Bitcoin network data does not provide values this week that track the decline in BTC prices. The latest on-chain data confirms that the difficulty has reached all-time highs and the hash rate is not far behind. On-chain data also shows no significant change in the amount of Bitcoin held by mining firms and indicates high confidence in network security.

Difficulty Drop Ends

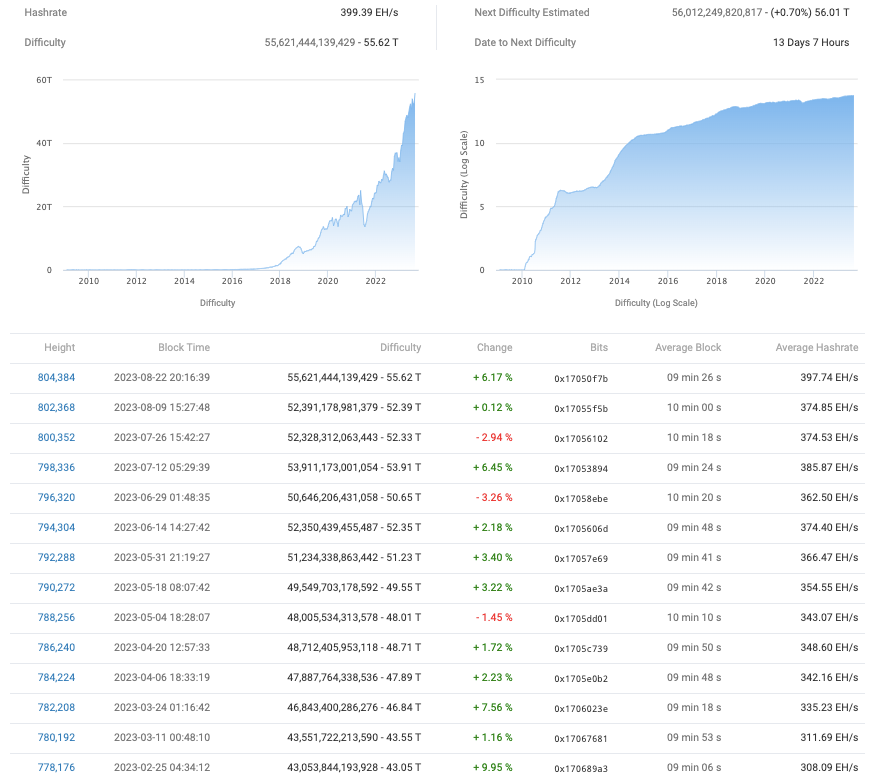

Despite a 10% drop in the BTC/USD pair last week, Bitcoin miners seem to be accustomed to the decline in prices. This was evident in the network activity on August 22, where the difficulty level increased by 6.17% in the biweekly automatic adjustment. According to figures from BTC.com tracking source, this increase not only pushed the difficulty to new record levels, but also indicated the sixth largest difficulty increase for Bitcoin in 2023.

Difficulty is a reflection of both miner competition and Bitcoin network security, and its upward trajectory indicates that miners have not yet struggled when it comes to profitability. The next automatic adjustment is expected to continue this trend and push the difficulty above 56 trillion for the first time.

High Hash Rate Indicates Confidence

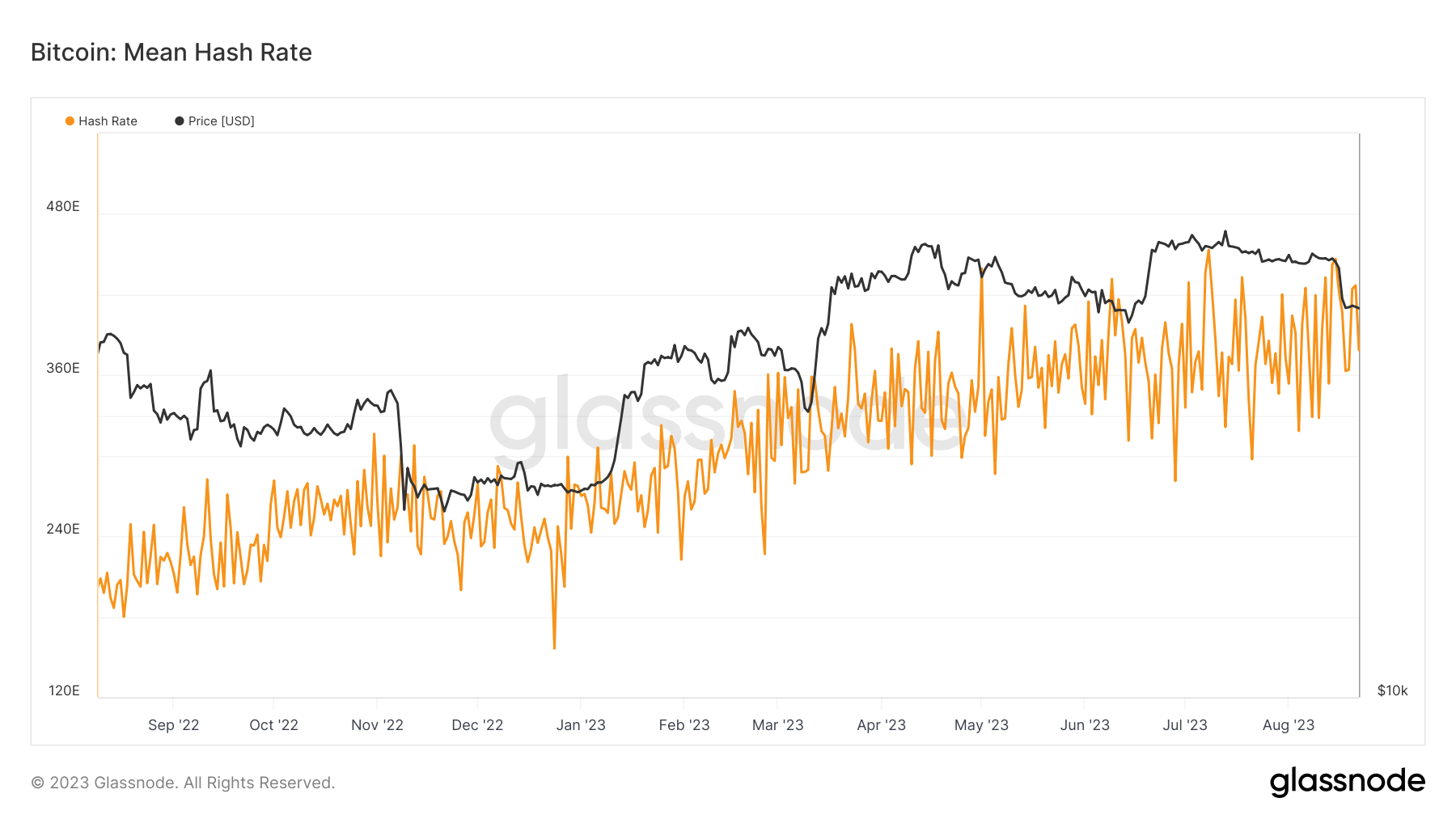

While it is not possible to calculate exactly depending on the source, the hash rate is already challenging all-time highs above 400 exahashes per second (EH/s). MAC_D, contributing to on-chain data analysis platform CryptoQuant, referred to “high confidence in security and reliability” among network participants for both Bitcoin and the largest altcoin Ethereum.

“Recently, BTC and ETH prices have dropped by 10%. However, there has been an increase in network security and reliability. First, BTC hashrate (SMA 14) shows higher figures during the decline, indicating that miners are more active in BTC mining. Second, the ETH staking rate shows that more ETH is being staked despite the price drop,” wrote in the August 22 Quicktake market update.

“This means that investors have high confidence in the security and reliability of BTC and ETH networks. Despite the decrease in price despite the increase in the intrinsic value of the two assets, it means that their values are low and can be considered as a time to actively accumulate assets.”

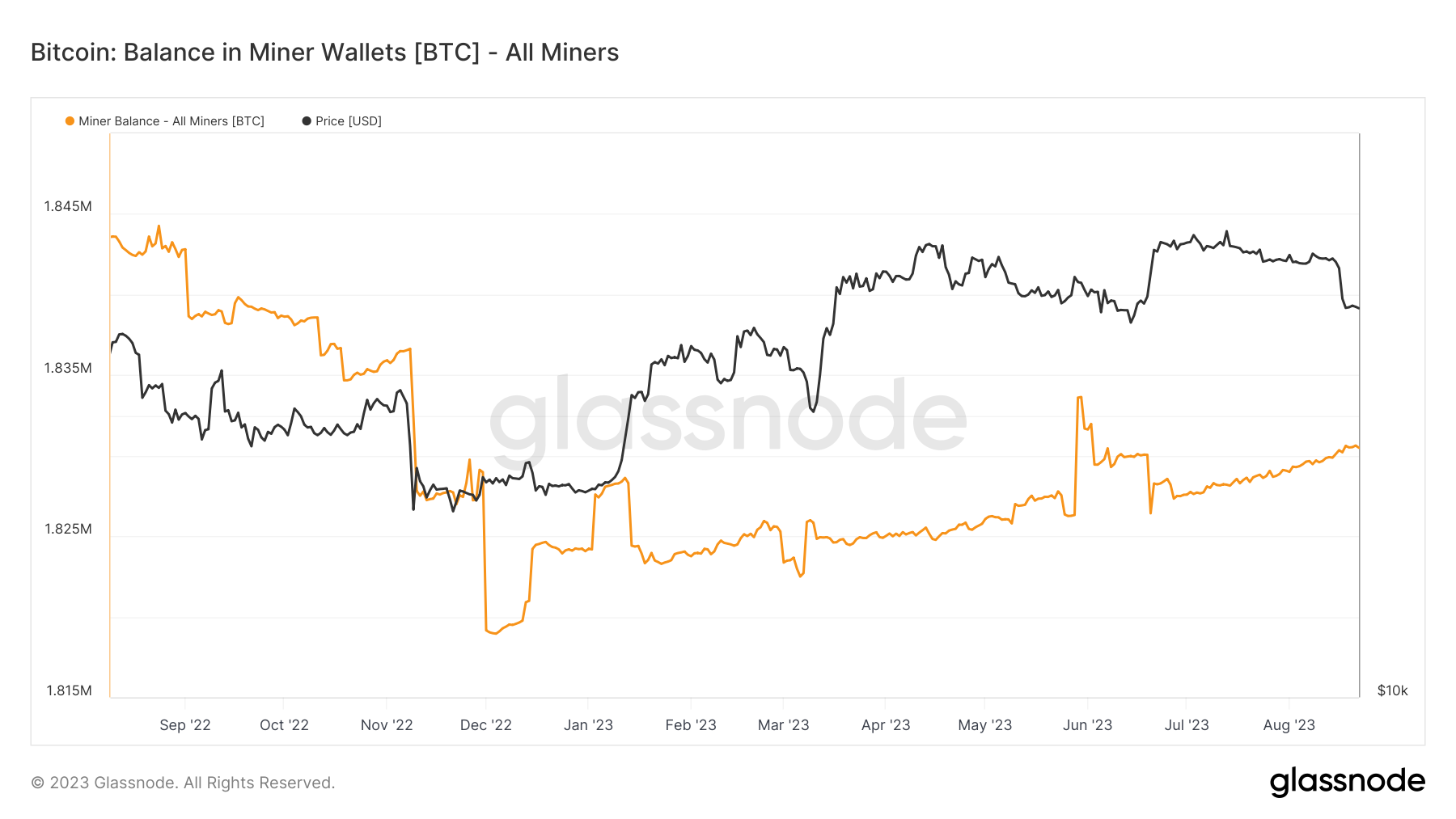

Separate data from on-chain data analysis firm Glassnode shows very little concrete change in the amount of BTC held by mining firms. This amount is slightly above 1.83 million BTC as of August 22 and has shown a steady increase of 0.08% since the beginning of the month.

Türkçe

Türkçe Español

Español