Bitcoin managed to preserve its gains this week, showing that investors are not in a rush to take profits even as the price approaches $70,000. The number of Bitcoin whales, or unique addresses holding more than 1,000 bitcoins, has risen to 2,104 as of March 7, indicating their anticipation of a continued uptrend.

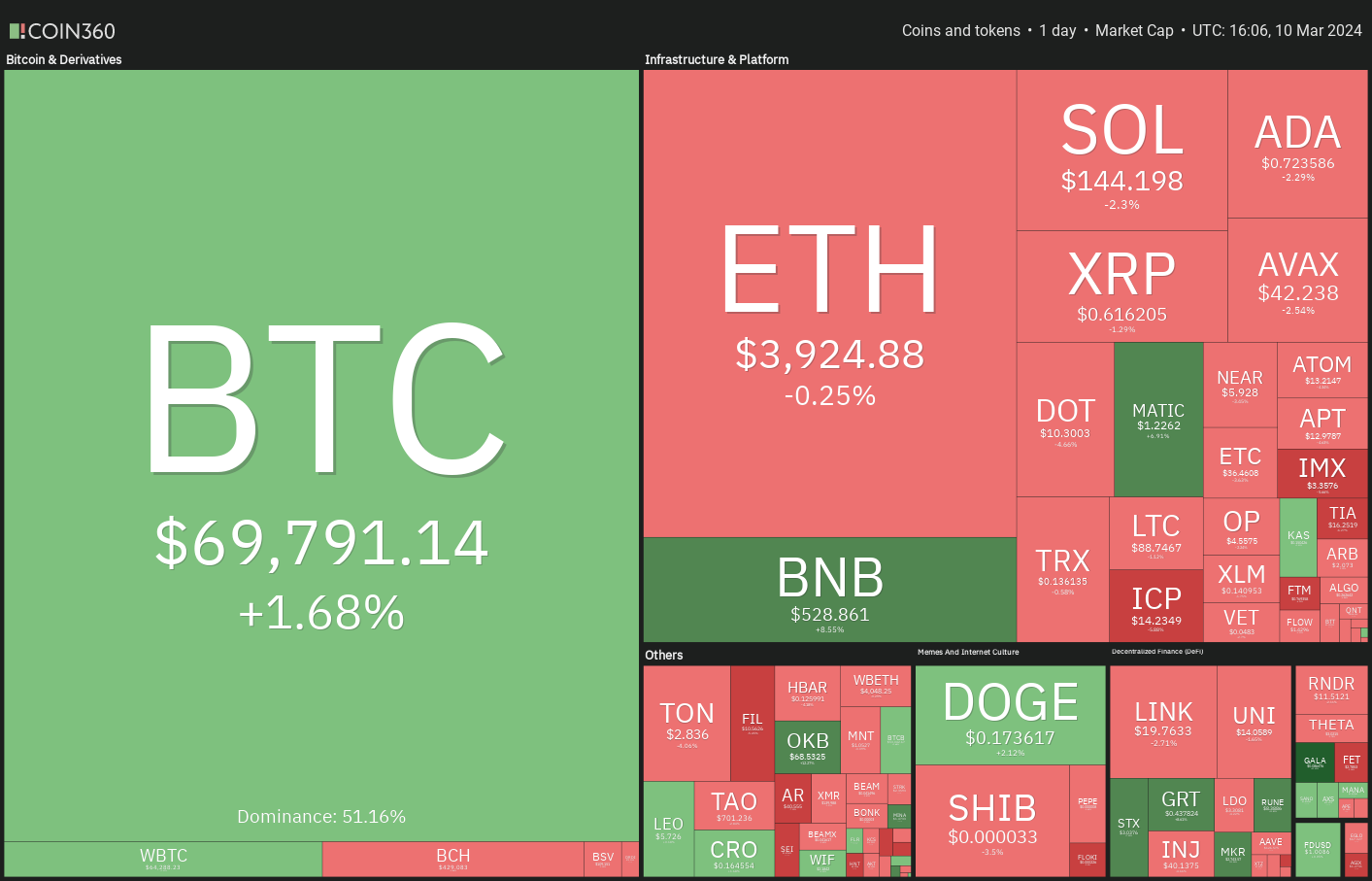

Bitcoin and Cryptocurrency Market Overview

Bitcoin’s rally has boosted sentiment across the cryptocurrency sector. Data from blockchain analytics platform DefiLlama shows that the global total value locked (TVL) in decentralized finance (DeFi) protocols has surpassed $100 billion for the first time in nearly two years. However, the TVL is still far below the record high of $189 billion reached in November 2021.

During a bull market, investors may become less cautious, expecting prices to rise. However, this often does not end well. Bitwise Chief Investment Officer Matt Hougan has warned investors to be cautious, noting that terrible projects are trading at crazy valuations during such times.

Bitcoin Chart Analysis

Bears are trying to halt Bitcoin’s rise around $70,000, but the bulls show no signs of giving up, which is a positive sign. This indicates that every dip is being bought. Bulls may try to push the price above $70,000 to maintain the uptrend. If they succeed, the BTC/USDT pair could gain momentum and rise to $76,000. This level may act as a minor barrier, but if surpassed, the rally could extend up to $80,000.

If bears want to make a comeback in this area, they will need to sell aggressively and pull the price below the 20-day exponential moving average (EMA) of $61,422. This could trigger stop-losses for some short-term investors and initiate a deeper correction towards the 50-day simple moving average (SMA) of $51,197.

Both moving averages are sloping upwards, and the relative strength index (RSI) on the 4-hour chart is in positive territory, indicating that bulls are in control. Buyers are signaling a buy on every dip by keeping the price above the EMA 20. A close above $70,000 could start the next leg of the uptrend. Conversely, if the price falls and drops below the EMA 20, the pair could decline to the SMA 50. A close below this support could be the first sign that bulls are heading for the exits. The pair could then fall to $59,000.

Türkçe

Türkçe Español

Español