Bitcoin (BTC) has been going through a challenging 12 months, with the leading cryptocurrency plummeting to $15,480 in the fourth quarter of 2022 after reaching an all-time high of $69,000 a year ago. Meanwhile, the Bitcoin mining industry is also struggling to sustain its operations with reported losses. Data from CompaniesMarketCap shows that 16 publicly traded Bitcoin mining companies have incurred losses of over $4.47 billion in the past 12 months (TTM).

Companies Losing Money from Bitcoin

Core Scientific (OTC:CORZQ) emerged as the biggest loser during this period, with losses amounting to $1.66 billion. Following the two largest Bitcoin mining companies in terms of market value, both of which are owned by BlackRock (NYSE: BLK), a major shareholder in the Bitcoin mining sector.

Both Marathon Digital Holdings Inc. (NASDAQ:MARA) and Riot Platforms Inc. (NASDAQ:RIOT) suffered losses of over $600 million YoY. All nine Bitcoin mining companies with larger losses have negative annual results exceeding $100 million. Canaan Inc. (NASDAQ:CAN) is the only positive company among the 16 industry leaders with a profit of $92.33 million in the past 12 months.

Bitcoin Mining Sector in Loss

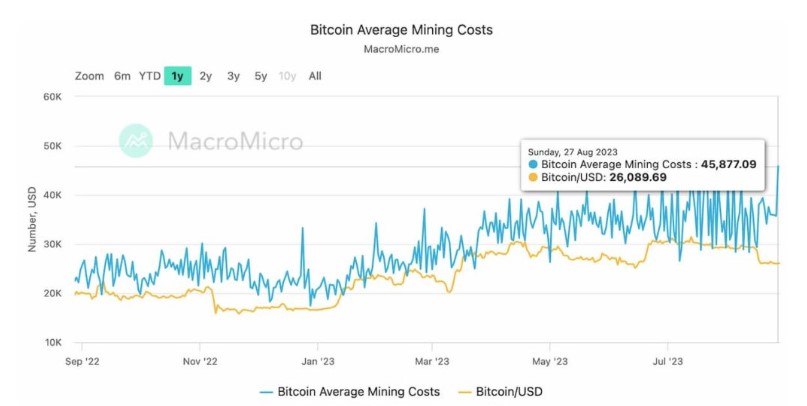

On August 22nd, Bitcoin mining difficulty reached an all-time high of 55.62 trillion hashes, increasing by 6.17%. With the continuous increase in mining difficulty over time, Bitcoin miners are operating at a loss because the average cost of mining a single BTC has been higher than the average price of 1 BTC in the spot market since August 2022.

The average mining cost, calculated by Cambridge University and depicted in a graph by MacroMicro, recorded an average cost of $45,877 per BTC mined compared to the spot price of $26,089 on August 27th. This translates to a loss of $19,588 per unit of the leading cryptocurrency produced.

The challenges faced by the Bitcoin mining industry not only affect each of these companies negatively but also have the potential to impact the entire Bitcoin ecosystem. It could potentially influence the perception of BTC as a reserve currency and crypto asset, in addition to decentralization and security.

The upcoming Bitcoin halving in April 2024, which will halve the block subsidy paid to miners for each mined block, will further decrease the earnings of Bitcoin mining companies unless there is a significant increase in BTC price.

Türkçe

Türkçe Español

Español