BTC is currently hovering around $35,000 and the $40,000 target is now closer than ever. This level could confirm the end of the bear market. Although investors find it hard to believe, when we see the price bounce back to $40,000 at the speed it dropped, it will almost certainly signal the end of the nightmare days.

Bitcoin Miners Halt Sales

Sudden drops in crypto currencies are not surprising. We have seen that most of the sudden sales in the BTC chart over the past two years have come from miners. The halt of miners’ sales is crucial for a bigger rally.

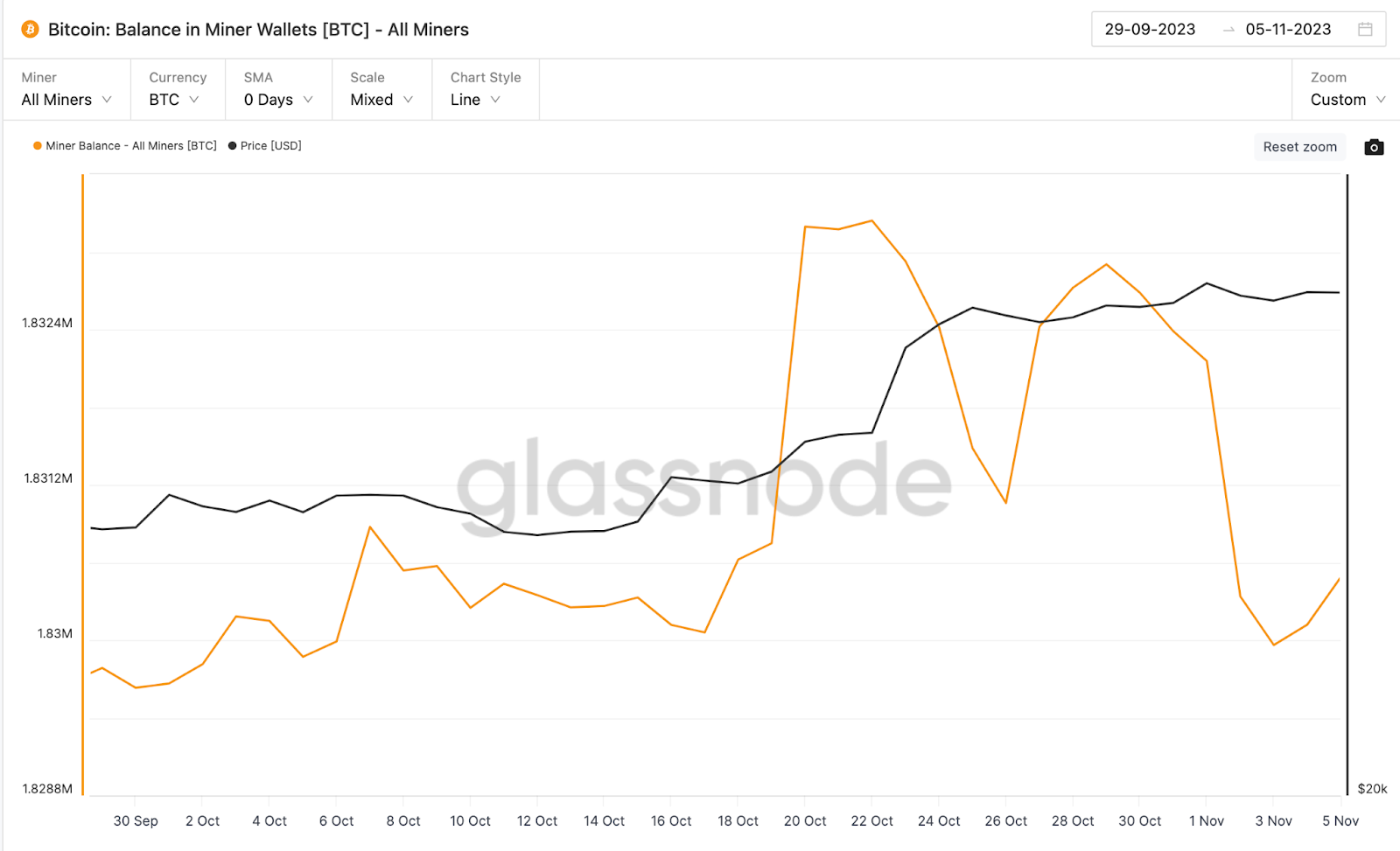

The price dropped to the $34,300 region from the $36,000 level due to miner sales. However, the latest data shows that miners are expecting a rise again. The Miner Reserves chart below shows that 583 BTC has been accumulated.

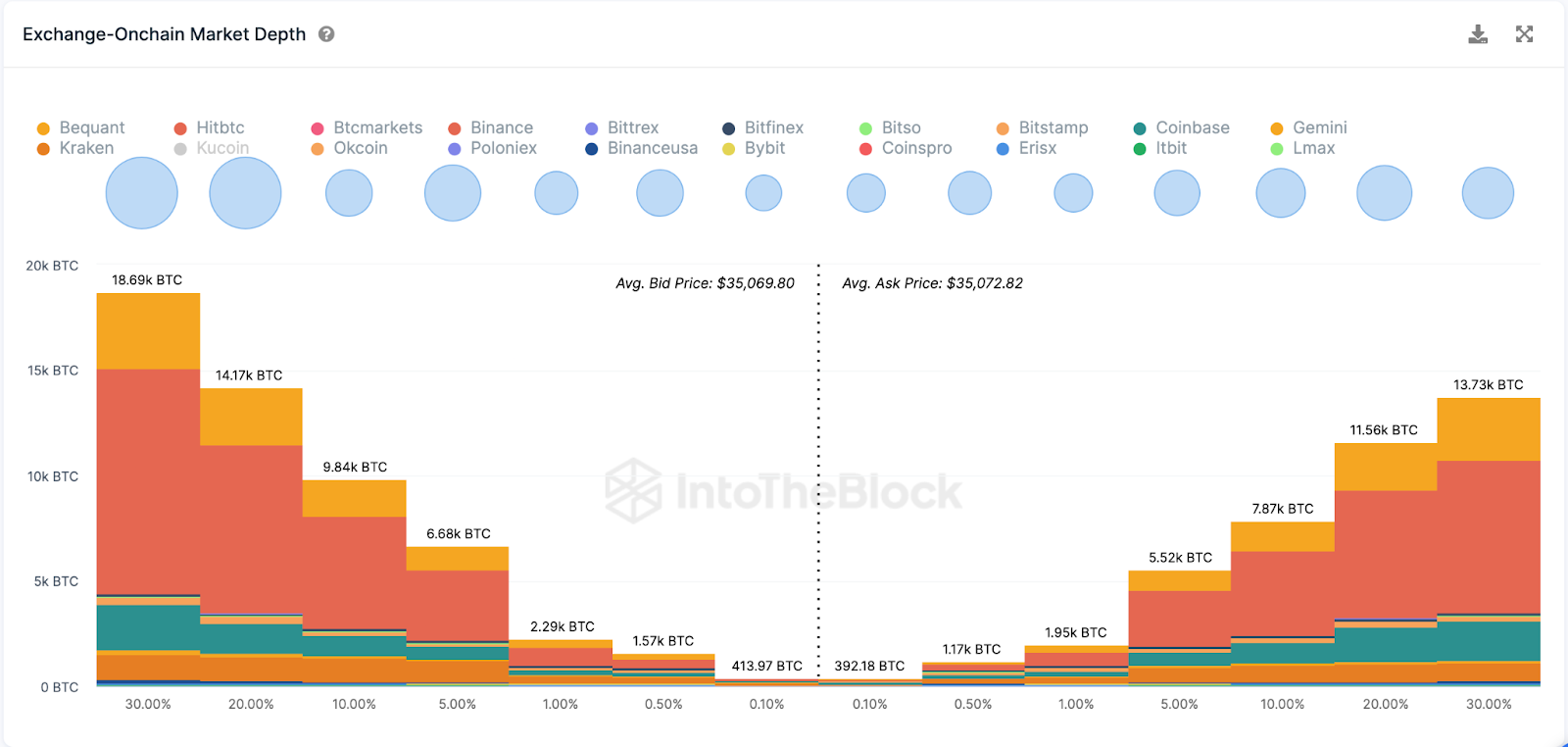

On the other hand, net outflows from exchanges are reaching new highs. Two important developments suggest that a break in resistance sales, which caused a shock effect, may have taken a break for a while. This also indicates that there is no massive resistance up to $40,000, showing that the target can be reached this month.

Will the Crypto Rally Continue?

In an environment where the BTC price is making new highs, altcoins will also follow. If the king crypto currency reclaims the $40,000 level and consolidates in this area, we may see stronger rallies in altcoins than in the past month.

According to the Aggregate Order Books data obtained from IntoTheBlock, bulls hold active orders to buy 55,000 BTC in the current price range. On the sell side, there are 43,000 BTC. The dominant bulls may continue to strive for the support to remain strong. This can pull the price up as the least resistant direction is upwards.

The most important region that could serve as resistance up to $40,000 is at $38,612. But what if the price starts to drop instead? In this scenario, whether the bulls can protect the support at $33,900 can determine the direction.

Türkçe

Türkçe Español

Español