In the Bitcoin  $91,967 options market, institutional investors are increasingly opting for protective put positions, as evidenced by recent data showing put options reaching a total value of over $1.15 billion. This surge corresponds to 28% of the total market volume, significantly higher compared to recent trends. This increase is believed to be a reaction to Bitcoin’s failure to surpass the $115,000 resistance level, a key psychological and technical barrier for many investors. As Bitcoin’s price retreats, this heightened risk-averse behavior by institutional investors indicates a potential new wave of market decline.

$91,967 options market, institutional investors are increasingly opting for protective put positions, as evidenced by recent data showing put options reaching a total value of over $1.15 billion. This surge corresponds to 28% of the total market volume, significantly higher compared to recent trends. This increase is believed to be a reaction to Bitcoin’s failure to surpass the $115,000 resistance level, a key psychological and technical barrier for many investors. As Bitcoin’s price retreats, this heightened risk-averse behavior by institutional investors indicates a potential new wave of market decline.

Institutional Put Transactions Skyrocket

Following Bitcoin’s pullback from $115,000, sell pressure intensified, leading to the retesting of the $110,000 support level. The bustling activity in the options market suggests that investors are bracing for short-term price declines. According to recent observations, the most traded contracts are currently out-of-the-money put options in the $10,400 to $10,800 range.

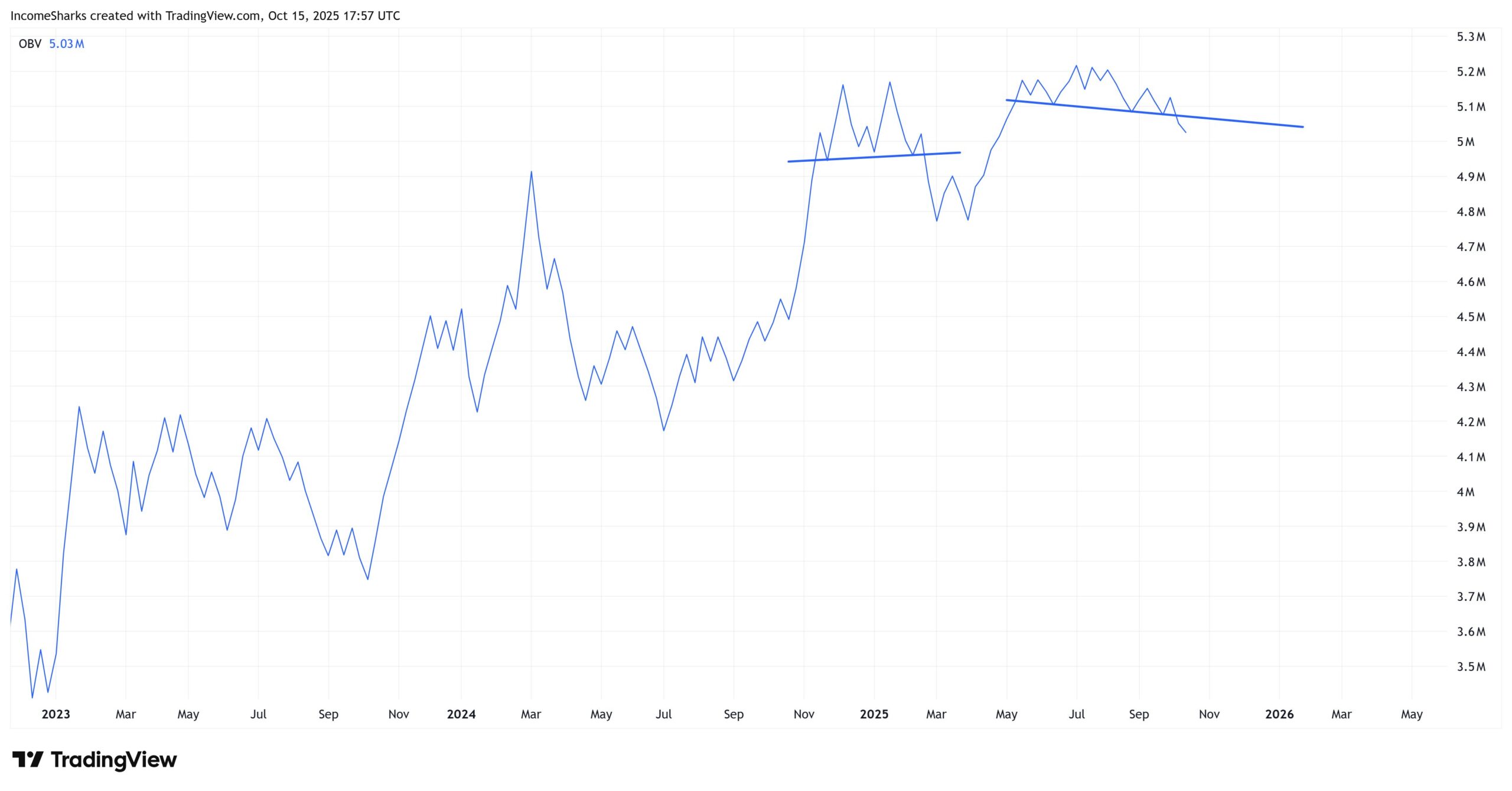

Market sentiment has decidedly turned negative, highlighting an increased perception of downside risk. Analysts point out that the current negative outlook mirrors the levels seen during the sharp market crash observed in October. Amid this heightened volatility, market participants are fortifying their defensive positions, with protective option purchases becoming a prevalent strategy in the near term.

Bitcoin’s Proximity to $100,000 Triggers Altcoin Anxiety

Institutional cautiousness is also evident in spot markets through ETF outflows. An influential market commentator has likened Bitcoin’s current technical pattern to the earlier correction phase that brought prices down to $80,000. According to this analysis, failure to maintain the crucial $100,000 support zone could lead to a deeper market pullback, which could notably trigger another downturn in altcoin markets.

The same analyst highlights that leveraged investors may face increased losses during this period, while long-term investors should maintain patience despite short-term volatility spikes. Further data reflects that out of a total of $415 million liquidated in the last 24 hours, $290 million involved long positions. The impending options expiration on Friday is closely monitored, as it may provide fresh insights into market direction.