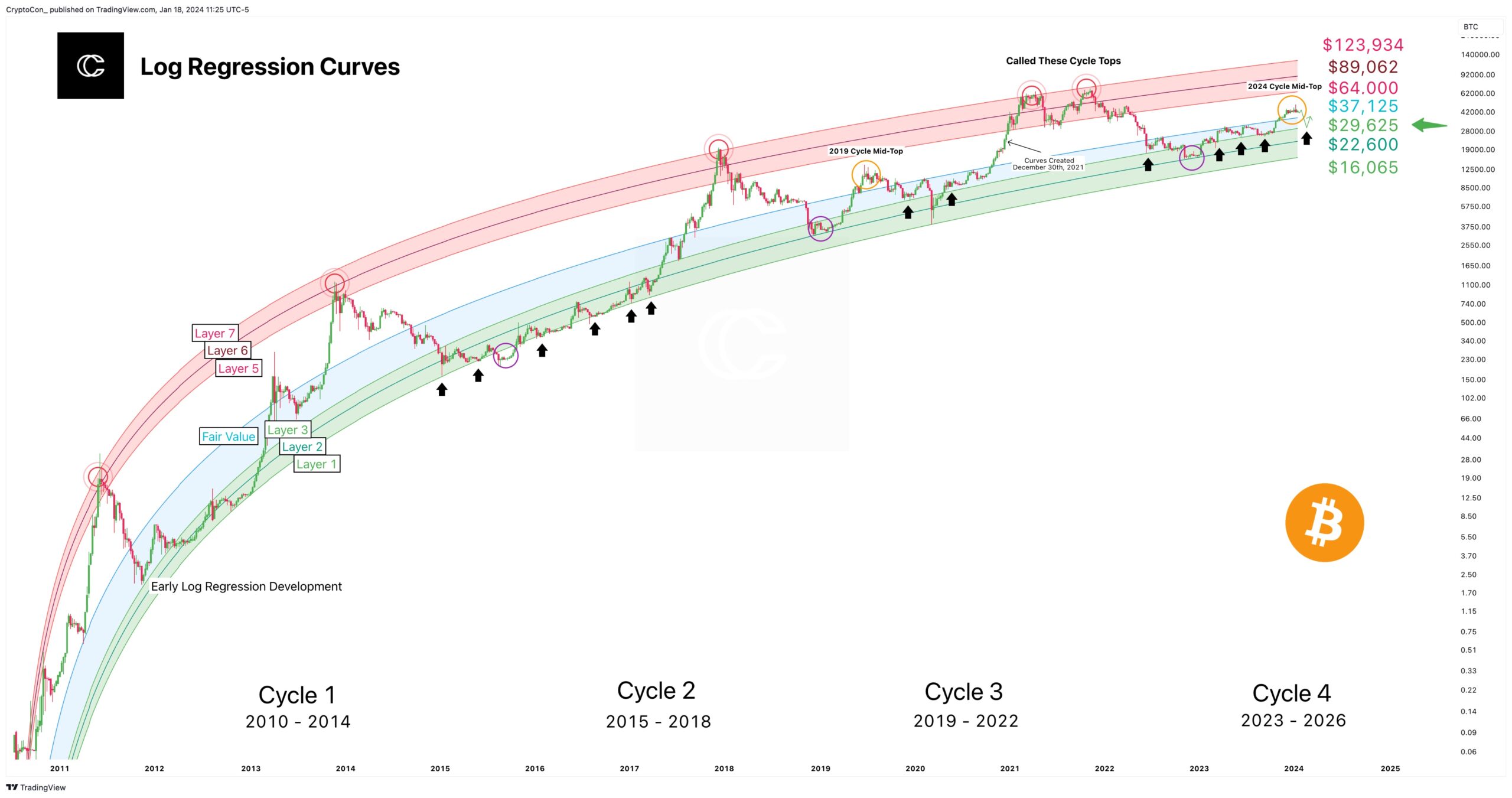

Cryptocurrency analyst CryptoCon’s recent analysis focuses on a Bitcoin Log Regression Curves approach. According to this, the log regression curves have once again proven their activity, resembling models observed in 2019 and pointing to a potential temporary peak in the current market cycle. But what does this mean? Let’s look at the analyst’s approach.

Bitcoin Daily Regression Curves at Work: Drawing Parallels with 2019

According to the analyst, as the price retests the third layer at $26,000, a familiar narrative reflecting the patterns seen in 2019 has emerged. The regression curves highlighted the recurring nature of these trends, indicating that $34,000 is the next target.

A significant moment occurred when the fair value layer was broken upwards, suggesting a move approaching the area circled in orange, reflecting the events of 2019. This historical parallelism provides a roadmap for potential price movements and valuable information for market participants.

Understanding Price Behavior: Between Two Bands

According to CryptoCon’s analysis, Bitcoin’s price tends to oscillate between two fundamental bands during a market cycle: Layer 3 and the fair value layer. The model’s prediction of a return to the third layer points to a potential price level around $29,625, consistent with historical accuracy as the model has successfully identified previous cycle peaks.

Looking forward, the top two layers offer intriguing figures:

- Layer 6: $89,062.

- Layer 7: $123,924.

These values are subject to weekly adjustments reflecting the dynamic nature of Bitcoin’s price movements.

Interpreting CryptoCon’s Analysis for Informed Decision Making

CryptoCon’s analytical approach provides a lens on the cyclical nature of Bitcoin’s price trends, drawing parallels between current models and those observed in 2019. Investors gain a nuanced understanding of potential price levels and market dynamics by recognizing the importance of the third layer and the fair value layer.

As Bitcoin’s price trajectory evolves, following this analytical approach becomes increasingly important for market participants. Consequently, CryptoCon’s analysis serves as a valuable guide for investors, offering predictions based on historical models.

The identified layers and predicted prices provide a framework for understanding Bitcoin’s current cycle and future potential movements. As the market evolves, this information contributes to making informed decisions in the dynamic world of cryptocurrency.

Türkçe

Türkçe Español

Español