Bitcoin price turned downward after reaching the $62,000 mark, experiencing a 5% loss. Altcoin investors are still enduring this painful volatility. The inflation data was positive, and yesterday’s PPI data was also very positive, but investors who bought at the dip did not miss a reasonable selling opportunity.

Why Did Bitcoin Drop?

With the CPI data, the BTC price rose to $61,800 on the Binance exchange. Further increases were expected, but this did not happen. The price dropped by 3% in an hour and recently rebounded from the $58,800 dip. At the time of writing, the price is hovering at $59,255. Altcoins turned red again.

Previously, Dann Crypto Trades warned that we might see irregular price movements as macro data comes in. The market’s insufficient pricing of the expected good inflation was already a sign of what was to come.

“CPI mostly comes in as forecasted. It’s quite good, and I doubt it will affect the markets much. Probably, the markets will do whatever they want to do. At least it’s good that there isn’t a crazy surprise up or down.”

Interest Rates Will Drop and BTC Will Rise

The scenario where we won’t experience a fake drop will meet us in an environment where interest rates fall. As liquidity becomes cheaper, risk markets, including crypto currencies and BTC, should rise. In his macro analysis, The Kobeissi Letter wrote:

“As headline inflation falls, Fed rate cuts are on the way. However, as rate cuts come, inflation in some categories will start to rise again.”

Although the expectation for a rise in the last quarter is strong in the medium term, short-term risks continue. Crypto analyst Roman wrote in his latest market assessment that Bitcoin price could easily drop 10% from its current level.

“Potentially, before making a long-term purchase, I expect the price to reach 58 and possibly 55 thousand. My plan hasn’t changed over the past week. Since we have downward price movement (low volume + price increase), I don’t see strength for an upward continuation here.”

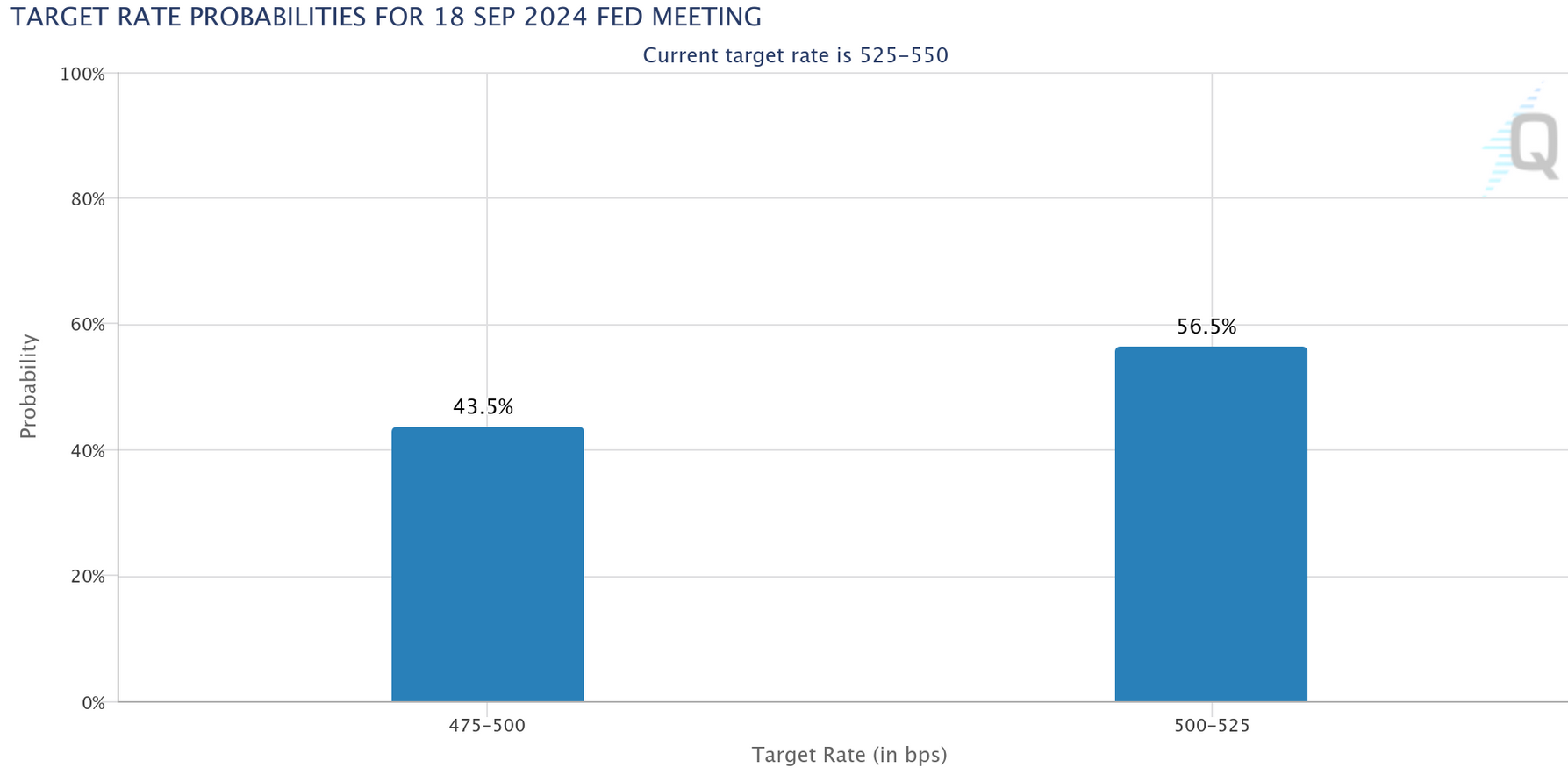

The resistance at $61,900 is currently a short-term obstacle, and before the September meeting, Fed members will decide on the rate cut size based on the August inflation data. If there is a surprise inflation increase, they might delay the rate cut decision.

Türkçe

Türkçe Español

Español