Bitcoin‘s price today broke through the $52,000 mark. The market’s optimistic mood was further boosted by inflows into spot Bitcoin ETFs. Additionally, as BTC reached a market value of $1 trillion once again, analysts began to offer their evaluations. Popular analyst Vijay Boyapati made a post on platform X, drawing parallels with Bitcoin’s past.

Reference to Bitcoin’s 2017 Price Levels

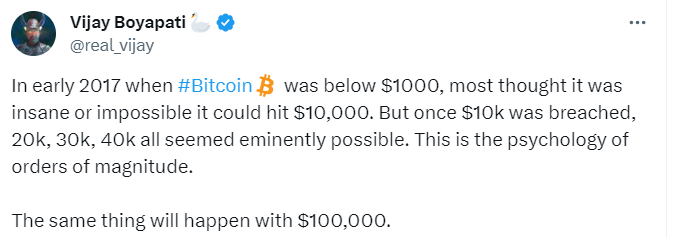

While discussing the value of Bitcoin, popular analyst Vijay Boyapati goes back to the year 2017. He emphasizes the psychology prevalent among many people when Bitcoin’s price was below $1,000.

When Bitcoin was under $1,000, most people considered the idea of BTC reaching $10,000 to be crazy and impossible. However, time proved these opinions wrong. Bitcoin had already begun its journey to $20,000 that year.

Shift in Belief about BTC

The analyst notes that when Bitcoin surpassed $10,000 in 2017, many people changed their stance and started to believe that seeing BTC at $20,000, $30,000, and $40,000 was possible. He points out that a similar shift in thoughts and attitudes is happening now.

The analyst indicates that the same psychology experienced in 2017 will occur when Bitcoin’s price hits $100,000. He emphasizes the psychological aspect of these changes, suggesting that the magnitude of future events is a matter of psychology.

Bitcoin Continues Its Price Increase

While the analyst evaluates the psychological side by connecting it with the past, today Bitcoin has made a significant move by exceeding the $52,000 level. At the time of writing, the BTC price was trading at $51,480.

On the other hand, today also brought an important assessment for Bitcoin from Galaxy Digital’s CEO Mike Novogratz. The renowned CEO shared his thoughts on why Bitcoin will increasingly be seen as a store of value, particularly pointing to the rising debt burden of the US and how it could positively affect Bitcoin.

An important assessment regarding America’s debt burden was also made in recent days by Bitcoin skeptic Peter Schiff. Peter Schiff countered the narrative that the American economy is in good shape, stating that this is not the case and predicting that gold will see significant increases in the future.