Bitcoin‘s (BTC) price is following an interesting pattern that could potentially provide investors with confidence for the coming days. At current price levels, the largest cryptocurrency’s price has risen to levels seen before the collapse of the major crypto exchange FTX, and even beyond to the levels of April 2022. So, what’s next for Bitcoin? Let’s take a closer look.

Bitcoin Price Prediction

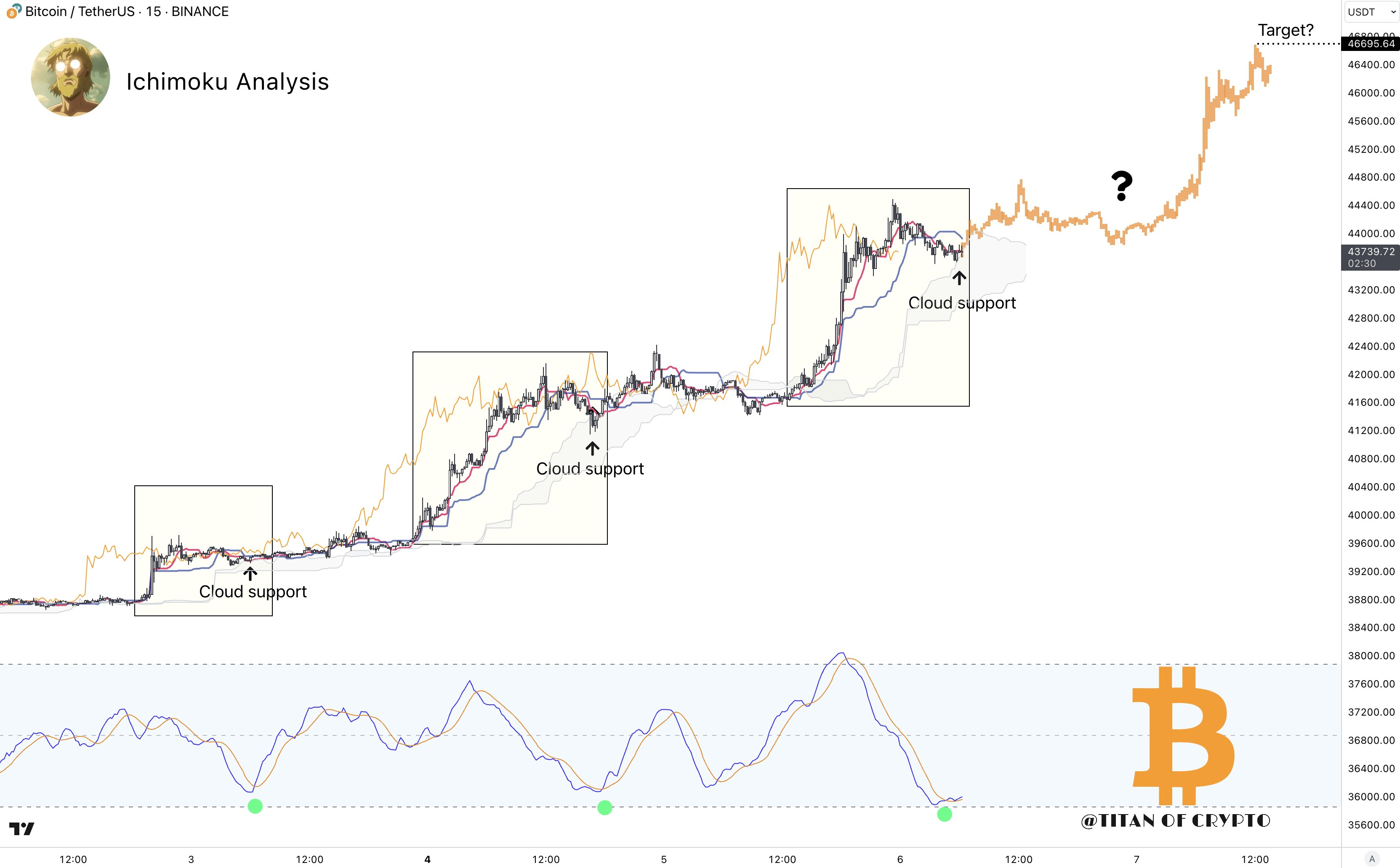

Crypto analyst and trader Titan of Crypto has announced, based on the price activity of the last 72 hours from his personal X account, that he expects a rise up to $46,500. Currently, the largest cryptocurrency follows the same pattern of price increase and subsequent correction in a very short time frame of 15 minutes over the last three days. The analyst, therefore, expects BTC’s price to reach $46,500 and added:

“Is $46,500 next for Bitcoin? In a lower time frame (15 minutes), BTC seems to be repeating the same pattern for 3 consecutive days. If this pattern repeats today, the target level will be $46,500.”

Another anonymous crypto analyst, known as Bitcoin Maximalist, also predicts a significant rally in the price of Bitcoin. The analyst expects to see Bitcoin light a massive green candle that could take it from current levels to $100,000 and beyond.

On-chain data also supports analysts’ bullish expectations. The number of Bitcoin wallet addresses holding more than 100 BTC has become active during the rally above $40,000 in the last four weeks.

Long-Term Expectations for BTC

Market observers point to two important catalysts for the largest cryptocurrency in the long term. The first catalyst is the potential approval of the first spot Bitcoin ETF in the USA. The second catalyst is the expected Bitcoin block reward halving in April 2024.

Furthermore, it’s a matter of curiosity whether the price will surpass $50,000 before the approval of the spot Bitcoin ETF and whether it will be in a good position to reach the next stage of the bull run. Experts point to the next likely dates for the ETF approval announcement as between January 6-8, 2023, although the US Securities and Exchange Commission (SEC) has the option to delay the ETF approval for several more weeks due to technical reasons.

Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.