According to CryptoQuant founder and CEO Ki Young Ju, Bitcoin‘s price could maintain its upward trend and triple its market value, potentially reaching over $260,000. On May 8, Young Ju posted on X that the current size of the Bitcoin network fundamentals could support a market value three times its last cyclical peak.

What’s Happening on the Bitcoin Front?

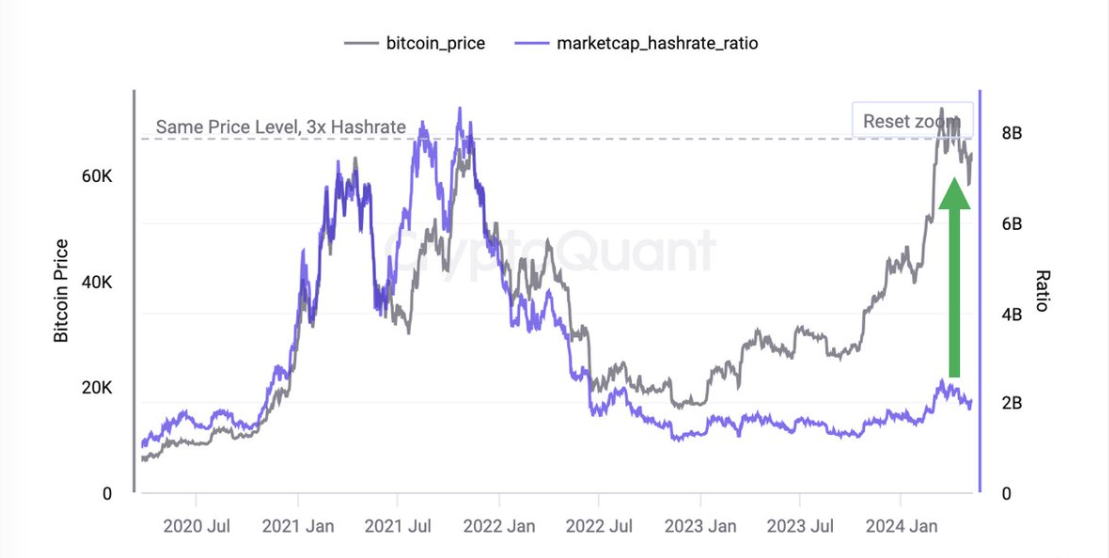

Young Ju referred to a chart comparing Bitcoin’s price and its corresponding hash rate to its market value, highlighting the ongoing volatility of cryptocurrency and the resilience of the Bitcoin network. The chart reveals a significant increase in Bitcoin’s hash rate/market value ratio by 2024, indicating a possible rise in market activities and investor interest.

The hash rate/market value ratio assesses the growth of mining activity relative to market value. If this ratio continues to rise, Young Ju stated that Bitcoin’s price could potentially be sustained at $265,000.

Prominent Figure Makes Noteworthy Statement

In response, analyst and trader Crypto Ceaser noted that Young Ju’s views are consistent with his own analyses, which show Bitcoin forming a significant cup and handle pattern on the weekly chart. This formation, a bullish continuation pattern, occurs with a wide, shallow movement creating the cup followed by a smaller dip forming the handle.

The cup and handle formation, typically occurring during a price consolidation period, is a bullish continuation pattern. If confirmed, the chart predicts a rise in Bitcoin to a technical target of $273,693:

“Although this target is particularly high, it is a legitimate goal and technically represents a diminishing return.”

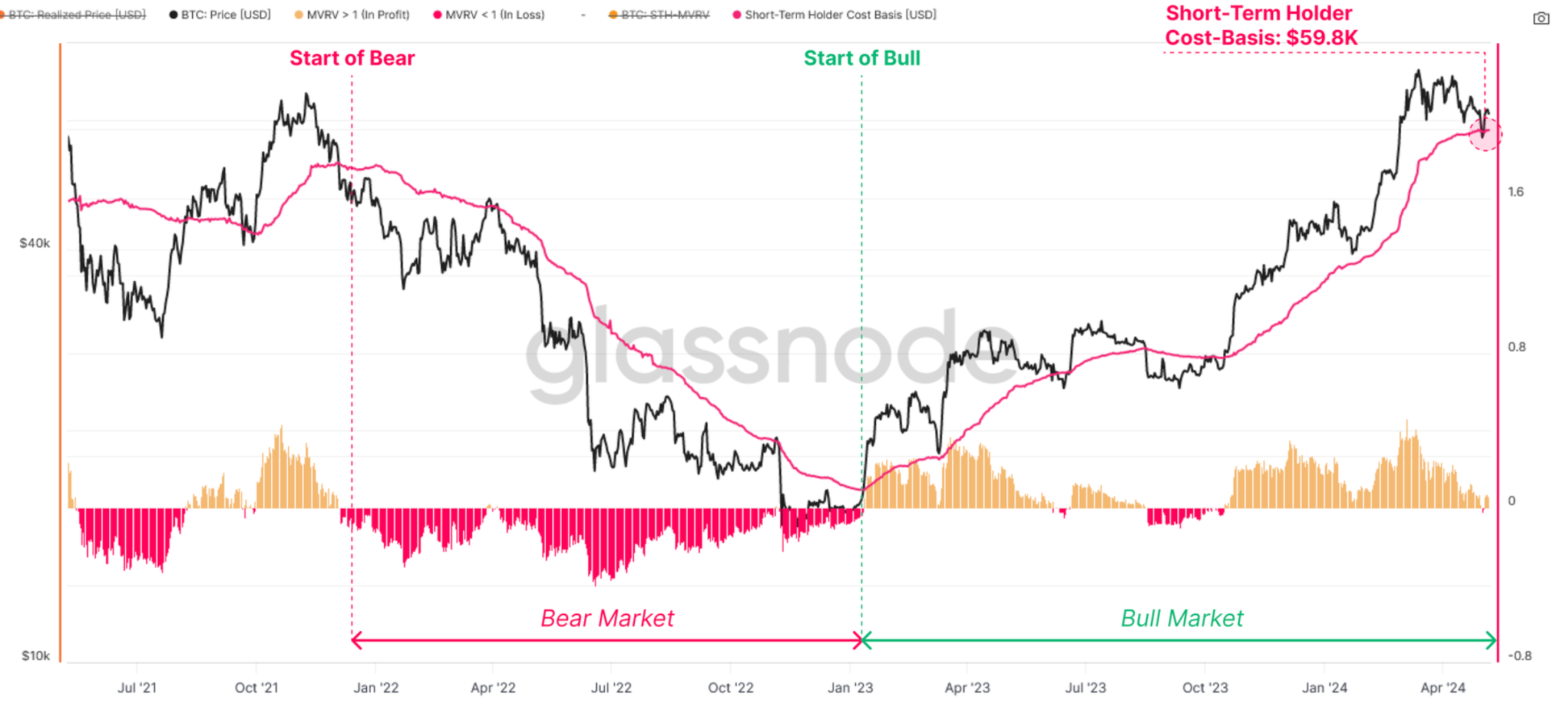

Glassnode analysts reported on May 7 that the average short-term acquisition price always served as a strong barrier during downtrends and provided solid support during uptrends:

“This thesis has held up so far this week; the Bitcoin market corrected to the $59,800 level below the STH-Cost Basis, found support there, and rose further.”

Türkçe

Türkçe Español

Español