Cryptocurrency analyst Kevin Svenson recently suggested in his analysis that Bitcoin (BTC) is at a critical point in its parabolic uptrend and is showing strong signals for a significant short-term price increase.

Sharing Bitcoin Expectations for the Short and Long Term

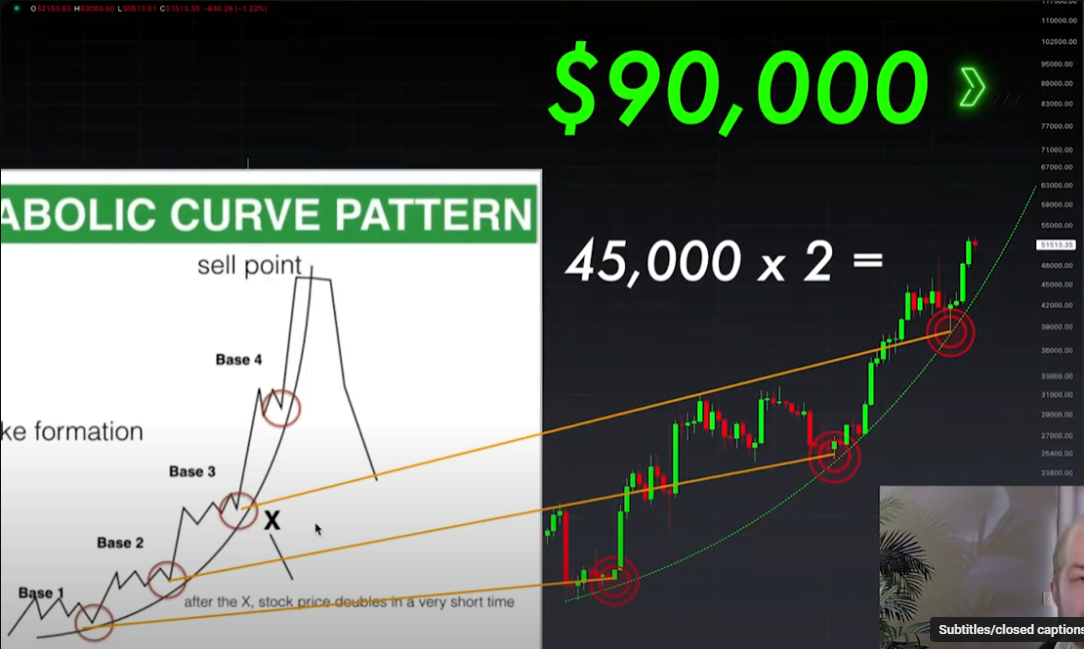

Svenson shared his latest observations on Bitcoin with subscribers on his YouTube channel. He stated that the largest cryptocurrency is moving according to a parabolic curve formation as if it were out of a textbook.

According to the analyst, Bitcoin is currently at the third bottom of the parabolic curve formation trend, which signals the possibility of significant gains in a steep upward movement. Svenson predicts that if the parabolic curve formation continues as expected, Bitcoin’s price could rise well above double its current levels, targeting $90,000.

While Svenson acknowledges the possibility of unexpected market movements, he points to $142,500 as the ultimate peak target for the largest cryptocurrency. This forecast underscores his optimistic view of BTC‘s long-term potential and the overall direction of the broader cryptocurrency market.

Svenson emphasized that historically, assets trading at the third bottom of a parabolic uptrend have experienced rapid price increases within a relatively short period. This assessment closely parallels the analyst’s bullish outlook on the potential trajectory of Bitcoin in the coming weeks or months.

Strong and Significant Rise on the Table

Furthermore, Svenson pointed out an interesting trend in the behavior between Bitcoin’s price and global liquidity dynamics. He noted that previous bull markets coincided with periods of increasing global liquidity, yet Bitcoin is currently rising despite a decrease in global liquidity. According to Svenson, this discrepancy suggests that if liquidity starts to recover, BTC could surge well beyond market expectations.

Highlighting various positive factors contributing to Bitcoin’s upward momentum, Svenson mentioned the approval of exchange-traded funds (ETFs), the upcoming block reward halving, and other positive developments in the cryptocurrency market. He believes that all these factors, combined with Bitcoin’s resistance against falling global liquidity, present a convincing scenario for a further price increase.

Türkçe

Türkçe Español

Español