Over the weekend, Bitcoin (BTC) miners collected more in transaction fees than the newly created BTC. Moreover, mining profitability reached its highest level since May 2022. On December 16th, Casa HODL co-founder Jameson Lopp released a block example concerning the production of Bitcoin miners.

Interest in BTC Mining

The block granted the pool miner from Braiins a substantial subsidy and approximately $570,000 worth of 13.4 BTC in fees for the specified period. Bitcoin educator Kashif Raza stated that this was more incentivizing for miners, saying:

Ordinals have turned out to be a blessing for miners but a nightmare for individuals sending micro transactions. This implies that more miners will deploy machines to obtain maximum off-block rewards.

Furthermore, according to BitInfoCharts, the average BTC transaction fees have climbed to the highest levels since April 2021. The cost of a Bitcoin transaction over the weekend also reached up to $37.

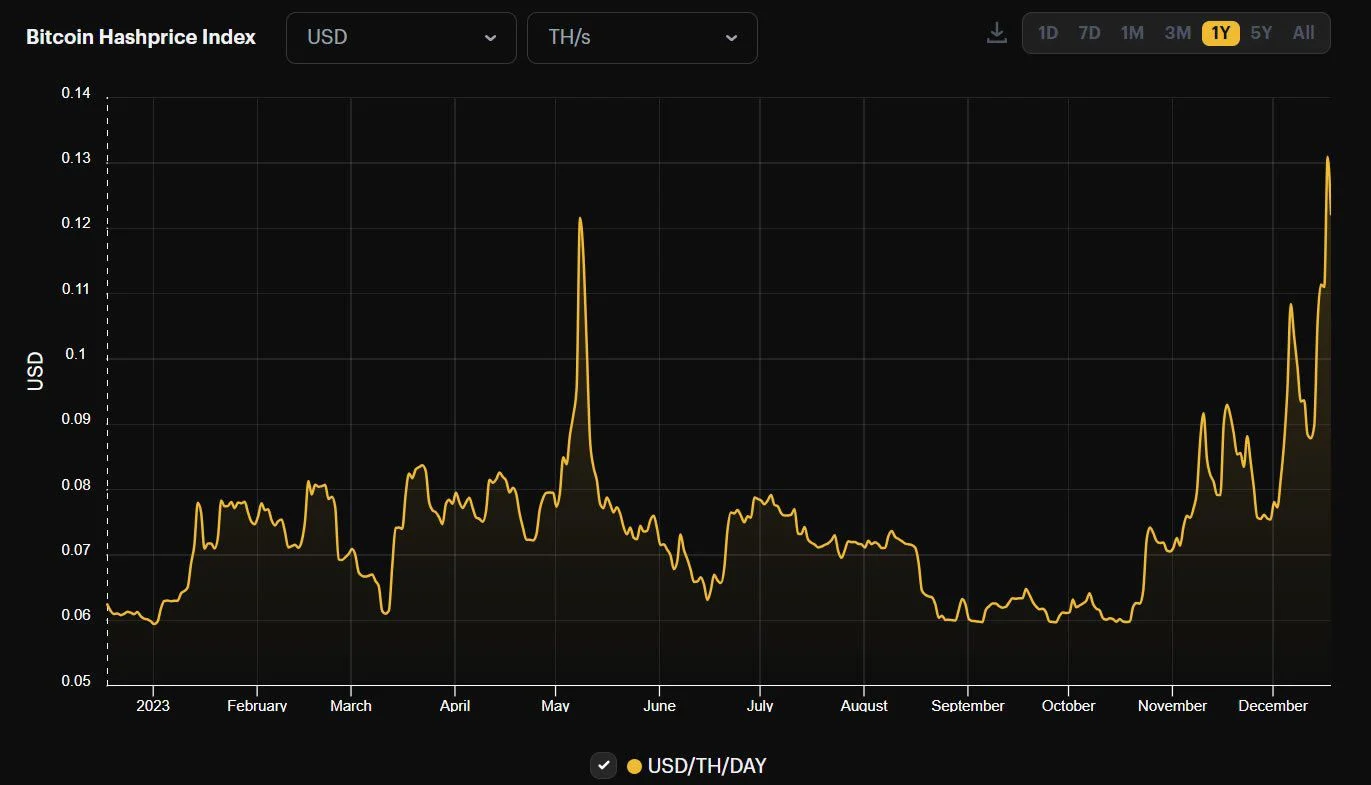

BTC Hash Rate at 19-Month Peak

Cryptographer Adam Back highlighted that ordinals are permanent, and therefore, people should stop complaining about them:

We are trying to stop them, but they will do it in worse ways. High fees encourage the adoption of Layer-2 and force innovation. So relax and build something.

He also added that Bitcoin miners can expect a more profitable period in the coming days. Additionally, profitability or hash price has garnered attention by reaching its highest level in 19 months, even surpassing the last ordinal frenzy in May. According to Hashrate Index, the hash price rose to $0.130 per TH/s/day on December 17th. The last time it was higher than today was in May 2022. However, it is still below the all-time high of $0.400 in June 2019. Hash price is a function of network difficulty, Bitcoin price, block subsidy, and transaction fees.