Bitcoin (BTC) market is gearing up for a significant event on December 29 at 8:00 AM, with the expiration of $10.1 billion in options. The latest data shows that call options have a clear advantage. However, bears could limit their losses significantly by pulling Bitcoin’s price below $42,000.

Open Position Incentives in Bitcoin

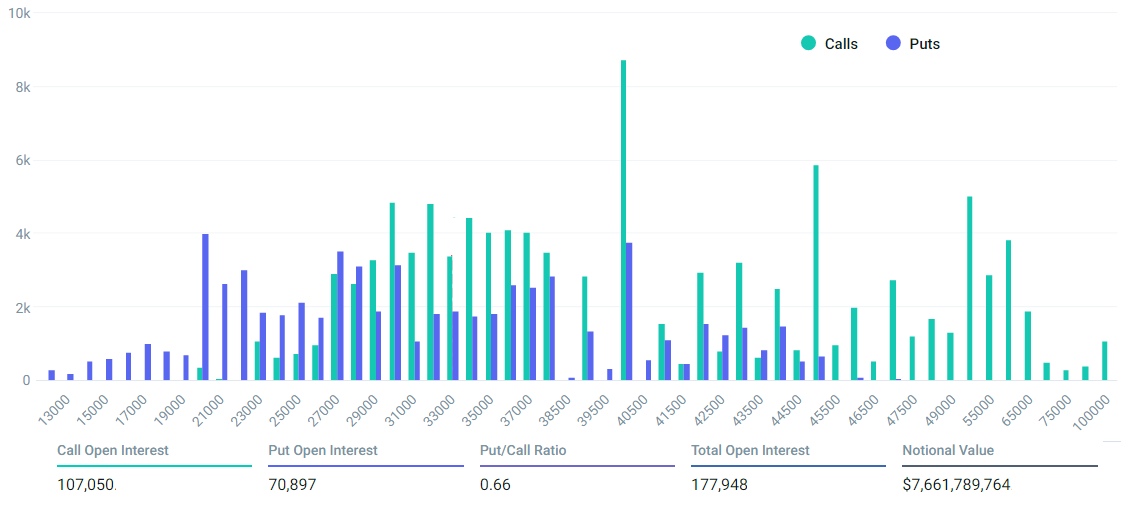

Both sides have incentives to influence Bitcoin’s spot price, but as the expiration date approaches, the outcome can be measured according to the expiry price. Options market leader Deribit has an impressive open position of $7.7 billion, but the surprise comes from the Chicago Mercantile Exchange (CME), which is in second place with $1.38 billion. CME’s open position is more than double that of OKX, which is in third place with $630 million.

The approval of a spot Bitcoin exchange-traded fund (ETF) in January has a significant impact on the December options expiry. The Securities and Exchange Commission (SEC) has significantly changed its approach to interacting with ETF proponents. Instead of outright rejection, the SEC is now actively engaging in dialogue with ETF creators. This change in approach is a positive signal and raises expectations for potential ETF approval in January. This could explain why bears might not be able to push Bitcoin’s price below $40,000 before the end of the year BTC options expiry.

Another significant development is Binance‘s recent defense agreement with the US Department of Justice and regulators, showing progress towards compliance and anti-money laundering practices in the crypto environment. This development, especially after changes to the board of Grayscale Investments and the resubmission of the request to convert Grayscale GBTC Trust, indicates an increase in the likelihood of spot ETF approval and integration into the mainstream financial ecosystem.

Turbulent Times in Bitcoin

The total open interest for the December options expiry stands at $10.1 billion. However, as can be understood from Deribit’s Bitcoin options interest chart, the final amount is expected to be much less due to the recent rise above $40,000 catching bearish investors off guard. Although the total open position of Deribit and CME options is $9 billion, put options are underrepresented by 32%, which could reflect an imbalance compared to the $5.4 billion in call open positions. Additionally, as Bitcoin has gained 25% in value since November, it is likely that the majority of put options will expire worthless.

If Bitcoin’s price remains around $43,100 on the morning of December 29 at 08:00 AM, only $185 million worth of these put options could be valuable. This discrepancy could arise if the right to sell BTC at $40,000 or $43,000 becomes useless in the event that Bitcoin trades above these levels at expiry.