Bitcoin (BTC) continues its upward price trajectory, while market indicators point to a potential downturn, reflecting a change in sentiment among traders and investors. Following a temporary recovery after the Fed’s interest rate decision, Bitcoin‘s price has entered a consolidation phase, trading at $66,256 with a 1.10% decrease in the last 24 hours at the time of writing. This situation has increased concerns about the continuation of the uptrend.

Many Indicators Signal “Excess”

Significant indicators, such as CryptoQuant’s Bull-Bear Market Cycle Indicator, point to the market entering an overheated bull phase, increasing concerns about the sustainability of the current rally.

High unrealized profit margins among investors reinforce the narrative of potential overheating. Additionally, a recent JPMorgan report suggests that Bitcoin is overbought and could face a correction towards $51,000, fueling these concerns.

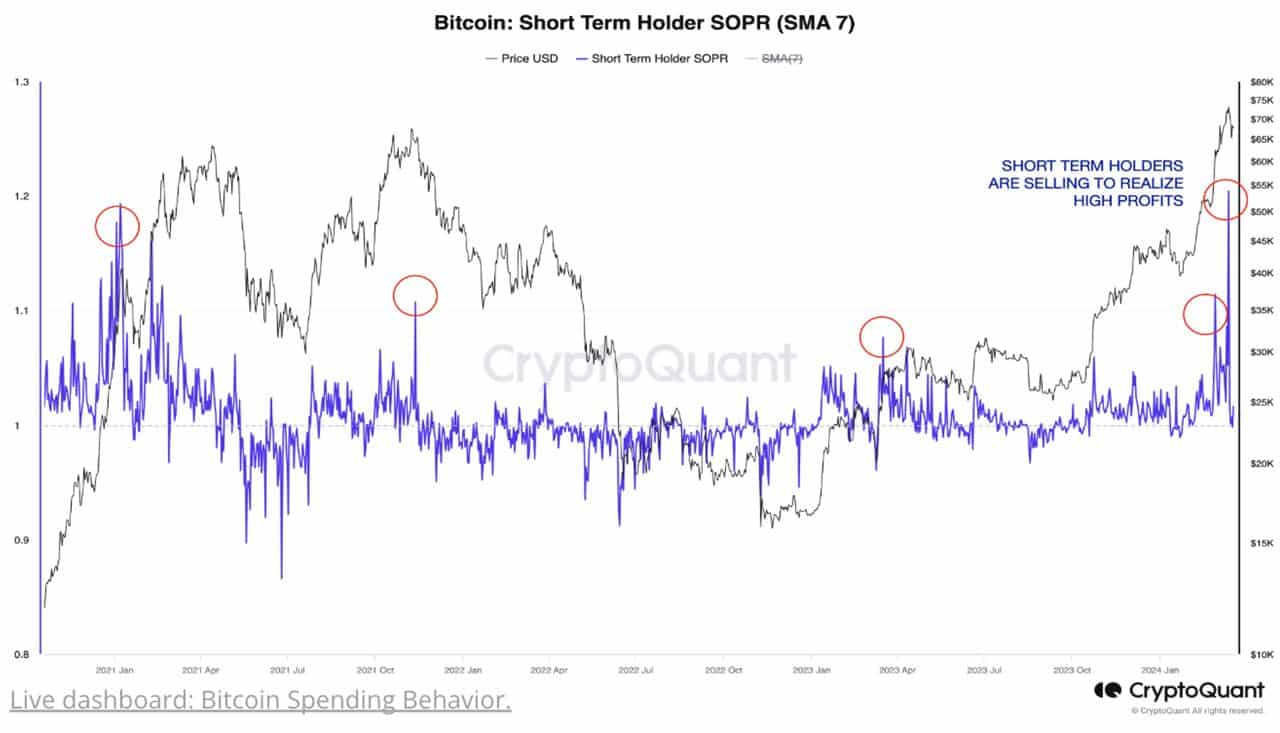

Recent market observations reveal an increase in selling activity among investors, reminiscent of levels last seen in May 2019, indicating a trend of taking profits amid a rising market. Moreover, significant Bitcoin holders, including large investors and miners, are signaling a potential shift in investor sentiment by selling their assets as prices reach unprecedented levels.

Analyst: Everything Is on Course

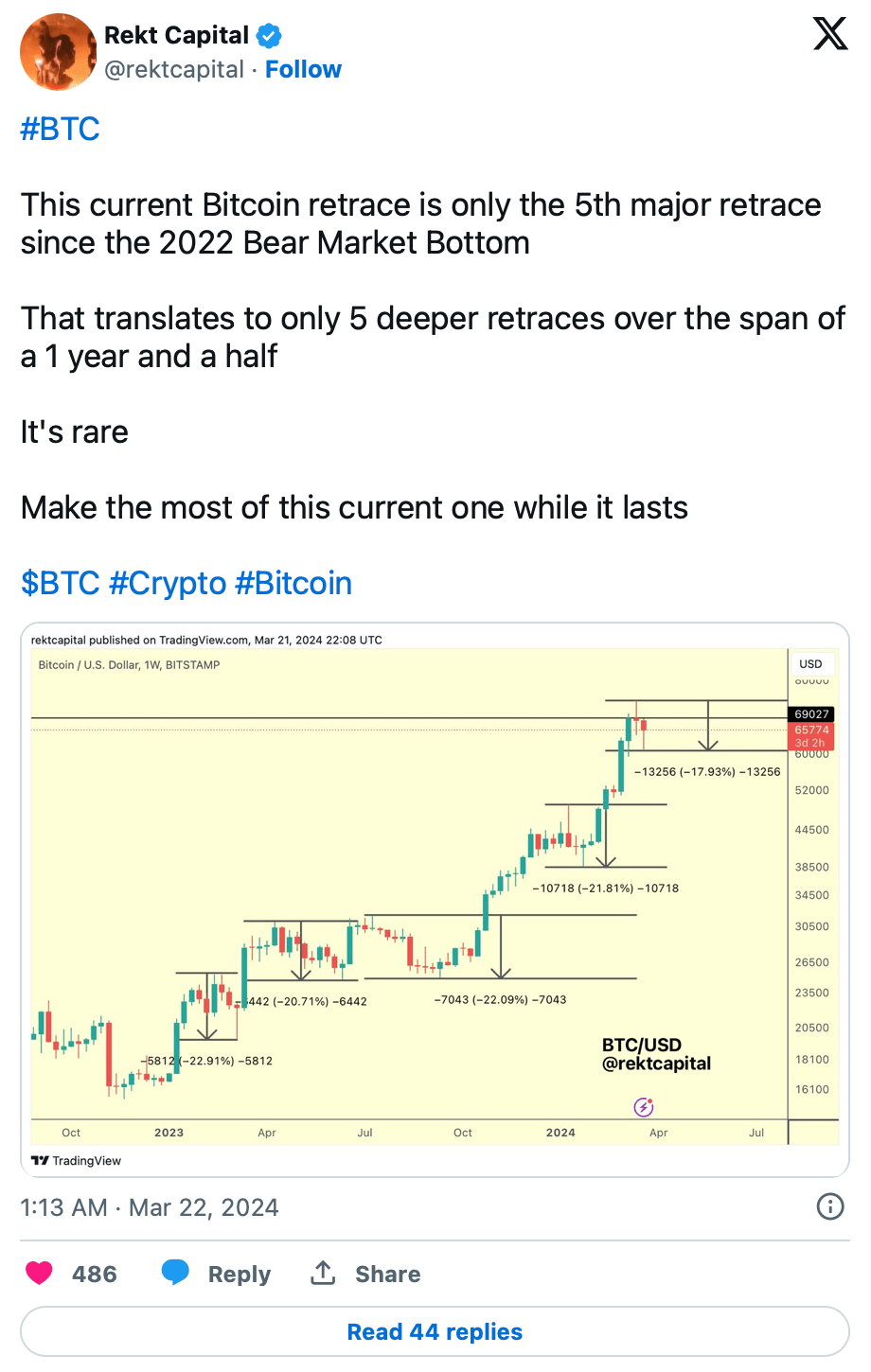

Despite the recent downturn, analysis by crypto analyst Rekt Capital shows that Bitcoin’s 18% pullback is in line with average retracements observed in the current market cycle, and pullbacks between 20% to 23% are considered normal.

According to Rekt Capital, the fact that Bitcoin’s first parabolic breakout rally has not yet started beyond previous all-time highs indicates a current reaccumulation phase. This phase, shown with a green trend line, reflects the anticipated breakout movement.

The analyst’s findings also highlight that this pullback is only the fifth major retracement since the bottom of the 2022 bear market, spanning approximately one and a half years, underscoring the rarity and significance of the current pullback.

Türkçe

Türkçe Español

Español