Bitcoin‘s (BTC) price experienced significant fluctuations recently, yet the general interest in BTC continues to be notably strong. The increase in BTC liquidity further highlights the growing interest in BTC.

Current State of ETFs

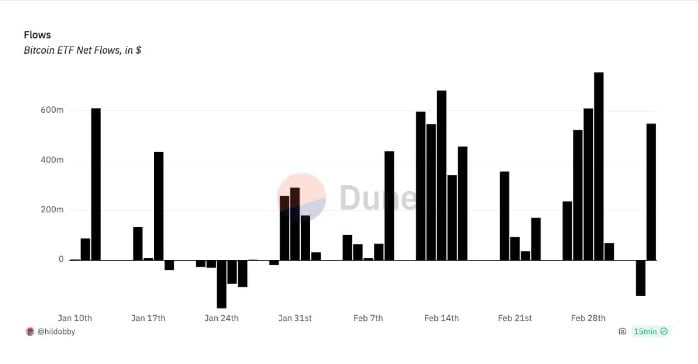

Recent data shows that approximately $1 billion worth of Bitcoin ETF volume has emerged, reaching an important level of $8.11 billion since the introduction of Bitcoin ETFs to the market.

This week, the price of Bitcoin saw a 15% pullback to $59,500, considered the bottom level from its new all-time high (ATH), raising questions as this was the second significant drop since ETFs were launched.

The previous drop on the day ETFs started trading was around 20%. The latest drop seemed to be the result of strategic moves by investors looking to secure their profits, especially after the substantial gains since January 11.

Five ETFs with the lowest entry, totaling $660 million in value, were relatively insignificant in terms of market tracking. In particular, GBTC trading at a 50% discount at one point suggests that investors holding GBTC may have continued without much concern over the 20% drop.

Despite a $10 billion outflow from BTC, the successful market entry of ETFs seemed to make the current declines less significant.

Looking at past cycles, expectations pointed to a drop of over 30%, while the last ATH before the halving indicated that the traditional structure might have changed. The changing structure, especially with no outflows in the last two days, clearly reflected the changing buyer profiles in the market due to increased entries.

Bitcoin Price Outlook

Moreover, significant changes are being observed in the market as Bitcoin’s supply is expected to halve in about 42 days. At the time of writing, Bitcoin was trading at $67,400, indicating a 2.09% increase in the last 24 hours.

If the price were to drop to $63,200, it is estimated that $2.2 billion worth of long positions could be liquidated, while a potential rise to $70,000 could liquidate approximately $2.4 billion worth of short positions.

Price movements that trigger the liquidation of long positions could increase selling pressure, leading to traders weakening and abandoning their positions, potentially accelerating the downward momentum.

Conversely, short liquidations caused by a price move to $70,000 could create a squeeze, leading traders to compete to close their positions.

Türkçe

Türkçe Español

Español