BTC price is finding buyers at $43,500 at the time of writing and rose after dipping to $42,450 at the opening of Asian markets. The markets have seen fluctuations continue with unconfirmed social media speculations about ETF approvals sweeping through. No official ETF approval has yet been received.

Current Bitcoin Status

The cumulative value of cryptocurrencies is anchored at $1.65 trillion, and BTC market dominance is increasing. BTC dominance is at 51.8% at the time of writing. This increase, reflecting the meltdown in altcoins, suggests that volatility could continue in altcoins when the ETF approval arrives. The biggest loser among the top 100 cryptocurrencies was BONK Coin, with a 27% loss in value.

The winners of the week were ICP, ARB, TIA, and SEI, but even these experienced double-digit losses in the last 24 hours. Their weekly gains, however, remain above 26%. Today’s employment data indicates that the Fed may not cut interest rates as much as expected, which is negative for risk markets.

What Will Be the Price of Bitcoin?

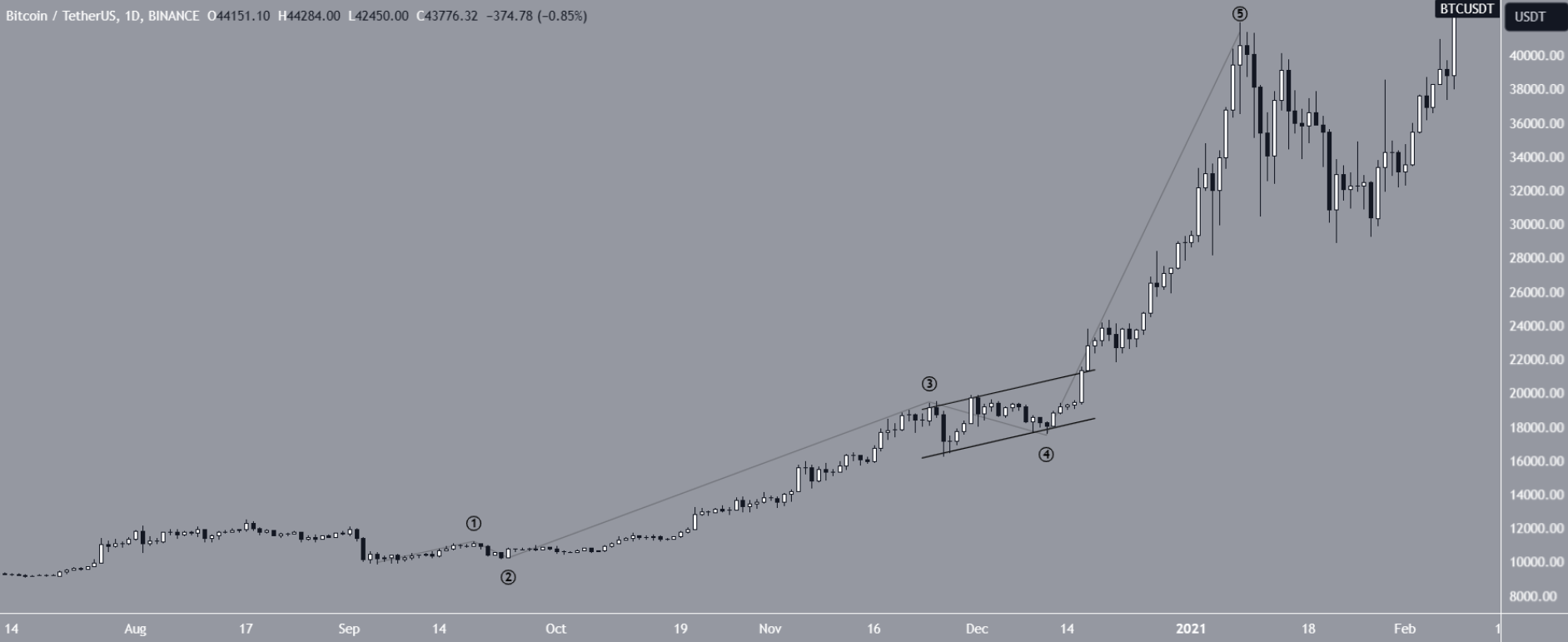

Readings on the daily chart are mixed due to RSI and Elliot wave counting. We cannot talk about a clear direction. Although the weekly outlook is positive, the expectation is notably shifting towards the negative in the shorter term.

According to Elliot wave counting, the most likely scenario is that BTC is in the fourth phase of a five-wave rising movement. A rising parallel channel forms the fourth wave, a flat correction, and such corrections before significant upward movements are not surprising.

The bearish divergence in RSI suggests that the decline may continue in the short term. If the BTC price breaks the current channel upwards, we could see it move towards the strong resistance area of $50,800.

There is a very interesting fractal from November 2020, and at that time, the Bitcoin price had seen a parabolic rise after a similar corrective wave. Analysts comparing the 2020-2021 period with today find this similarity noteworthy.

Despite the bullish prediction, if the bearish divergence in RSI is an early warning and the price breaks down from the parallel channel, we could see the price retract to as low as $37,800.

Türkçe

Türkçe Español

Español