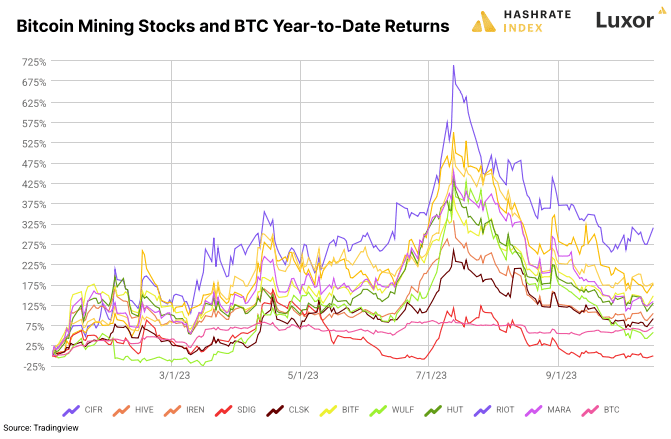

The recent bullish run in the market has once again turned the attention towards Bitcoin (BTC). In addition, the Hashrate Index recently published the Q3 2023 Bitcoin mining report, shedding light on various aspects of crypto mining during the July-September 2023 period.

Current State of BTC Mining

Publicly traded Bitcoin mining companies had a good start in July, with their stocks trading above $30,000 for most of the month. However, the performance of these stocks started to be affected when the price dropped to the range of $25,000 to $26,000. According to the report, Bitcoin’s seven-day average hashrate increased by 56% in the first five months of 2023. It then experienced a 1.3% decrease in hashrate during June, July, and August.

In September, it suddenly increased by 12%. After growing by 6% so far this month, it reached an all-time high (ATH) in mid-October. The report stated that they are confident this is a seasonal trend during the summer months. Miners based in the United States limit their mining activities during these months. The country hosts approximately 40% of Bitcoin’s global hashrate.

BTC Mining Report

The report also sheds light on the Bitcoin production and hashrate of leading Bitcoin mining companies. Marathon Digital increased its operational hash rate from 7.3 EH/s to over 19.1 EH/s since the beginning of the year.

Among publicly traded Bitcoin miners operating in North America, it has the highest active hash rate. The report suggests that the company could reach its target of 23 EH/s if it switches its existing S19j Pro machines with the current S19 XP machine inventory. Riot Platforms experienced a significant decline in Bitcoin production. Its hashrate did not grow as expected, mainly due to the facility limiting its operations during the month. Iris Energy significantly increased its hash rate from 1.57 EH/s to over 5.55 EH/s this year by replacing ASICs with new machines. However, Bitcoin production has decreased in the past few months.