Bitcoin price was nearing its daily close at the time of writing and was trading at $70,700. DOGE became the star of the day, returning to the long-unseen price of $0.22. A positive upcoming few hours for altcoins is possible, but only if the daily close remains within the current range. So, what’s the latest on the ETF front?

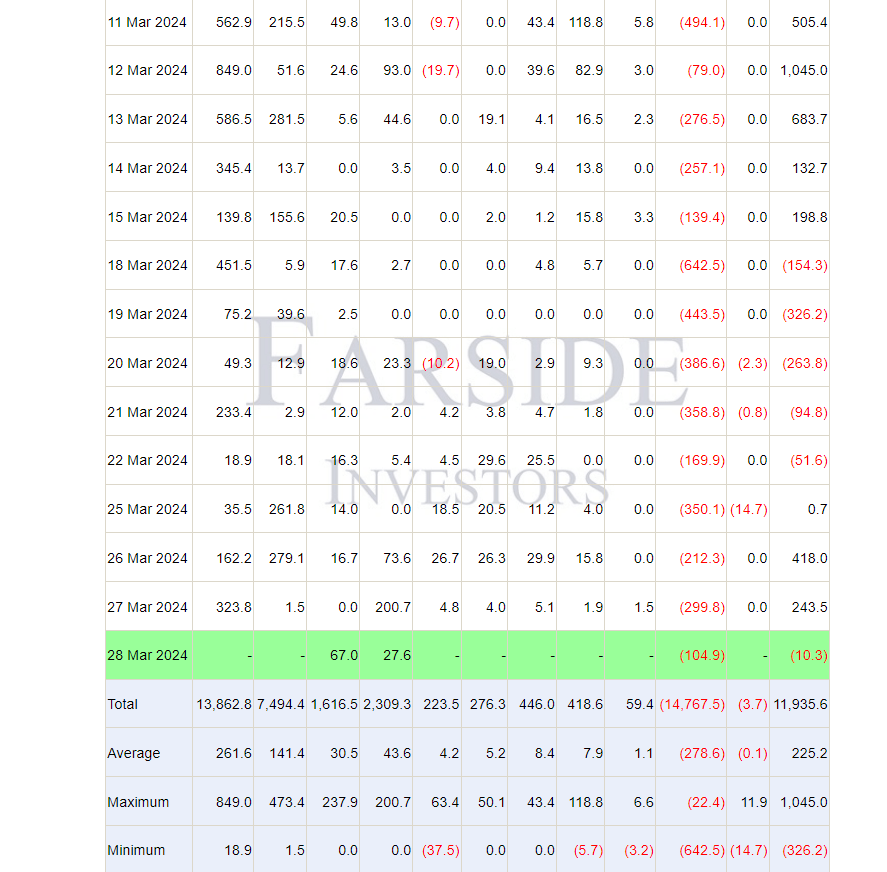

Spot Bitcoin ETF on March 28

Last week, we witnessed how sales in the ETF channel caused fluctuations in the spot markets. We learned two things through experience. First, the demand in the ETF channel may not continue to be strong forever. Second, the selling trend in this channel quickly pumps negativity into crypto exchanges.

While the timing of the next bear market is uncertain, we can say that it could be much more intense due to excessive selling in the ETF channel, even before we’ve seen the peak of the bull market. Data from March 28 started to come in and was generally positive. GBTC outflows were limited to $104.9 million. The good news is that inflows into the BITB ETF exceeded $67 million. There were also above-average inflows of $27 million for ARKB.

Although volumes for Fidelity and IBIT were low on March 28 (compared to March 27), GBTC saw weak outflows, suggesting a similar net inflow figure as the previous day. This indicates that Asian investors could continue to drive market growth as they start their day.

Bitcoin (BTC) Price Prediction

To date, inflows from the ETF channel have reached the brink of $12 billion. We’ve had a strong start, and the first quarter is nearly over. Very few altcoins see $12 billion in net inflows and over $100 billion in volume in their first quarter. This justifies the long-term optimism for Bitcoin, as highlighted by the BlackRock CEO.

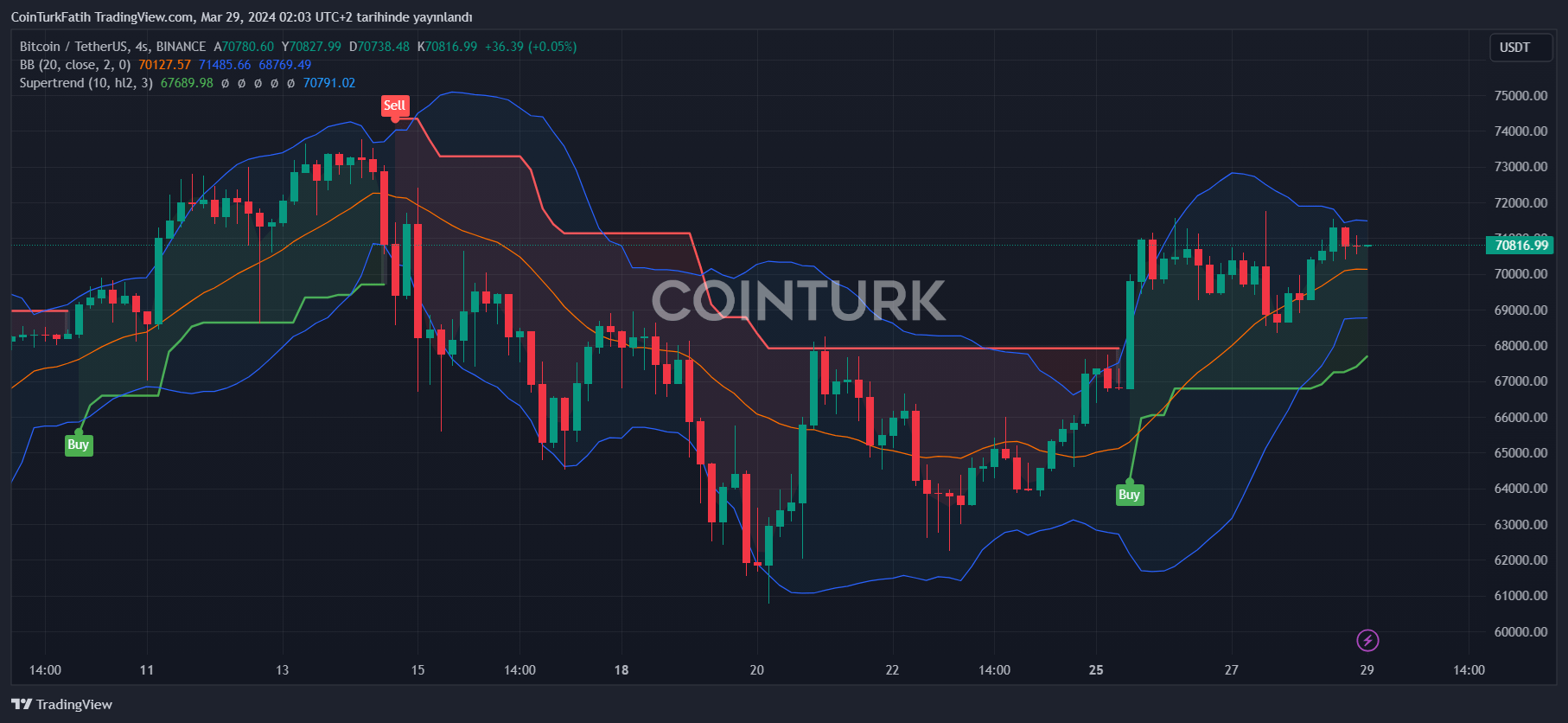

However, most investors are more concerned with what will happen to Bitcoin in the next few days rather than in six months. BTC is doing well, with $70,460 acting as support and the daily close occurring above $70,700 at the time of writing. Although $71,518 has turned into resistance, it may be surpassed in the coming hours.

What’s truly important is the potential for the all-time high (ATH) level of $73,777 to be surpassed and become support. If this happens, the price is expected to approach $80,000.

Türkçe

Türkçe Español

Español