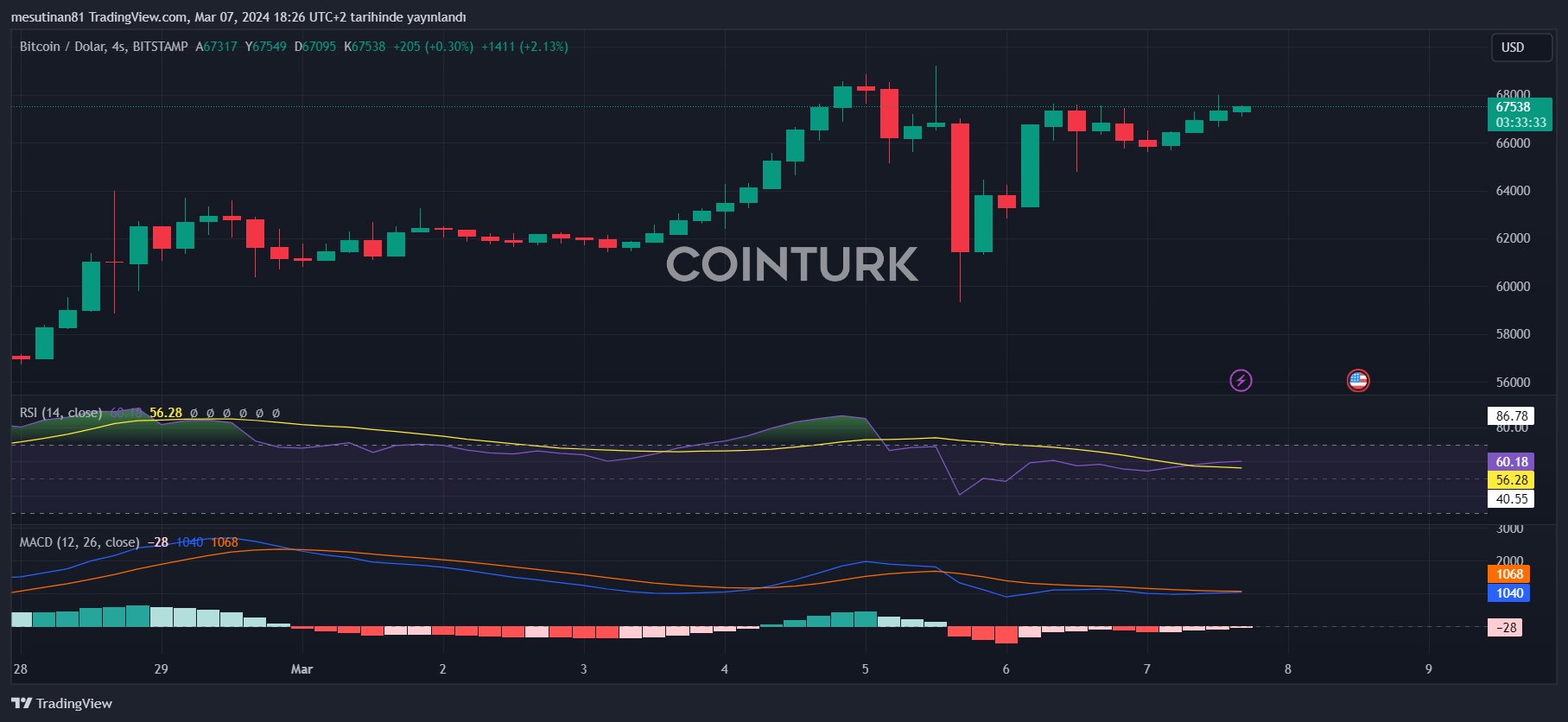

Described as the king of the cryptocurrency world, BTC stubbornly resists above the $66,000 mark. On Tuesday, it witnessed a double-digit drop from its all-time high. However, BTC maintained its resistance against the bears’ efforts to lower its price. This situation can be associated with Bitcoin‘s strong fundamentals and the growing interest of institutional investors.

Emphasis on $66,000 in Bitcoin Price Commentary

In particular, the entry into the market of massive financial institutions like BlackRock, through funds that facilitate access to Bitcoin such as the iShares Bitcoin Trust, stands out as a significant factor increasing BTC’s resistance.

The increase in Bitcoin assets held by BlackRock indicates that institutional demand remains strong and interest in BTC continues. As a result, it is not surprising that BTC maintains its resistance around the $66,000 levels. This also leads to increased expectations for Bitcoin’s price in 2024. For instance, Michael Novogratz, a prominent figure in the crypto world, predicts that Bitcoin will reach $100,000.

Influx of Institutional Investors into Bitcoin

According to financial analysts’ data, BlackRock’s total Bitcoin assets have reached 187,538 BTC. These figures show that the interest and confidence of institutional investors in Bitcoin are steadily increasing. Moreover, the interest of other ETFs and funds in BTC is also seen to be increasing. For example, according to data provided by Farside, the “Nine” ETF has transferred significant resources into Bitcoin, which continues to increase BTC’s value.

Despite this steady increase in Bitcoin’s price, some think it’s time to shift from BTC, now called “King Crypto,” to altcoins. In particular, with the increasing interest in decentralized finance protocols and other next-generation crypto projects, many investors are turning to alternative cryptocurrencies in addition to BTC.

BTC Predictions Keep Coming

Along with the rise of these alternative cryptocurrencies, many analysts continue to predict that Bitcoin’s price will also increase. Many forecast that BTC could reach a value between $80,000 and $1 million going forward. This highlights Bitcoin’s potential and long-term growth expectations.

In conclusion, Bitcoin’s 24-hour chart shows a 0.95% increase, trading at $67,300, indicating that activity in the cryptocurrency world continues and that BTC is still considered a reliable asset among investors. In the coming days, with the growing interest of institutional and individual investors in Bitcoin, the price of BTC is likely to rise even further. Bitcoin is trading at $67,538 at the time of writing this article.