At the time of writing this article, the price of Bitcoin was above $26,800. On-chain activity is increasing, and volatility may return. The amount of BTC entering exchanges and being transferred between wallets has been noteworthy in the past few days. This situation usually occurs before periods of significant volatility. The price can go in either direction. So, how do macro developments affect the market in the medium term?

Bitcoin and Medium-Term Predictions

The US PCE data has increased by 3.5% over the past 12 months. Fuel and food prices are highly volatile, but even excluding them, inflation is far from the Fed’s target of 2%. Moreover, the possibility of it returning to the target range is weakening. In fact, the 2025 forecasts have been revised upwards.

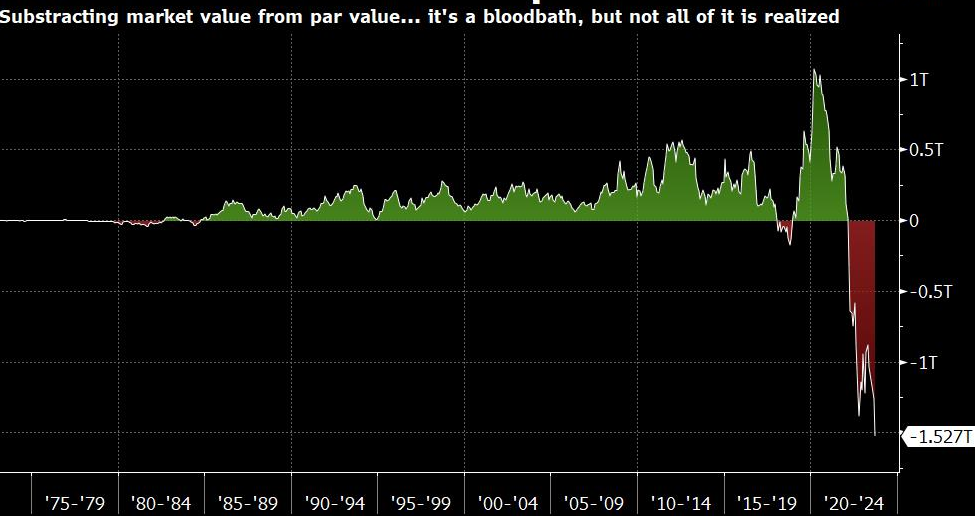

US Treasury bonds have surprisingly lost $1.5 trillion in value primarily due to these rate increases. As the US Treasury continues to fill the market with debt, there is a real risk of further interest rate hikes and increasing losses for fixed-income investors. It is expected that the maturity of an additional $8 trillion in government debt over the next 12 months will contribute further to financial instability.

Daniel Porto recently stated:

“The Fed will play a game where inflation leads, but the real question is whether we can sustain this trend without causing too much damage?”

There is an increasing risk that the central bank’s tightening in this cycle could jeopardize the financial system. The CEO of JP Morgan also recently warned of a potential interest rate of 7%. Under these conditions, it seems difficult for cryptocurrencies to perform well in the medium term.

Cryptocurrencies and High Interest Rates

Interest rates have risen rapidly, and customers who wanted to withdraw their money from banks faced significant problems in the first quarter of this year due to discounted sales of depreciated bonds. Following bank bankruptcies, the Federal Reserve’s BTFP emergency credit program was activated. However, this is a temporary solution, and the process of potential interest rate increases further complicates the situation.

Banks are increasing their interest rate sensitivity by transferring their assets to private credit and hedge funds. This trend is preparing to worsen further, increase yields, and increase losses in fixed-income markets if the debt ceiling is raised to prevent a government shutdown.

The deteriorating profile of the Federal Reserve’s balance sheet, measured by the $1.5 trillion paper losses in US Treasury bonds and rising inflation, could have positive implications for scarce assets like Bitcoin in the long run. However, until there is a major breakthrough in Fed policy that turns the tide in favor of Bitcoin, there may continue to be a negative trend in the crypto market.

The fundamental requirement for the rise of cryptocurrencies is cheap money. It does not seem possible for them to achieve significant gains in risk markets as long as the Fed does not open the taps no matter how dire the situation is. If the Fed’s breathing is cut off at some point, it is likely that Bitcoin will return to its former glory in the long run.

Türkçe

Türkçe Español

Español