Bitcoin‘s (BTC) highly anticipated fourth halving is drawing near, and the cryptocurrency market is observing a notable trend among miners. According to data from CryptoQuant, miners have begun to liquidate their Bitcoin holdings. This move could aim to capitalize on the ongoing bull run and prepare for future profitability by upgrading their equipment.

Expert Views on Bitcoin Mining

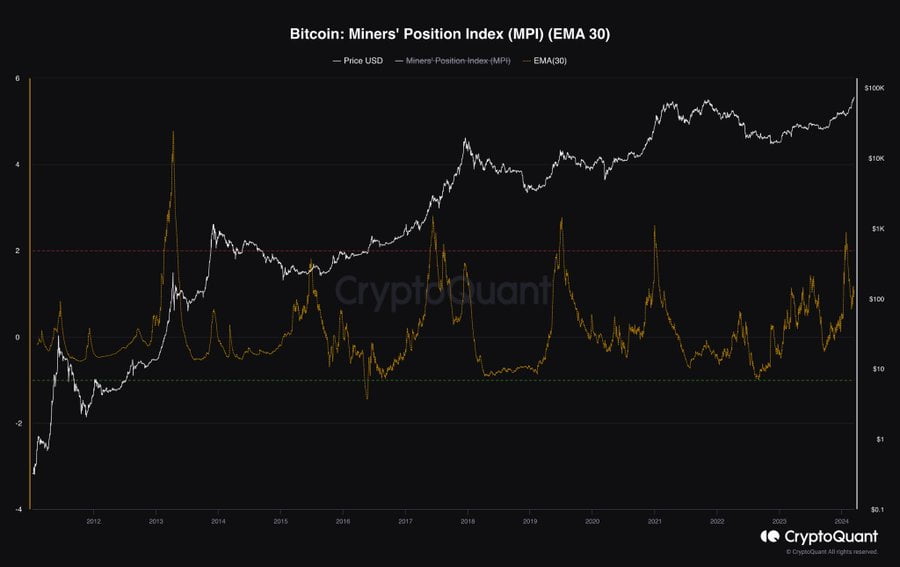

Despite this sell-off, Bitcoin’s core momentum continues to stay robust, supported by significant capital inflows, particularly through spot exchange-traded funds (ETFs). CryptoQuant’s CEO Ki Young Ju shared an explanatory chart on March 13, illustrating miners’ selling activity trend since 2012. The CEO emphasized that as long as the inflow to ETFs remains stable, the current bull market is likely to persist. Ki Young Ju’s analysis also indicated that the main sellers are not US-based mining operations.

Bitcoin miners play a vital role in the network’s ecosystem. They secure transactions and create new Bitcoin through the mining process. Historical data suggests that miners sell a portion of their assets before halving events to secure profits, reduce price fluctuation risks, and reinvest in mining infrastructure. Therefore, as the halving event approaches, it can cause some volatility in the market. Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Liquidations in the Mining Sector

Despite the increase in miners’ selling activities, analysts continue to be optimistic about the direction of Bitcoin. Researchers at Coinbase Research emphasize that the recent price surge is just the beginning of a longer bull run. This optimism is linked to the billions of dollars in net inflows into spot Bitcoin ETFs over the past two months, which is said to fundamentally alter the market landscape.

This new capital inflow is seen as a counterbalance to the selling pressure from miners and could support Bitcoin’s bullish outlook. As the Bitcoin market continues to evolve, the actions of miners and the flow of new investments through ETFs play a critical role in shaping the future of the cryptocurrency. Despite the current sales by miners, significant capital entering the market through investment vehicles could indicate sustainable upward momentum for Bitcoin.

Türkçe

Türkçe Español

Español