Cryptocurrency markets will experience a significant event today with the expiration of a massive $4.7 billion Bitcoin option contract. This event draws significant attention as it coincides with the end of the month, a period typically associated with increased activity in derivatives. Market observers are keen to understand how this expiration will impact the broader crypto environment.

This Week in Cryptocurrency Markets

This week, there was a slight decline in sentiment in the crypto markets. This change followed the recent approval of spot Ethereum exchange-traded funds (ETFs) by the U.S. Securities and Exchange Commission. On the other hand, the approaching expiration of Bitcoin option contracts has the potential to inject a wave into the markets.

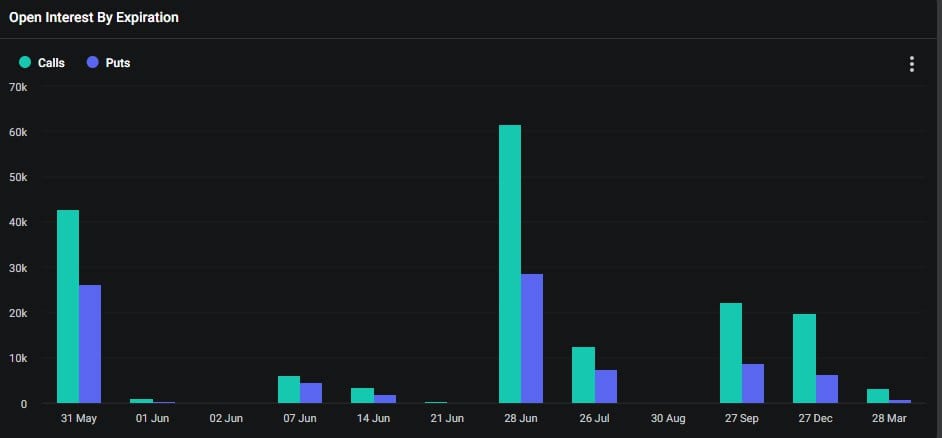

With 69,200 contracts expiring today, the scale of the expiration is quite large. According to Deribit, a leading derivatives exchange, month-end expirations typically see higher volumes compared to other periods. The current put/call ratio for these Bitcoin options stands at 0.61. This indicates that call options (long positions) outnumber put options (short positions). The maximum pain point, or the price level at which the most options will expire worthless, is around $65,000. This figure is notably $3,500 below Bitcoin’s current spot price.

A significant amount of open interest (OI) remains in long positions at various strike prices, including $70,000, $75,000, $80,000, and even $100,000. The total open interest for these long positions is $886 million. On the short side, the strike price with the most OI is $60,000, with a total open interest of $519 million. This distribution indicates that many investors are optimistic about Bitcoin‘s future price movement.

Total Value of All Bitcoin Option Contracts

The total notional value of all outstanding Bitcoin option contracts is an impressive $19 billion. In addition to Bitcoin, there are significant Ethereum contracts expiring today, worth approximately $3.7 billion. The put/call ratio for these 910,000 contracts is 0.84, indicating a more balanced sentiment between long and short positions compared to Bitcoin.

Interestingly, despite the significant size of today’s expirations, the spot markets have shown minimal reaction so far. The overall market value has remained steady at $2.68 trillion. Over the past 12 days, there has been very little movement in the crypto markets. As of the latest data, Bitcoin is trading at $68,489 with a modest 1.2% increase, while Ethereum has seen a slight decline, trading at $3,751.