As consolidation accompanies a short-term slowdown in institutional investments, Bitcoin price continued to weaken on February 23. Data from TradingView shows Bitcoin price movement struggling around $51,000. Investors have been stuck in a narrow trading range for over a week as concerns about entries into spot Bitcoin exchange-traded funds (ETFs) emerged.

Why Is Bitcoin Price Falling?

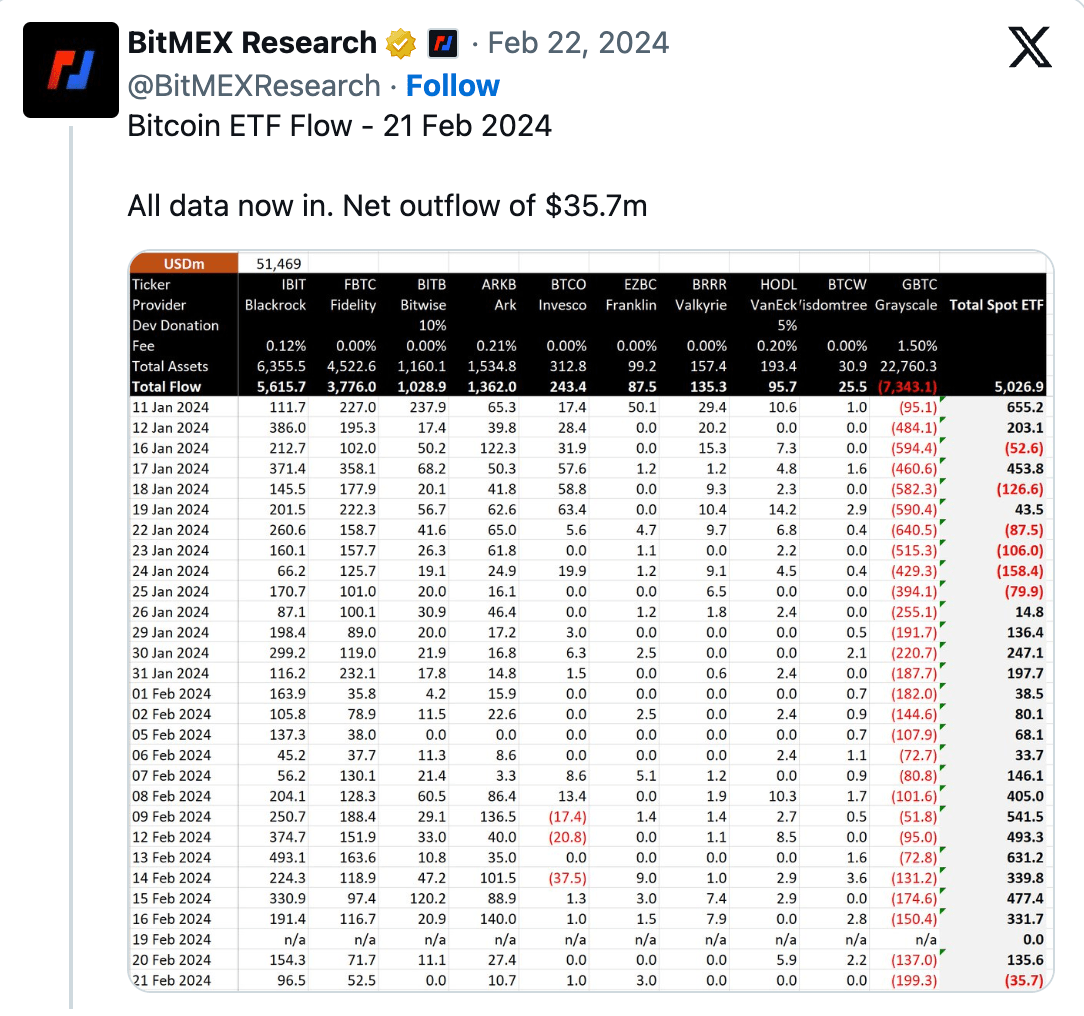

Bitcoin has seen a significant slowdown in volatility recently, with data shared by sources like BitMEX Research on February 21 indicating a net outflow of approximately $36 million.

A stronger activity was observed on February 22, and even when taking into account outflows from the Grayscale Bitcoin Trust, there was a net inflow of just over a quarter million dollars. James Van Straten, a research and data analyst at crypto analysis firm CryptoSlate, commented on the issue:

“Normalcy resumed with an entry of $251 million into Bitcoin ETF funds.”

Thomas Fahrer, CEO of the crypto-focused review portal Apollo, continued to purchase from ETF operators and predicted that BlackRock’s iShares Bitcoin ETF fund (IBIT), the largest of these funds, would change Bitcoin supply dynamics in the future, making the following comment:

“98% of all Bitcoins are already worth more than $100,000 when you try to buy them. Remember that the current price is just marginal trade. Blackrock will test this theory, so we will learn soon.”

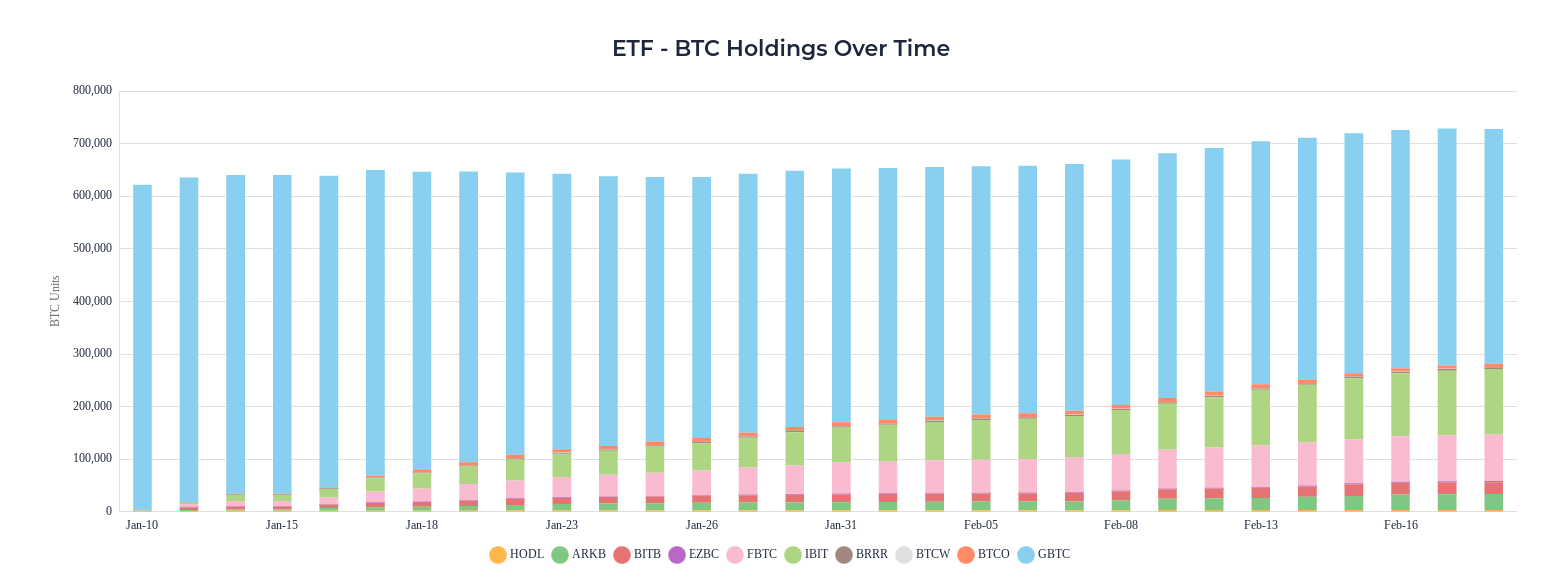

According to data from Apollo’s own ETF tracker, as of February 23, IBIT held 124,535 Bitcoins valued at $6.35 billion.

Prominent Analyst Comments on BTC

Meanwhile, popular investor Skew, who focuses on low-timeframe Bitcoin price analysis, assessed the mood among experienced market observers. Skew noted that the uptrend remains unbroken, but significant support levels have come into play again.

These were the 88-bar and 100-bar exponential moving averages (EMAs) on the 4-hour chart at $50,017 and $49,654 respectively, and the 18-bar EMA on the daily chart at $49,645. Skew mentioned in a part of his latest analysis:

“Price is currently trading around the low range and 4-hour 55 EMA, typically a near-term trend inflection point, suggesting momentum may rise soon. Buyers and sellers will likely battle for control here.”

Türkçe

Türkçe Español

Español