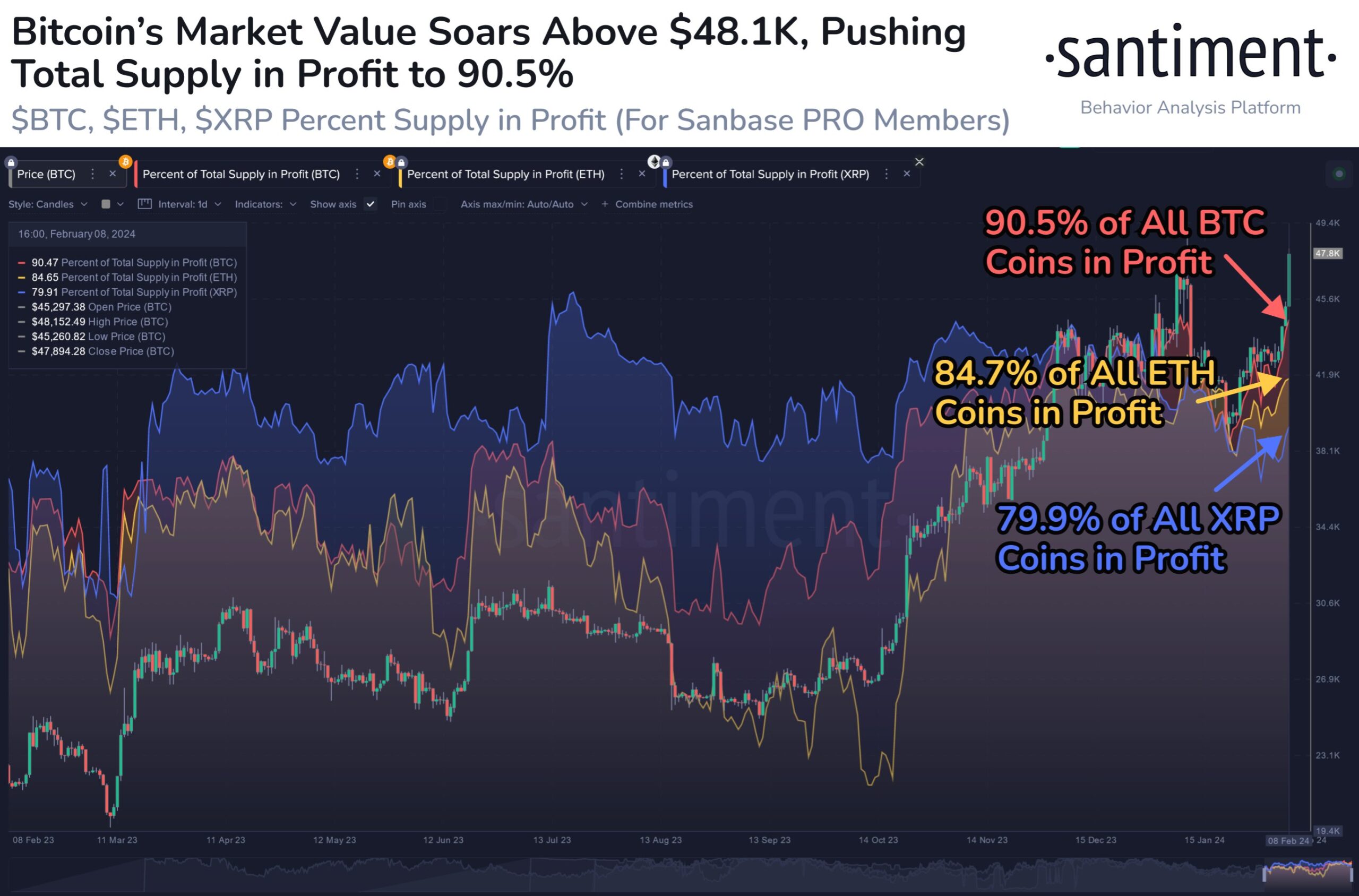

Santiment reported that with only 10 weeks left until the halving event, Bitcoin has seen a significant increase in value, approaching the $50,000 mark. Currently, 90.5% of BTC coins are experiencing astonishing profitability compared to their initial creation. This statistic underscores the leading cryptocurrency’s extraordinary growth and resilience.

Analyzing Profitability Among Major Cryptocurrencies

Compared to Bitcoin’s impressive performance, Ethereum (ETH) and Ripple (XRP) are showing somewhat lower profitability rates. Currently, 84.7% of ETH coins and 79.9% of XRP coins are profitable. Although both altcoins have achieved positive returns for the majority of their coins, they lag behind Bitcoin in terms of overall profitability.

Bitcoin’s recent surge towards the $50,000 milestone indicates renewed investor interest and market optimism. The halving event, planned to occur in just 10 weeks, contributes to expectations and speculation surrounding Bitcoin’s future trajectory. As supply decreases due to halving, the potential for increased scarcity typically boosts demand and further elevates Bitcoin’s value.

Factors Boosting Bitcoin’s Profitability

Various factors contribute to Bitcoin’s sustainable profitability and upward momentum. Institutional adoption, increased general acceptance, and growing interest from individual investors play a significant role in boosting demand for Bitcoin. Additionally, the limited supply of 21 million coins and the planned halving events every four years create scarcity, adding intrinsic value to the digital asset.

While Bitcoin continues to demonstrate its resilience and profitability, challenges persist in the form of regulatory scrutiny, market volatility, and technological advancements from competing cryptocurrencies. However, these challenges also present opportunities for innovation and growth in the crypto space. Adaptability and strategic planning will be crucial for Bitcoin to maintain its dominant position and successfully navigate future market dynamics.

In conclusion, Bitcoin’s ascent towards the $50,000 level and the upcoming halving event underscore its status as the leading cryptocurrency. Considering that 90.5% of BTC coins are currently profitable, Bitcoin’s resilience and growth potential are undeniable. As the crypto market evolves, investors and enthusiasts will closely monitor Bitcoin’s performance and its impact on the broader digital asset landscape.

Türkçe

Türkçe Español

Español