Bitcoin price is gearing up for a new weekly close and this close is extremely important before the Fed meeting. Last week, the price experienced extreme volatility and is about to conclude its price correction initiated after the ETF approval. So, what do the current market predictions from experts tell us?

Bitcoin (BTC) Expert Commentary

As of January 27, the Bitcoin price is holding at $42,000 and at the time of writing stands at $42,150. Investors may see new highs, but first, the weekly close must be made and the long upper wick must remain as is.

The agenda includes MTGOX sales, FTX assets, GBTC outflows, and the upcoming halving. Now that GBTC outflows have balanced out, the sentiment is even more positive. Popular cryptocurrency commentator Michael Poppe believes that the BTC price correction has ended. He mentioned that the price will target higher levels between today and the halving period in April.

“Perhaps we will go up to $48,000 once more before then, followed by a final correction. That period will be the time for Altcoins. The real impact of the ETF will emerge over the next few years, resulting in Bitcoin’s price reaching $300,000-500,000.”

The analyst believes that the $30,000 liquidity can be taken in a few months and that the balance on the futures side could force the price to do so.

Will Cryptocurrencies Fall?

Experts like Capo and Chris talk about the possibility of a drop to $20,000, but these predictions have not been taken seriously for the last 8-9 months. Especially Capo’s expectation of a major crash seems to have fallen through with the Binance settlement, yet the star analyst of 2022 does not shy away from making a sharp “U-turn”.

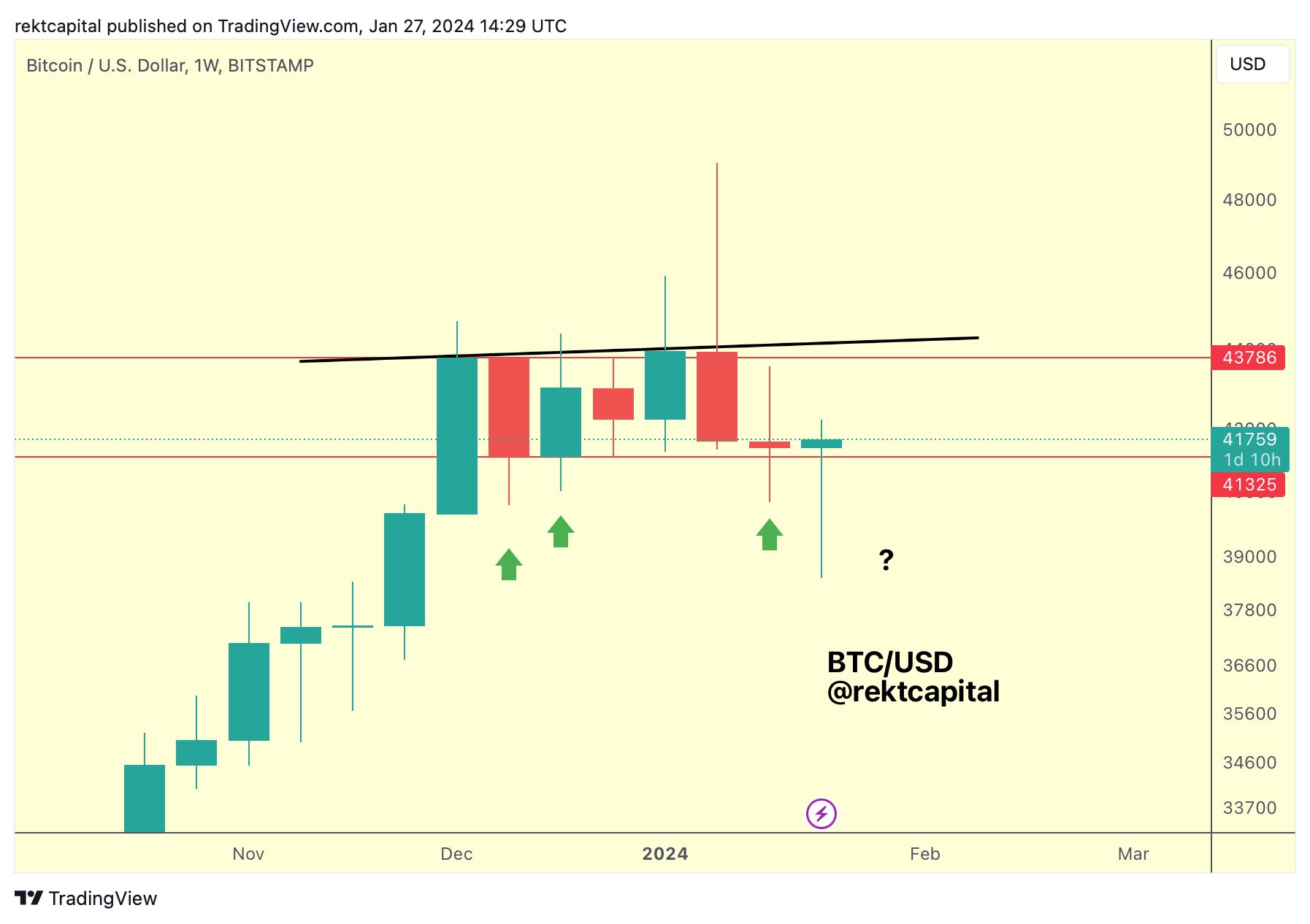

On the other hand, Rekt Capital wrote;

“Bitcoin, which has been slowly positioning itself to reclaim the range it lost at the beginning of this week, has shown a strong response in the ending week. A weekly close above the range around $41,300 could be sufficient to reclaim the range.”

The analyst’s target seems likely to be achieved with the current outlook. Volume has dropped to the $30 billion area, and buyers’ demands are strengthening in the support zone. Since no interest rate hike is expected next week, today is unlikely to be very challenging, and a safe weekly close is probable.

Türkçe

Türkçe Español

Español