Bitcoin price has dropped to the $27,000 level after a long hiatus, which was expected for a long time. It was said that the shallow volatility during the period when the price was stuck between $28,500 and $31,400 would not last long. As expected, the king of cryptocurrencies entered a period of extreme volatility.

Why is Bitcoin Price Falling?

Bitcoin price closed below $29,000 for the first time in 56 days. Analysts attribute this to inflation and interest rates. We had already mentioned that the recent FOMC minutes would trigger such a process. Another major issue that fuels negative sentiment for BTC is regulatory concerns. Market makers are withdrawing from the market due to this, and giants like Binance are facing the wrath of the SEC.

In the medium term, if macro data does not improve suddenly and US officials do not put a stop to the SEC, the decline in crypto can continue. The Jackson Hole meeting on September 26th, along with the new inflation, wage increase, and employment data coming in September, will be of critical importance. Powell’s statements at this meeting last year caused significant fluctuations in the market. Crypto Traders Are Rushing to This App – Here’s Why You Should Too

The minutes emphasized a 2% inflation target. This caused the yield on US 10-year Treasury bonds to reach its highest level since October 2007, leading investors to steer clear of riskier assets like cryptocurrencies. Concerns about the Chinese economy may have also contributed to the decline. The country’s lower-than-expected retail sales growth and fixed asset investment declarations potentially affected the demand for cryptocurrencies.

Cryptocurrencies Can Fall Further

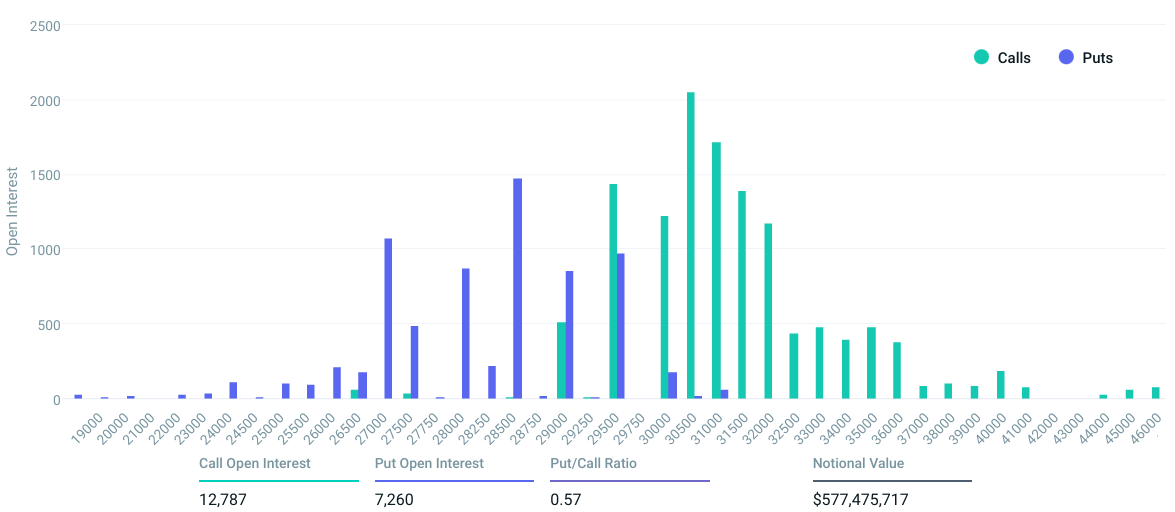

Despite the uncertainty about the immediate causes of the decline, the $580 million Bitcoin options expiring on Friday served the bears. They could potentially make $140 million in profit on August 18th, increasing the downward pressure on Bitcoin and making the search for the bottom more difficult.

While the exact reasons for the price drop remain uncertain, there is a possibility that Bitcoin could reverse its trend after the expiration of weekly options on August 18th.

Below are the three most likely scenarios based on the current price movement. The number of option contracts available for purchase and sale instruments varies depending on the expiration price on August 18th. As you can see below, the options favor the bears, and the price is likely to remain below $28,000 when the options expire.

- Between $28,000 and $28,500: 100 buy contracts versus 5,300 sell contracts. The net result favors the sellers with $140 million.

- Between $28,000 and $28,500: Sellers have an advantage with $60 million.

- Between $28,500 and $29,500: Sellers have an advantage with $20 million.

Given the increasing concerns about the impending economic slowdown due to central banks’ steps to control inflation, it is likely that Bitcoin bears will maintain their advantages. If the Bitcoin price can rise above $28,500, it can escape this pressure. However, the upcoming Jackson Hole meeting and recent data weaken this possibility.

Türkçe

Türkçe Español

Español