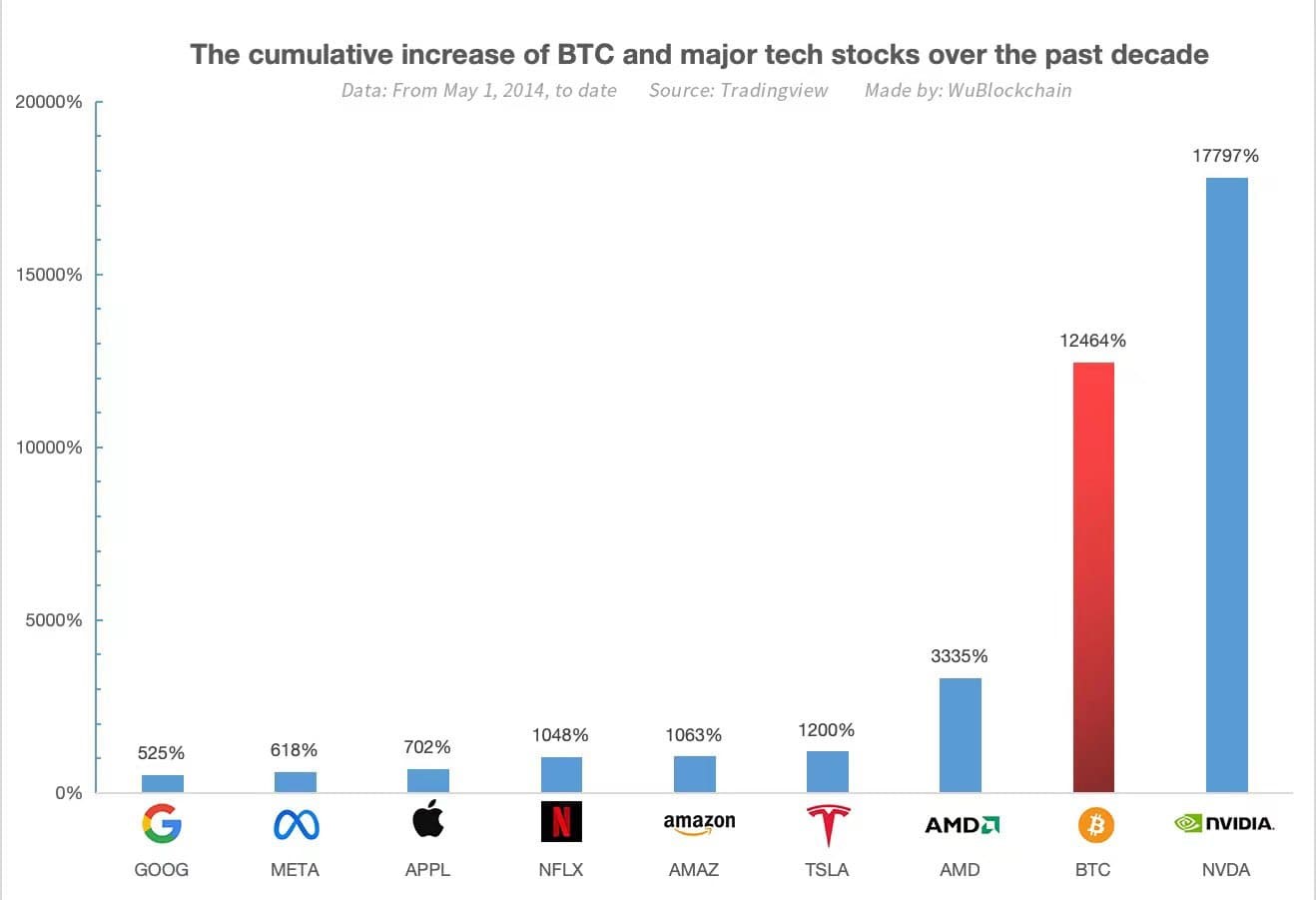

In the last decade, Bitcoin‘s (BTC) price has seen an extraordinary increase of 12,464%, outperforming technology giants such as Amazon, Alphabet, and Netflix. Chinese Blockchain journalist WuBlockchain published an analysis on May 3rd from his X account, examining Bitcoin’s performance alongside nine major technology stocks. This study further solidified Bitcoin’s reputation as a strong investment tool through its robust growth.

Nvidia Leads, Bitcoin Claims Second Place

The research shows that Nvidia, with an even more impressive value increase of 17,797%, leads due to its cutting-edge GPUs and semiconductor products, but Bitcoin’s rise to second place, especially in such a volatile market, highlights its significant impact and potential within the financial ecosystem.

The WuBlockchain team compiled the cumulative gains of Bitcoin and nine major technology stocks such as Google, Meta, Apple, Netflix, and Amazon over the last decade. While Bitcoin achieved a 12,464% increase in value, placing it second, Nvidia topped the list with a 17,797% increase.

Other technology companies like Advanced Micro Devices (AMD) and Tesla also made significant gains, with increases of 3,335% and 1,200% respectively. These figures highlight the dynamic growth in the technology sector, but particularly underscore Bitcoin’s high performance success and resilience story.

Transforming the Investment Landscape

Despite the high volatility and uncertainties inherent in cryptocurrencies, Bitcoin’s impressive growth trajectory over the last decade demonstrates its resilience and potential as a viable investment option. As investors continue to diversify their portfolios and seek potentially high returns, this analysis provides a valuable reference point by showcasing the notable performance of both established technology stocks and emerging digital assets like Bitcoin.

With technological innovation driving markets forward, the intersection of traditional finance and digital assets offers new opportunities for investors to explore and benefit from in the coming years.

Türkçe

Türkçe Español

Español